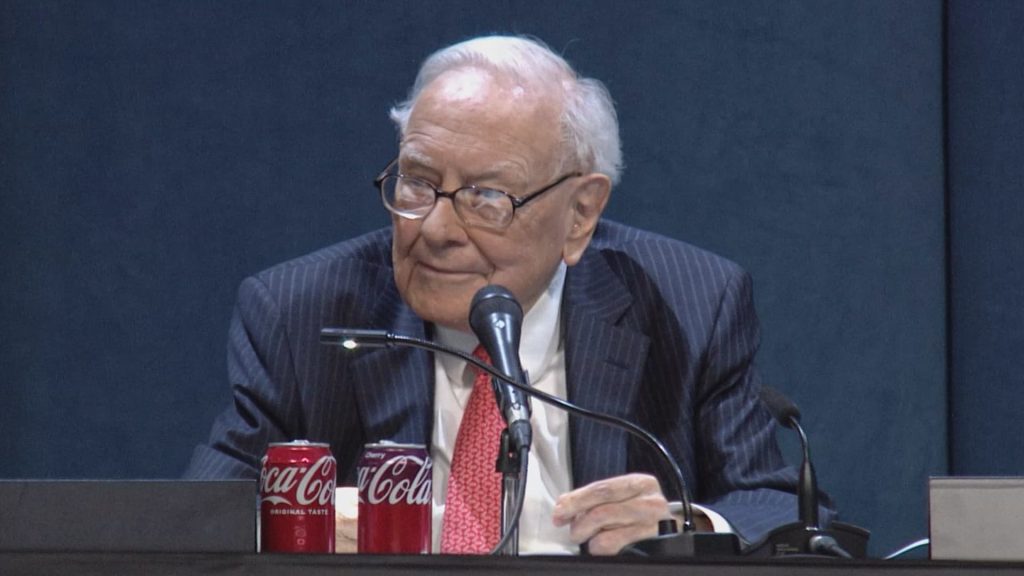

Keefe, Bruyette & