Every few years, Wall Street rediscovers nuclear power.

Once shunned as dangerous, nuclear power is now getting a second chance as the world scrambles to meet rising power demand without choking the planet.

This time around, the story is being fueled by artificial intelligence.

Data centers are on track to triple electricity consumption by 2030, and governments are pouring billions into carbon-neutral energy solutions. That puts nuclear power in the spotlight like never before.

Enter NuScale Power (NYSE: SMR).

Founded in 2007, NuScale has built the only small modular reactor, or SMR, design approved by the Nuclear Regulatory Commission. That gives it a huge head start over its rivals. Each NuScale Power Module generates 77 megawatts of clean energy, and up to 12 modules can be combined at a site.

The kicker? They’re “walk-away safe,” requiring no operator action or external power to shut down. That safety profile is a major selling point.

NuScale has also structured its business cleverly. Through an exclusive partnership with energy production company ENTRA1, it sells Power Modules while ENTRA1 finances, develops, and operates the plants. That makes NuScale more asset-light, relying on service revenue, royalties, and module sales rather than taking on heavy construction risk. Think of it as “nuclear-as-a-service.”

The macro picture couldn’t be better.

The U.S. Department of Energy estimates we’ll need to quadruple our nuclear capacity by 2050 just to keep up with demand. Recent executive orders are streamlining regulation, and federal subsidies are flowing. Bipartisan support is in place, which is rare in today’s political climate.

If ever there were a time for nuclear to shine, it’s now.

Financially, though, NuScale is still in the proving stage.

Revenue spiked to $34.2 million in the fourth quarter of 2024 but cooled to $13.4 million and $8.1 million in the first two quarters of 2025. Operating expenses remain steep at around $43 million a quarter.

On the plus side, liquidity is solid at nearly $490 million as of June 2025. That gives NuScale breathing room, but it’s still burning cash.

The stock has reflected the drama. After spending much of 2023 and early 2024 under $10, shares began a furious rally. By mid-2025, they had rocketed above $50 before tumbling back to the high $30s today.

That’s still a more than tenfold gain from the lows. But the volatility shows how quickly sentiment can swing between euphoria and caution.

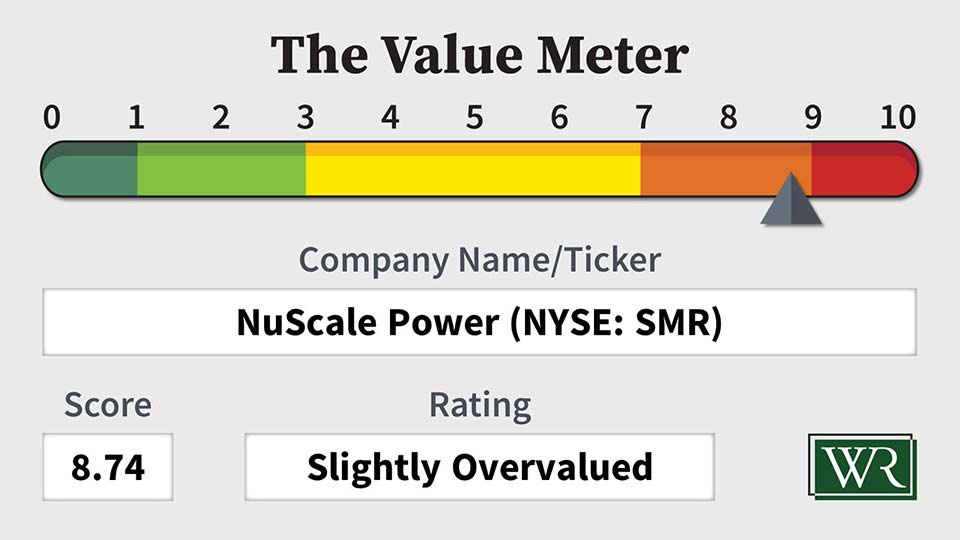

Now to The Value Meter.

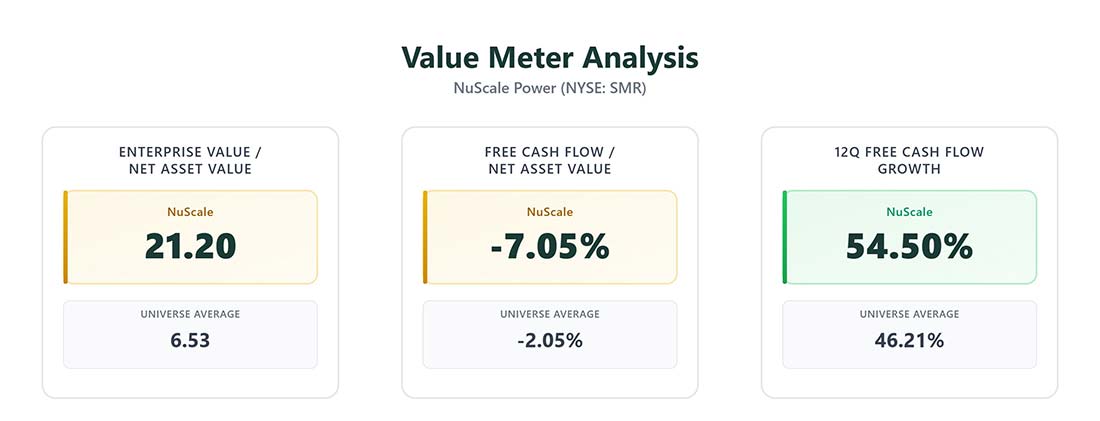

On enterprise value-to-net asset value (EV/NAV), NuScale clocks in at 21.20, compared with a peer average of 6.53. Investors are paying a big premium relative to the company’s assets.

On free cash flow-to-net asset value (FCF/NAV), NuScale posts -7.05%, worse than the universe average of -2.05%. That means it’s less efficient at generating cash than its peers.

Where NuScale does stand out is in consistency: Its 12-quarter FCF growth rate of 54.5% beats the peer group’s 46.2%. The direction is good, even if the cash burn remains real.

If nuclear energy is indeed entering a renaissance, NuScale is arguably the best-positioned SMR play out there. But the stock price already reflects a lot of optimism.

For conservative investors, the prudent move is to wait for a better entry point. For speculative investors, it’s a high-risk, high-reward bet on the future of power.

The Value Meter rates NuScale Power as “Slightly Overvalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.