- Key insights: ACH Network volume is on the rise as checks decline.

- What’s at stake: The growth could reduce bank deposits and card payments.

- Forward look: Nacha has proposed increasing the per-transaction dollar limit for same-day ACH to $10 million from $1 million.

The ACH Network reached new highs in 2025, with person-to-person and business-to-business payment volumes experiencing robust growth.

Full-year ACH Network volume totaled 35.2 billion payments. That’s up almost 5% over 2024, according to a recent

Processing Content

“ACH is a backbone of payments,” Ben Danner, senior analyst with Javelin Strategy & Research, told American Banker. He was especially impressed with the growth in P2P volume, up 19.8% to 470 million.

Consumers are building up balances in apps like Venmo and PayPal, which doesn’t bode well for banks if they’re taking money out of their bank accounts and parking it with these services, so it remains a trend for banks to watch, Danner said. The other standout is B2B volume, which grew at a healthy 9.9% clip, suggesting businesses are using it to pay suppliers and each other, rather than checks or commercial credit cards, Danner said.

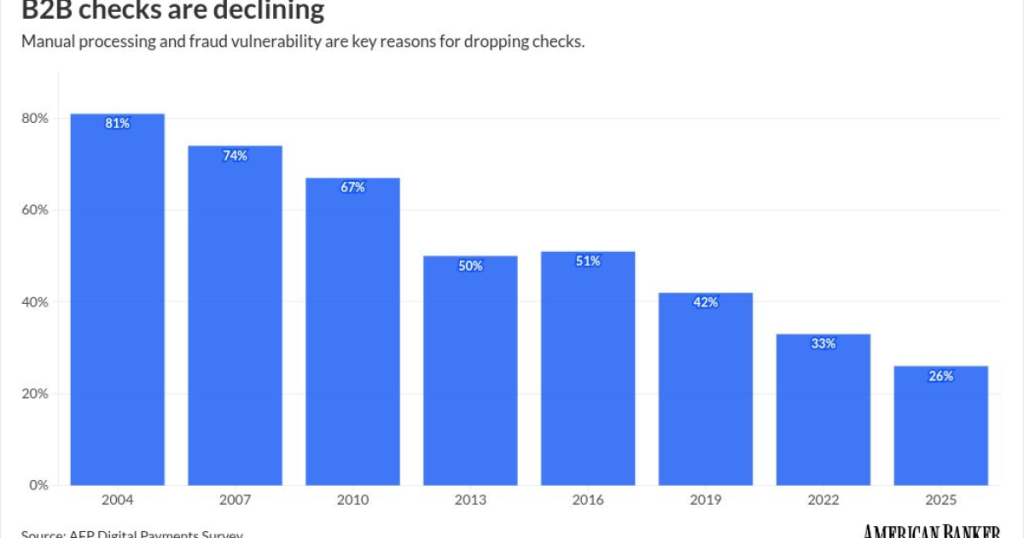

Indeed, B2B payments made by check continue to decline. In 2025, organizations said that just 26% of their B2B payments were made by check, according to the Association for Financial Professionals Digital Payments

Manual processing and fraud vulnerability are key reasons for dropping checks. These reasons are cited by 75% and 66% of organizations, respectively, who plan to eliminate check use, according to the report.

Even so, Robin LoGiudice, strategic advisor with the commercial banking and payments team at Datos Insights, said it will take a long time for checks to go completely out of fashion. While large companies are moving toward electronic payments, many small businesses are still wedded to checks, she told American Banker. Banks charge for these services, and there’s not enough volume for them to make significant money. But fintechs and others have expressed interest in the smaller market, she said.

ACH is a popular payment method with businesses

Third-quarter data from Datos Insights illustrates the payment methods most used by businesses. The report asked 1,036 mid- and large-size companies to estimate what percentage of their business payments by volume were paid with various payment tools in the last 30 days. ACH and same-day ACH totaled 16.7%, paper checks totaled 10% and mobile payments (digital wallets or digital payment services like PayPal and Venmo, which do a large amount of settlement over ACH) totaled 9.2%. That was followed by cash at 8%, purchasing card at 7.3%, corporate card at 6.7%, RTP at 5.8% and wire transfers at 5.4%.

Changes ahead

Nacha has proposed increasing the per-transaction dollar limit for same-day ACH to $10 million from $1 million. Comments are currently under review, including consideration of whether adjustments should be made to the proposed rule change, a spokesperson told American Banker. There is no specified time frame for this phase. The change would put same-day ACH on par with the Clearing House’s

New ACH risk management rules also begin taking effect this year. The rules are intended to reduce fraud, such as business email compromise. They establish a base-level of ACH payment monitoring on parties in the ACH Network, with the exception of consumers, according to the Nacha spokesperson.

Potential for continued growth in ACH

The growth of

Walmart’s Pay by Bank, for example, was set up to use the ACH network for processing payments, allowing customers to link their U.S. bank accounts to Walmart Wallet and pay directly from their bank account during checkout, bypassing credit or debit cards.

A number of gas stations also offer pay-by-bank programs that use ACH to deduct funds from customers’ accounts. Several phone and utility providers also offer pay-by-bank programs.

How real-time rails could impact same-day ACH

Last year marked 10 years’ worth of same-day ACH payment data. In 2016, there were 13 million same-day ACH payments, according to Nacha. That rose to 1.45 billion payments last year. Since inception, there have been more than 5.7 billion same-day ACH payments, according to Nacha.

Same-day ACH could eventually face more competition from the real-time rails, but even when the latter are more mature, many businesses will continue to use traditional ACH, Danner told American Banker. For some use-cases, speed isn’t the main factor. For example, for a basic payroll direct deposit, most employers won’t want to pay more to send the money, he said.

Real-time payments are still in their infancy in the U.S. The RTP Network, for example, processed 125 million transactions in last year’s

“It’s just not a concern right now,” LoGiudice of Datos Insights told American Banker. She said ACH will continue to be the forerunner, at least until real-time payments become more ubiquitous in the U.S., and that’s far off. “ACH still is the predominant payment type,” LoGiudice told American Banker. “It’s cheap, it works,” she said.