When most folks hear “natural resources,” they picture oil wells and gas rigs. But the real resource driving the next decade isn’t liquid fuels.

It’s the obscure minerals that power modern tech – especially “rare earth elements,” which are used in the ultra-strong magnets inside electric vehicle motors and wind turbines. Right now, China dominates over 90% of global market share, which is why the West is scrambling to build secure supply at home.

That backdrop puts a spotlight on NioCorp Developments (Nasdaq: NB). Think of NioCorp as a small-cap lever on several critical materials that the U.S. still largely imports.

The company is advancing a project near Elk Creek in Nebraska to produce minerals like niobium, scandium, and titanium, and it is evaluating whether to add another category of materials called “magnetic rare earth oxides.” These include neodymium-praseodymium, dysprosium, and terbium.

Washington is paying attention. In August, the Pentagon awarded up to $10 million under the Defense Production Act to help NioCorp’s Elk Creek unit develop a domestic scandium supply chain.

But there’s a problem. The company is pre-revenue and still in development.

In its latest quarterly report, cash and equivalents were just $1.3 million, and management disclosed substantial doubt about the company’s ability to continue at its current pace without additional financing. The nine-month cash flow statement showed operating cash outflows of $5.9 million, offset only by financing raises.

On the funding front, NioCorp has reported progress in its application for roughly $800 million from the U.S. Export-Import Bank, but that remains in preliminary stages.

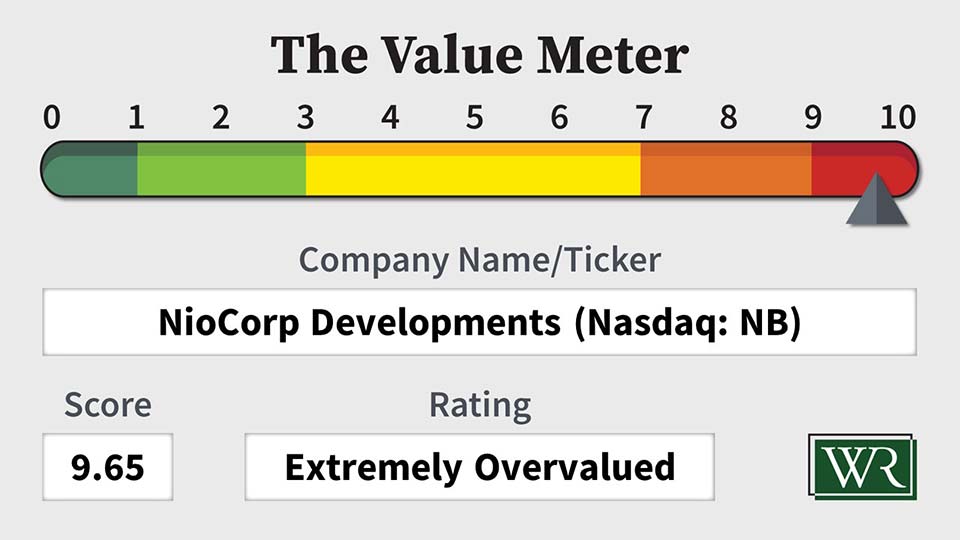

When we put these facts through The Value Meter, the numbers tell a stark story.

The company’s enterprise value-to-net asset value ratio stands at 322.2, compared with a peer universe average of 6.53. That means investors today are paying $322 for every $1 of net assets – an extreme premium compared with NioCorp’s peers.

Free cash flow-to-net asset value is -291.7%, compared with a peer average of -2.0%, reflecting the heavy cash burn relative to assets. Over the past 12 quarters, the trend in free cash flow improvement is roughly in line with peers at 45.5% versus 46.2%, but that still represents improvement off a negative base.

In short, the company has not produced sustained positive free cash flow in the past three years, which means the business model remains a bet on future financing and execution rather than a reflection of current cash returns.

Despite this, the stock has delivered fireworks. Shares are up more than 200% year to date.

These are the kinds of moves that are driven by policy headlines and scarcity enthusiasm more than underlying fundamentals. Momentum traders can ride that wave for a while, but value-oriented investors would do best to stay clear.

This is where perspective matters.

I love the theme. The West needs secure supplies of niobium, scandium, and rare earths, and NioCorp is one of the few U.S. names trying to build them. Plus, the DoD grant and NioCorp’s interest income from its financing activities are real tailwinds.

But price still matters. At today’s levels, our Value Meter framework says you are paying an extreme premium for assets that still need years of capital and flawless execution before they begin generating cash.

Stocks that are this stretched can – and often do – keep running, but that’s a trader’s game, not a value investor’s. In my experience, restraint beats fear of missing out.

The Value Meter rates NioCorp Developments as “Extremely Overvalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.