It’s been a wild ride for mortgage rates this year. The 30-year fixed began 2024 at around 6.625% and is currently not far from those levels.

Despite that, rates were as low as 6% and as high as 7.50%. So there has been quite a range over the past 50 weeks or so.

Rates rallied last December after the Fed revealed it was ready to pivot and begin loosening monetary policy.

But as always, they ebbed and flowed along the way, instead of simply falling lower and lower, with the past couple months quite the rollercoaster higher.

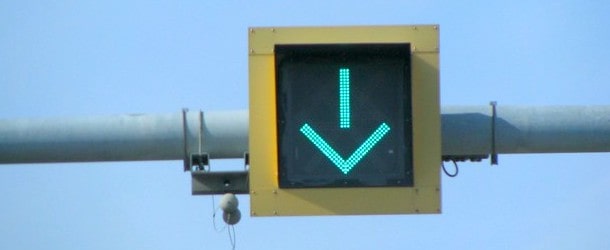

However, we remain in a falling rate environment, even if rates aren’t currently at their 2024 lows. Allow me to explain.

Mortgage Rates Are Better Than Their Year-Ago Levels

Many things, including home prices and mortgage rates, are measured both monthly and year-over-year.

The latter can give you a bigger picture of where something is trending, whether it’s home prices or mortgage rates.

For example, home prices might fall month-to-month, but still register year-over-year gains thanks to stronger months along the way.

When it comes to mortgage rates, I’ve argued since mid-September that we remained in a falling rate environment.

Why did I have to? Because rates on the 30-year fixed climbed from about 6% to 7% in the span of less than two months.

This had many fearing for the worst. That the recent improvement in rates was another head fake. And a return to 8% or higher was imminent.

After all, we’d seen this movie before, as recently as spring of this year, when the 30-year fixed climbed from 6.5% to 7.5%.

But my argument has always been that we’ve seen lower highs. So first it was 8%, then 7.5%, and most recently 7%.

In addition, mortgage rates have been besting their year-ago levels, showing a longer-term trend as opposed to some short-lived noise.

But They’ll Need to Keep Dropping Thanks to a Recent Uptick

Just to summarize the past couple months, the Fed cut rates in mid-September, which led to a little sell the news bounce in rates.

Simply put, the cut was baked in as evidenced by rates falling nearly two percentage points from October 2023.

Then we got a one-off hot jobs report that further propelled mortgage rates higher, followed by a presidential election.

Once it became clear that Trump was the frontrunner to win, rates moved even higher still, as his policies like tariffs are expected to be inflationary.

But eventually that big run up in rates ran out of steam and they seemed to get back on their downward track.

Ultimately, the economic data is what matters and it continues to show cooling inflation and some concern about rising unemployment.

That has pushed mortgage rates back from 7.125% to around 6.75% again. The big question now is if they can keep going lower.

As shown in the chart above from MND, the 30-year fixed plummeted in early December 2023 when the Fed implied it was done hiking and ready to cut rates in 2024.

That required the 30-year fixed to be sub-6.82% to beat its year-ago levels, which it barely accomplished thanks to another soft labor report this past Friday.

It now faces an even bigger test as the 30-year fixed was 6.65% in mid-December 2023, meaning we’ll need to see rates improve further over the next week to match/beat those levels.

Of course, it doesn’t need to be perfect.

Can Mortgage Rates Get Back to Sub-6% By February?

While rates certainly seem to be trending in the right direction after the dust settled from the election, they’ve still got to work to do.

In order to continue to remain below year-ago levels, they’ll need to fall another 10 basis points over the next week, which seems reasonable.

But to reach lower highs in 2025, they’ll need to keep showing improvement and get into the 5s, considering we saw a rate of 6.125% earlier this year.

They have time to do that, but mortgage rates tend to be lowest in winter, so perhaps it’ll happen sooner rather than later.

The last time the 30-year fixed was sub-6% was actually on February 2nd, 2023, when it hit 5.99%, per MND. It was very short-lived, and rates jumped to 7% that same March.

However, it’s possible rates could continue to drift that way into 2025, divvied up between some improvements this month and in January.

And it’s not really a big ask if you consider that the 30-year fixed was 6.125% in mid-September. Also note that rates tend to fall for several years after a Fed pivot.

Conversely, the biggest risk to mortgage rates climbing in the short-term, other than any strong economic data such as higher inflation or lower unemployment, would be inauguration-related noise.

There’s been a relative calm of late, but with that date steadily approaching, the government spending and inflation rhetoric could ratchet up again in early 2025.

Still, it wouldn’t surprise me to see mortgage rates continue to trend lower in 2025 and remain in a falling rate environment.