WASHINGTON — Todd Harper is the rarest of Washington creatures: A regulator who actually gets along with everyone.

During his years as Democratic chairman of the National Credit Union Administration, the credit union industry’s federal regulatory agency, Harper cultivated friends and allies across the aisle. The proof came during a House Financial Services Committee hearing last year, when former Chairman Patrick McHenry (R.-N.C.) tore into Biden administration financial regulators, systematically eviscerating each in turn over everything from policy decisions to agency scandals.

“Because of your actions, the political independence and authority of your agencies is in danger of being reduced, whether it’s by Congress, the president or the courts,” he charged.

Then, McHenry turned to Harper.

“Thank you for being here,” McHenry said.

“You’re welcome,” Harper replied.

This is the figure Harper has cut for years: unflappable, bipartisan and the kind of financial regulator who could navigate Washington’s partisan warfare without making too many enemies.

Which makes what happened this spring all the more surprising: Less than a year after that exchange with McHenry, Harper was fired as a member of the NCUA board in an abrupt email.

“On behalf of President Donald J. Trump, I am writing to inform you that your position on the National Credit Union Administration is terminated, effective immediately,” the email read.

His colleague Tanya Otsuka, also a Democrat, received the same message within about a minute of Harper’s being sent.

Harper didn’t actually see his termination notice initially. The administration had sent it to the wrong email address, and it took two days for them to track down the correct one.

“They couldn’t even get my email right to send,” Harper later laughed in an interview with American Banker.

Harper and Otsuka now find themselves enveloped in a larger effort by the Trump administration to redraw the boundaries between the White House and independent regulatory agencies, with President Trump asserting the power to remove board members from the opposing party without cause. Harper and Otsuka won an

But this goes beyond a typical Trump-era regulatory power struggle. The firings didn’t just change the NCUA’s policy direction; they may have removed the board’s ability to function entirely.

The NCUA governing statute requires a two-member quorum, and Harper’s and Otsuka’s departures left the board with just one member: Trump-appointed Kyle Hauptman, who currently serves as the NCUA’s chairman. While Harper and Otsuka are back at the agency for now, it was helmed for months by a single board member and very well may return to that state as the court case continues to work its way toward resolution.

“The agency’s own rules say that quorum is two members of the board,” Harper said. “It’s hamstrung as to what it can do.”

The credit union boom

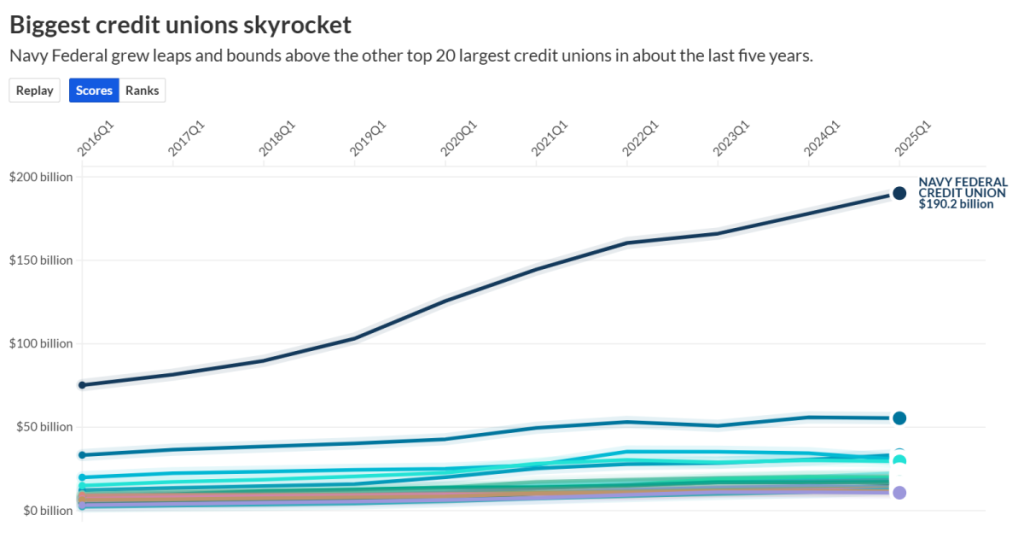

The NCUA’s shaky ability to operate fully comes as the $2.3 trillion industry that Harper and Otsuka helped oversee has gotten bigger, more powerful and more concentrated.

In the last five years, some of the largest credit unions have transformed from sleepy, small dollar lenders serving police unions and teachers’ credit cooperatives into nationwide enterprises, some of which are snapping up community banks as they grow.

To its biggest critics, the credit union industry’s biggest institutions are increasingly behaving more like profit-driven banks with a tax advantage, rather than mission-centric nonprofits.

