Macy’s (NYSE: M) has been a part of my life for as long as I can remember.

When I was growing up, it wasn’t just a store – it was the place my family went for back-to-school shopping, for new dress shirts before church, and for the Thanksgiving parade on TV. Even today, I find myself browsing its racks more often than I care to admit.

It’s one of those rare retailers that still feels familiar, even as the world of shopping has shifted online.

But sentiment and nostalgia don’t keep a business alive. Numbers do. And as I noted when I evaluated the stock last November, Macy’s has spent the past few years trying to prove that department stores aren’t relics of the past.

Macy’s isn’t just the red-star brand we all know. It’s a three-nameplate company, with Macy’s, Bloomingdale’s, and Bluemercury under its roof. Together, they span everything from affordable apparel to luxury handbags to high-end skincare.

Management’s “Bold New Chapter” strategy is focused on trimming underperforming stores, reinvesting in digital, and giving prime real estate a facelift under the “Reimagine 125” program. The company’s goal is to modernize the core Macy’s fleet while leaning into higher-growth banners like Bloomingdale’s and Bluemercury.

The second quarter of 2025 brought some progress. Net sales came in at $4.8 billion, topping guidance, with comparable sales up 0.8% at company-owned stores and 1.9% including licensed and marketplace sales.

Bloomingdale’s continues to shine, posting 3.6% comparable sales growth on an owned basis and 5.7% including licensed and marketplace sales, marking its fourth straight quarter of gains. Bluemercury notched its 18th consecutive quarter of growth at 1.2%. Even the 125 “reimagined” Macy’s stores managed 1.1% comparable owned growth, outpacing the broader chain.

The company’s earnings were mixed. Adjusted earnings per share came in at $0.41, which beat guidance but was down from $0.53 last year. Gross margins slipped 80 basis points to 39.7% due to markdowns and tariffs. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) landed at $393 million and 7.9% of revenue, both of which were down from a year ago.

Cash flow was light. For the first half of 2025, Macy’s generated $255 million in operating cash flow, but after capital expenditures and software investments, free cash flow was -$13 million. That’s a worrying sign for a company that needs cash to both reinvent itself and pay shareholders.

Speaking of which, Macy’s did still return capital. The board declared a dividend of $0.1824 per share and bought back $50 million worth of stock last quarter, bringing its total to $151 million worth repurchased year to date. The balance sheet also looks healthier after the company trimmed long-term debt by about $340 million and pushed major maturities out to 2030.

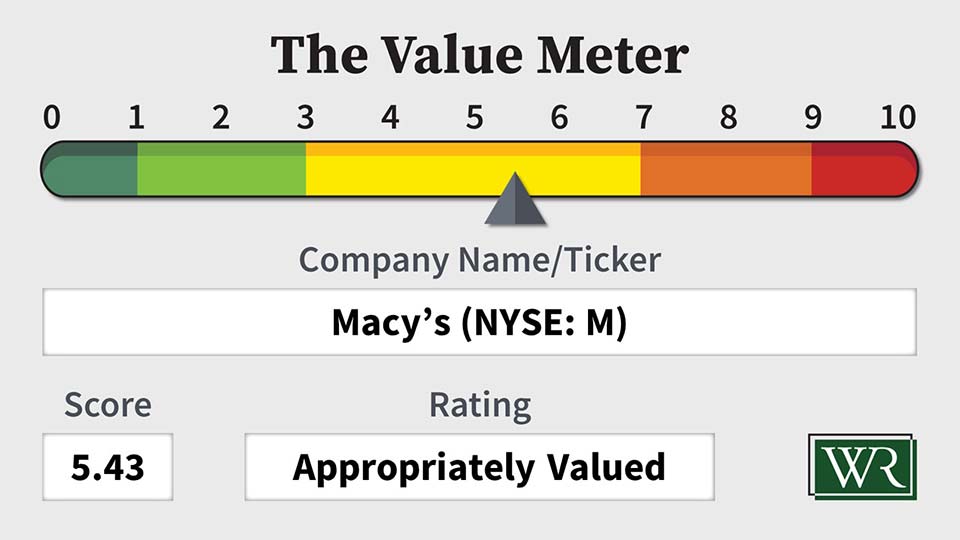

When we run Macy’s through The Value Meter, the picture continues to look nuanced.

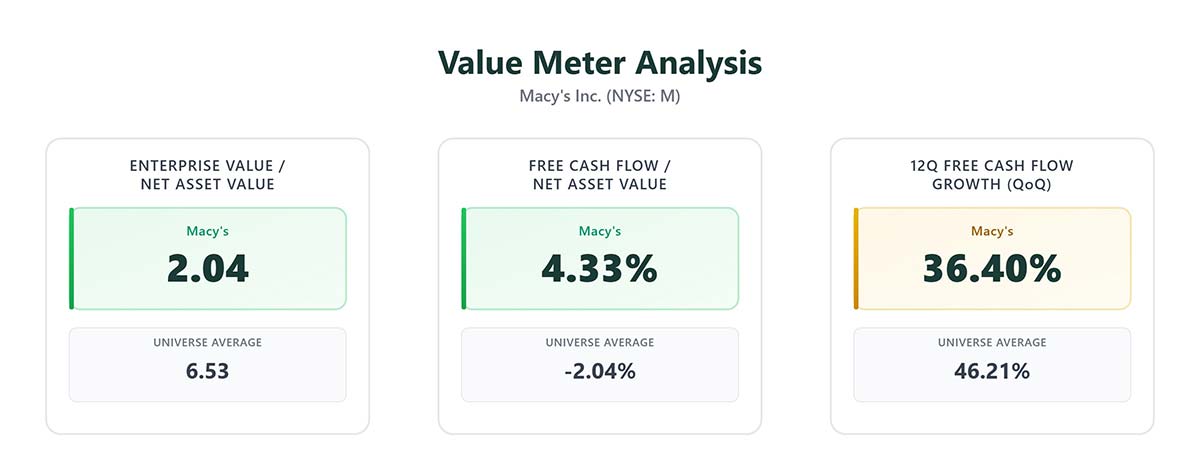

Macy’s EV/NAV ratio comes in at 2.04, far cheaper than the universe average of 6.53. In plain English, you’re paying less than one-third the “going rate” for Macy’s assets compared with the average company. That makes it look attractively priced from a balance sheet perspective.

Despite a choppy year for retail, Macy’s is still generating cash. Its FCF/NAV sits at 4.33%, compared with a universe average of -2.04%. That means Macy’s is producing real cash relative to its resources, while many peers are burning through theirs. That efficiency gives it some breathing room to invest, buy back stock, or pay dividends.

The weaker spot in Macy’s profile is consistency. Over the past three years, it grew its quarterly free cash flow just 36.4% of the time, below the universe average of 46.2%. Put differently, Macy’s has produced positive quarters – but not as steadily as investors would like. Retail cycles, tariffs, and markdowns still make this cash machine sputter from time to time.

Overall, Macy’s balances out. Its cheap valuation offsets its uneven cash flow history.

But over the past year, shares have been on a roller coaster.

After peaking above $20 early in 2024 and at over $17 late in the year, the stock tumbled below $10 in April before staging a modest recovery. Now, after the sharp post-earnings spike, Macy’s trades near $17 – still well off its highs but up more than 40% from its spring lows.

Macy’s is doing many of the right things: closing underperforming stores, refreshing prime locations, and leaning into growth banners like Bloomingdale’s and Bluemercury. But the challenges are just as clear.

The Value Meter rates Macy’s as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.