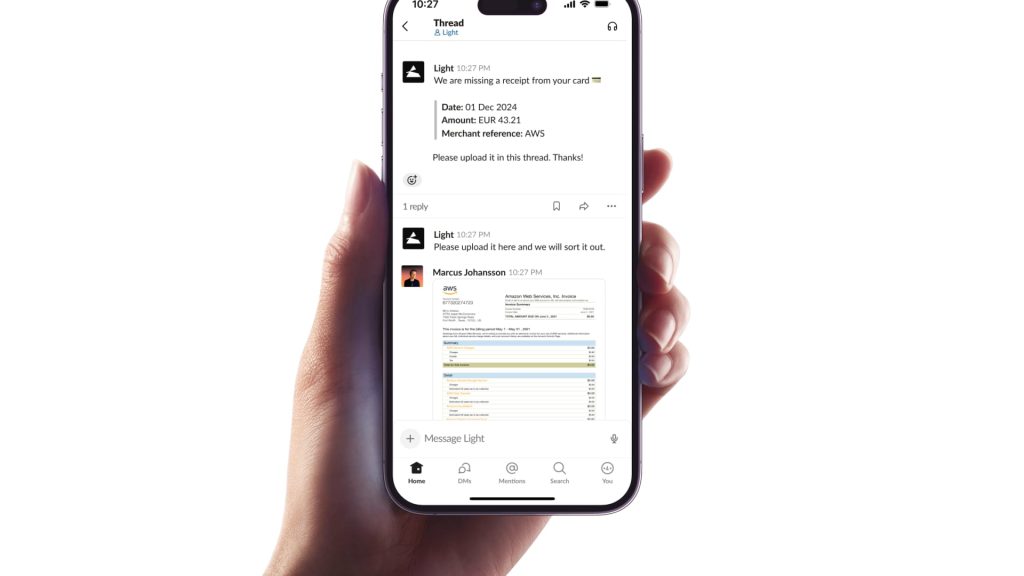

Light uses artificial intelligence to automate companies’ finance and accounting functions.

Light

Danish startup Light is the latest in a series of European tech firms raising cash as venture capitalists search for the next big thing in artificial intelligence.

Founded in 2022, Light develops software that uses AI to automate various functions that exist within businesses’ finance teams, including accounting, bookkeeping and financial reporting.

The Copenhagen-headquartered company told CNBC that it had raised $30 million in a Series A funding round led by Balderton Capital, an early investor in fintech unicorns Revolut and GoCardless.

Atomico, Cherry Ventures, Seedcamp and Entrée Capital also invested in the round, along with angel investors including Hugging Face co-founder Thomas Wolf and Meta board member Charlie Songhurst.

Light plans to use the cash to “double down on the commercial side” of the business, Jonathan Sanders, Light’s CEO and co-founder, told CNBC. The startup recently opened an office in London and says it is planning to open one in New York to meet U.S. demand.

Light isn’t the only startup out there using AI to streamline companies’ finance and accounting processes.

Pigment, a business planning and forecasting platform designed to be more user-friendly than Microsoft Excel, last year raised $145 million at a valuation north of $1 billion. More recently, accounting software startup Pennylane raised 75 million euros ($88.4 million), doubling its valuation to 2 billion euros.

Currently, the market for software that helps companies manage their finances is dominated by industry behemoths like Microsoft, Oracle and SAP. However, these systems can often be cumbersome, requiring specialists to “tinker around the edges for a year or two just to make it work,” according to Sanders.

“We service fast-growing, fast-scaling companies who need a system where they can expand really fast,” Sanders told CNBC. Light’s customers include Lovable, the buzzy Swedish AI firm recently valued at $2 billion, and Sana Labs, which is being acquired by Workday for $1.1 billion.

Sanders said AI can rapidly transform how companies handle their finances. “The future of numbers is text,” he says. For example, rather than sifting through company policies to find a team’s meal allowance, this can be automated by an AI agent that has access to the relevant documents.

Moving forward, Light wants to focus on large, enterprise-level customers that struggle with “broken processes and workflows,” according to Sanders. “No human team can continuously analyze, reconcile and update thousands of pages of policies for coherence,” he told CNBC.

WATCH: Is Europe’s IPO market finally staging a comeback?