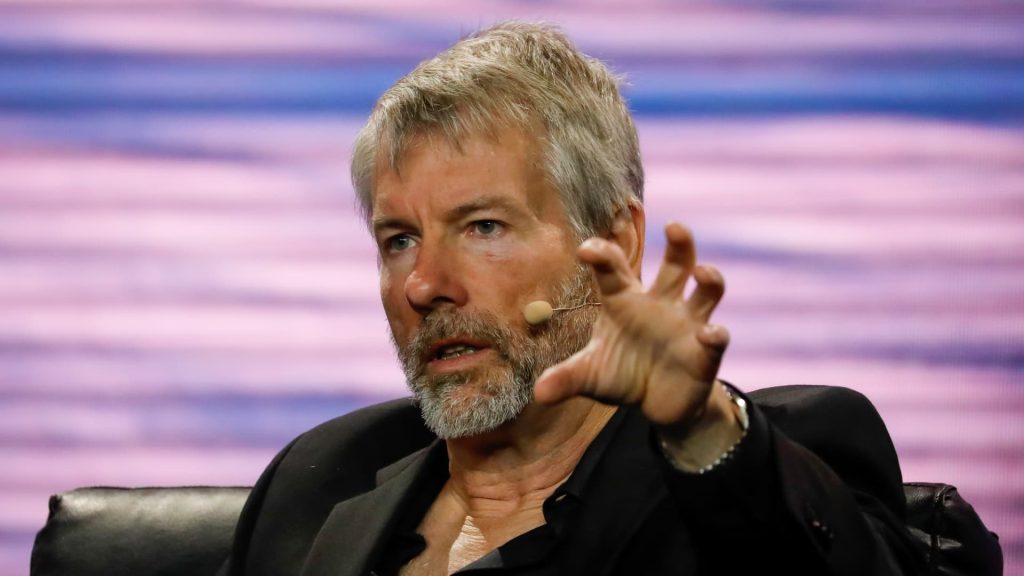

Michael Saylor, chairman and CEO of MicroStrategy, speaks during the Bitcoin 2022 conference in Miami on April 7, 2022.

Eva Marie Uzcategui | Bloomberg | Getty Images

Shares of MicroStrategy were higher Monday after Nasdaq announced the bitcoin proxy will join the tech-heavy Nasdaq-100 index.

The stock last traded more than 5% higher in premarket trading.

Nasdaq rebalances its Nasdaq-100 index every year. The companies flagged for inclusion are mostly based on the market cap rankings as of the final trading day of November. The stocks also need to meet liquidity requirement and have a certain number of free floating shares.

The index inclusion, which takes effect Dec. 23, comes after MicroStrategy’s massive surge this year. In 2024, the stock is up 547% — far outpacing the S&P 500’s 26.9% advance — as the price of bitcoin scales to all-time highs. Bitcoin last traded around $103,806.69, up less than 1% on the day.

MSTR year to date

MicroStrategy has been building its bitcoin reserves for years, making it a proxy for the digital currency. The company currently owns more than 420,000 bitcoins.

The addition also means MicroStrategy will be included in the popular Invesco QQQ Trust ETF, which tracks the Nasdaq-100. This will likely lead to passive inflows for MicroStrategy stock, potentially giving it another boost.

“MSTR’s Bitcoin buying program is unprecedented on street, and makes it the largest corporate owner of Bitcoin (2% of supply equivalent to $44Bn market value),” Bernstein analyst Gautam Chhugani wrote Monday. “Inclusion in Nasdaq100 further improves MSTR’s market liquidity, further expanding its capital flywheel and Bitcoin buying program.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.