The Value Meter was never built to chase returns. It was built to answer a narrower question: What am I actually paying for the cash this business produces?

That difference matters when you look back at the results – and when you’re honest about what they do and don’t say.

Let’s start with what’s worked.

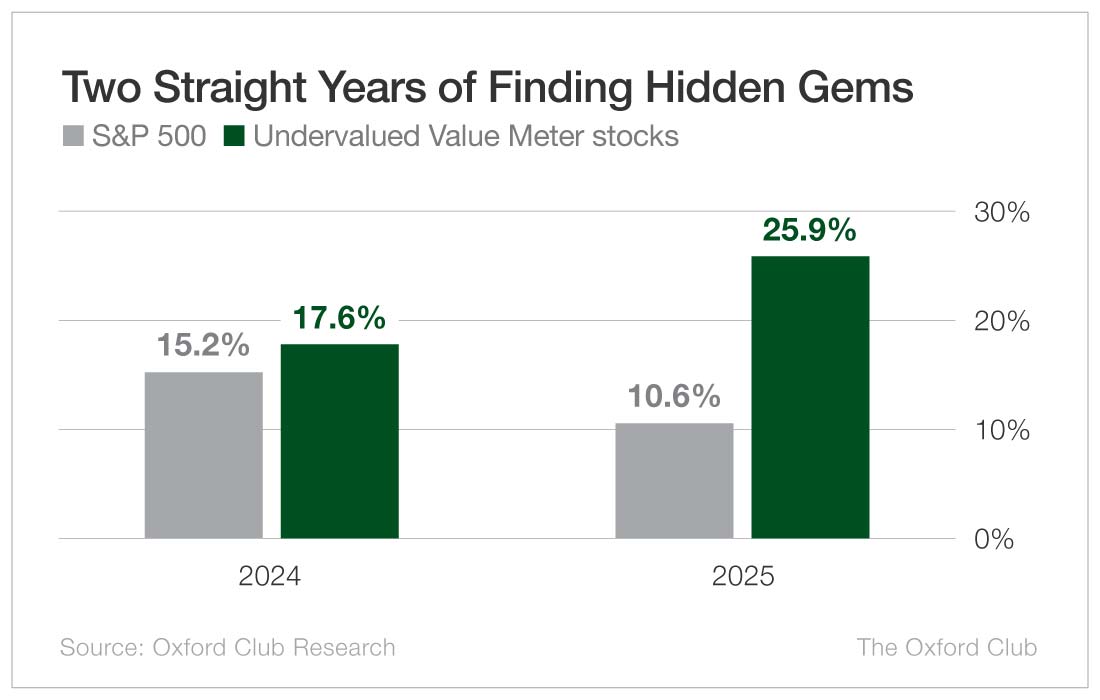

Across both 2024 and 2025, stocks rated as undervalued by The Value Meter − that is, stocks that scored below the midpoint on our scale − beat the S&P 500 on average.

In 2025, that gap widened. Undervalued stocks gained roughly 26% on average in less than seven months, beating the market by more than 15 percentage points.

In 2024, undervalued stocks delivered better returns, higher win rates, and stronger relative performance than overvalued stocks.

That’s exactly what you’d expect from a system focused on cash generation and asset efficiency.

The Value Meter gave undervalued ratings to a number of breakout stocks in 2025 as well, including infrastructure provider Vertiv Holdings (NYSE: VRT), tech manufacturer Applied Materials (Nasdaq: AMAT), and even $4.5 trillion market cap Nvidia (Nasdaq: NVDA).

By the end of the year, these three stocks were up 91%, 90%, and 53%, respectively.

But now comes the part that’s less comfortable.

In 2025, stocks flagged as overvalued didn’t lag. They led.

While undervalued stocks were more likely to outperform the market, overvalued stocks had a higher average return. On the surface, that looks like a miss. But markets don’t price stocks on cash flow alone – especially in the short run.

They price momentum. They price stories. They price what might happen next. When liquidity is plentiful and narratives take hold, stocks can trade far above what their assets and cash flows justify.

And they can stay there longer than fundamentals would suggest.

A system like The Value Meter isn’t built for that environment. It penalizes weak cash generation and expensive balance sheets. By design, it will lag when speculation outruns discipline.

That isn’t a flaw. It’s the trade-off.

The Value Meter is biased toward durability, not excitement. It assumes that cash will eventually matter more than optimism. That assumption doesn’t help you time tops, but it does help you avoid paying too much for businesses that don’t earn what they’re priced to deliver.

The results from 2025 were a reminder of something every investor relearns sooner or later: Markets can stay disconnected from fundamentals longer than you expect.

The data doesn’t owe you immediate validation. And no system – no matter how grounded – is ever a finished product. That doesn’t call for a teardown. It calls for discipline.

The Value Meter isn’t meant to win every sprint. It’s meant to keep investors from overpaying for fragile businesses when enthusiasm is doing most of the work. When the market remembers that cash pays the bills, that discipline matters again.

It always does.