“A small number of credit unions are increasingly acting like for-profit banks, trying to take advantage of the regulatory and legal benefits associated with a credit union’s nonprofit status,” said Aaron Klein, a senior fellow at the Brookings Institution. “You have to ask yourself, what makes a credit union different than a bank? It should be their field of membership and their mission-driven status. If they’re out there trying to maximize profit, maximize bonuses for their executives, put their name in big, bright letters in

Navy Federal is the largest and fastest growing credit union. It’s also one of the credit unions that acquired the stadium naming rights, which it bought for the Washington Commanders stadium.

For the credit unions themselves, this kind of growth isn’t surprising. America’s Credit Unions, a trade group based in Washington, said that credit unions as an industry aren’t straying from their original mission.

“Honestly I’m always amazed that credit unions aren’t growing faster than they are,” said Curt Long, America’s Credit Unions chief economist. “It really doesn’t make sense for any consumer to be getting a loan anywhere else. When bankers complain about things like stadium naming rights, I’m always thinking credit unions need to get their name out because not enough people know about us. There’s still this lack of awareness among consumers about the best alternative out there.”

And while some credit unions have gotten large, they still pale in comparison to the largest banks, he said.

“The thing that the bankers like to do is to kind of try and isolate the largest credit unions and say that they’re not acting like credit unions,” Long said. “I think when you compare the largest credit unions to the largest banks, there really is no comparison, right? I mean, they blow us out of the water.”

What’s the status of the NCUA now?

With Harper and Otsuka back on the board following the federal court ruling, the agency is temporarily operating with its full three-member complement. But the legal battle is far from over, and the agency could once again find itself with just one board member depending on how the appeals process goes.

The NCUA has contended that the board can operate with one person, despite the agency’s bylaws. That hasn’t been tested, since Harper and Otsuka were reinstated before the NCUA’s July board meeting, but the agency said immediately after Harper and Otsuka’s initial dismissals that Dennis Dollar, a previous NCUA chairman, acted as the sole board member and took several administrative and operational actions during a period of two months in 2002.

Hauptman declined to comment for this article.

Harper said that several key initiatives were derailed by the boardroom upheaval.

“One thing we had teed up to act on is executive pay,” he said. “It had been part of the semi-annual agenda that we had voted on. Right now, state-chartered credit unions do have to file 1-990s, federal credit unions do not, so to me this is unfinished business.”

Beyond executive compensation disclosure, Harper said the agency was working on establishing “a consumer financial protection program that is on par with those of our other agencies.”

That project, Harper said, “is treading water.”

Otsuka said that the stakes go beyond regulatory policy.

“Our whole financial system is built on trust,” she said. “People need to feel confident that when they put their hard-earned money in a credit union or a bank, it will be there when they need it. And so when people lose that sense of trust, it can impact the financial system, it can lead to failures, it can lead to crisis, it can lead to people losing their homes.”

Failure risk for credit unions

The NCUA might have a harder time dealing with that risk than the banking regulators, Klein said.

“One of the things that you have to be really concerned about with the credit unions is the failure of a large credit union, and will it threaten the solvency of small ones because of the assessment base?” Klein said. “I mean, not only are credit unions more concentrated [than] the big [banks], but there’s a lot of really little [credit unions] in ways that are just not true for banks. The ability of the industry to handle an assessment to cover the failure of one of the big guys is much thinner.”

In the interview with American Banker, Harper said that there’s an argument for increasing that pot of money that the NCUA holds to resolve failed credit unions.

“There are important questions that we need a board to determine what the normal operating level is for the share insurance fund, and in my mind we need to have more in reserve there, given what’s happening overall,” he said.

In the fall of 2024, Harper as chairman of the NCUA said that the number of troubled complex credit unions tripled in the last quarter, and the amount of assets in those troubled credit unions grew by more than fivefold.

“It’s been about a decade since we last saw this proportion of insured shares at risk,” Harper said at the time. “So, we must remain vigilant as we navigate this situation.”

For the community banks, this rang alarm bells, especially with the drama on the NCUA’s board.

“In terms of the conserving of failing credit unions at a certain asset size, you need a board action,” said Michael Emancipator, the Independent Community Bankers of America’s head regulatory counsel. “Clearly, there are some large $500 million-plus credit unions that are in, let’s just say, conservatively, are going to require closer scrutiny, and potentially would need board intervention.”

It’s a little up in the air as to whether the NCUA would be able to do that, he said.

“I don’t think it’s ever a good time for regulators to not have a full toolkit,” Emanicaptor said. “When you have agencies that are not equipped to supervise financial institutions, I think history has shown that’s where latent problems can come to a head.”

Frank Gargano contributed to this report.