They say a rising tide lifts all boats. That has certainly been true in gold.

As the price of gold has climbed steadily, many miners and royalty firms have moved with it. Royal Gold (Nasdaq: RGLD) is one of them.

Royal Gold is a gold royalty and streaming company. It provides capital to mine operators in exchange for a share of future production. It does not operate the mines, which means it avoids labor costs, fuel risk, and project overruns.

So when gold rises, the firm’s margins rise too.

The model is efficient. In 2024, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) margin was about 81%. The company holds interests in 364 properties across 30 countries. The asset base is broad. The structure is stable.

The stock has advanced alongside gold, so momentum has been strong. The market views Royal Gold as a clean way to gain gold exposure without running a mine.

The important question is whether price reflects operating reality.

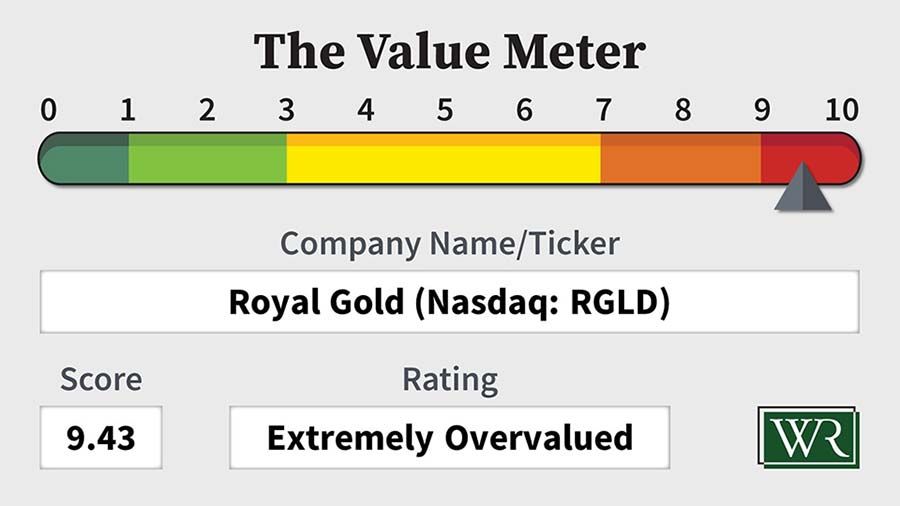

That is what The Value Meter aims to test.

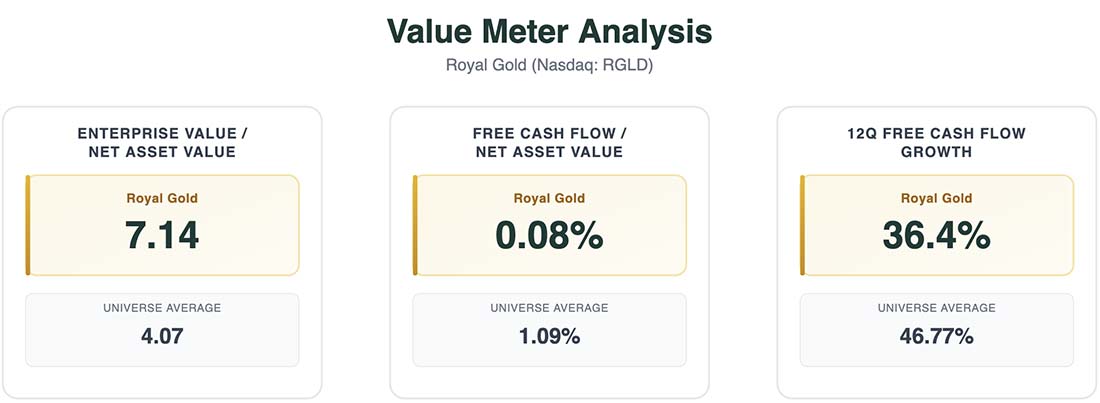

Royal Gold’s enterprise value (EV) – i.e., the hypothetical cost to acquire the business in full – currently sits at about 7.1 times the company’s net asset value (NAV). That’s well above the average EV/NAV of 4.1 across the broader market.

That is a significant premium. However, a higher multiple can be justified if asset value converts into cash at a stronger rate.

For Royal Gold, quarterly free cash flow relative to net asset value (FCF/NAV) is 0.1%. The broad market average is 1.1%.

In other words, Royal Gold trades at nearly double the asset valuation while producing less free cash flow per dollar of asset value.

Growth does not close the gap either. Over the last 12 quarters, free cash flow has grown quarter over quarter 36.4% of the time. The market averages 46.8% over the same period.

There is a clear disconnect between valuation and output.

Market sentiment implies stronger asset strength and cash durability than the data supports. The current price assumes continued gold strength and sustained expansion.

If gold continues higher, the premium can hold. But if gold stabilizes, there is little cushion in the stock’s valuation. Although the business remains sound, the valuation reflects optimism beyond relative fundamentals.

The Value Meter rates Royal Gold “Extremely Overvalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.