- Key insight: Banks are seeking scale by inking merger agreements, despite investor concerns about tangible book value dilution.

- What’s at stake: So far, 2025 is on track to be the biggest year for bank deals since before the pandemic.

- Supporting data: The stock prices of banks that shrink their share counts are likely to outperform their peers over time, according to a Truist Securities analysis.

All banks are “opportunistic.”

At least, when asked about whether they plan to ink a merger deal, most bank leaders give a standard answer to the effect of, “we assess potential transactions, evaluating whether they meet our strategic objectives and enhance shareholder value.”

But in recent months, some banks have gotten walloped on Wall Street for giving the same reply that’s been the standard for years.

When First Horizon signaled in October that it would look at doing a deal, its stock price fell by as much as 13%. Eastern Bankshares’

And it’s not just executives’ remarks that are highlighting a disconnect between bankers who crave scale and investors who rebuke the transactions needed to get there.

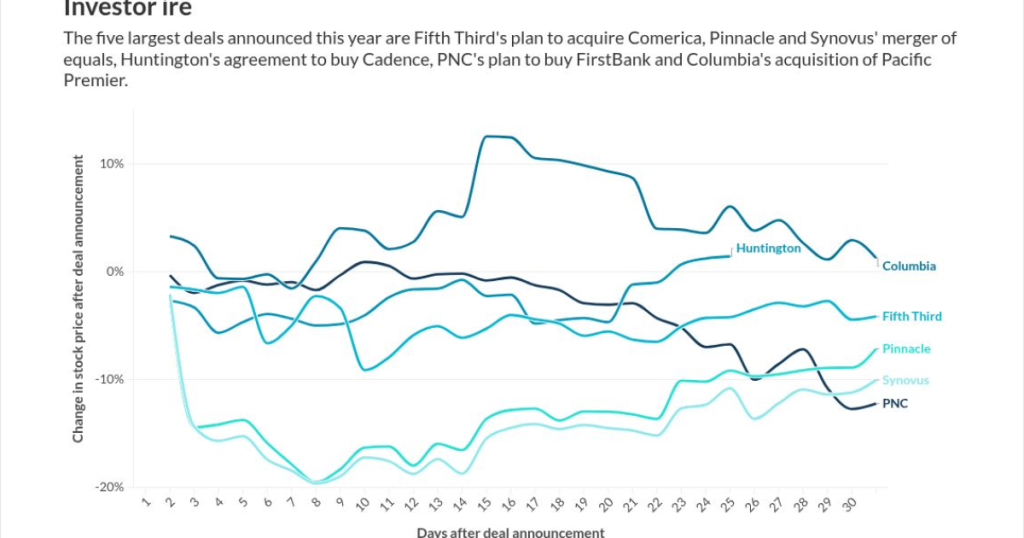

An American Banker analysis of the five largest bank transactions announced this year found that in the majority of cases, the stock prices of the buyers fell in the 30 trading days after the deal was announced.

Thirty trading days after Fifth Third Bancorp announced a deal to acquire Comerica, shares in the Cincinnati-based bank were down more than 4%. In the case of the

After years of a less merger-friendly regulatory climate, along with unfavorable interest rates and election uncertainty, the

Brian Foran, a managing director at Truist Securities, told American Banker that getting larger is the name of the game for banks right now. But he also said that investors look down at tangible book value dilution, the volatility of purchase accounting and integration risk, all of which are major factors in bank deals.

“And the management teams are like, ‘Look, you’re missing the forest for the trees,'” Foran said. “‘There’s going to be a few people who get scale and come out of this on the other side stronger, and they’re going to leave other people behind. And this M&A window might only be open for a couple of years.'”

Industry leaders like JPMorganChase CEO Jamie Dimon and Bill Demchak, the CEO of PNC Financial Services Group, have often

But PNC Chief Financial Officer Robert Reilly said at an industry conference last month that the Pittsburgh-based bank

“We’re not masochists,” Reilly said. “We won’t lose our discipline. We won’t lose our focus on what’s best for our shareholders. And I think at the moment, the valuation is putting some of that in.”

PNC’s share price fell some 12% to $179.40 in the 30 days of trading after it announced plans in September to acquire FirstBank Holding Company. The superregional bank’s stock price has since recovered to $190.40 per share.

One activist investor has been especially vocal in the fight against bank deals.

HoldCo Asset Management has released reports this year outlining why three different banks —

Some of HoldCo’s efforts have paid off. After the firm released a report analyzing Columbia’s three acquisitions since 2020 — which saw the company grow from about $17 billion of assets to $70 billion — CEO Clint Stein said the bank

First Interstate, seemingly in line with a HoldCo presentation, said in October that it isn’t

HoldCo declined to comment.

In an analysis of the stock performance of the 72 largest banks in the country, Truist Securities’ Foran found that in most cases, “balancing growth with capital return is a better strategy than capital return at all costs.”

But it’s also the case that banks that shrink their share counts are likely to outperform their peers on stock price, according to the Truist Securities analysis. The analysis found that 30 of the 72 largest U.S. banks shrunk their share count in the last 10 years, and about 40% of the share count shrinkers did bank deals in that timeframe. Taken in isolation, acquisition deals typically result in a higher share count.

Two of HoldCo’s targets, Columbia and First Interstate, had among the worst combination of asset growth versus shareholder dilution over time, per Truist’s analysis.

In recent months, banks have seemingly begun to price in the dismal view that the market has been taking on deal announcements.

Fifth Third’s agreement to buy Comerica is expected to close with no dilution to Fifth Third’s tangible book value per share, which came to the surprise of analysts. (HoldCo, which had pressured Comerica to sell itself this summer, is

But despite the skepticism of investors, 2025 is on track to be the largest year for bank dealmaking since before the pandemic, with more than 180 transactions announced so far.

“I’ve been a little surprised how the banks, as a group, seem to be saying, ‘I hear your arguments, duly noted, but overruled. And we’re pursuing M&A anyway,'” Foran said.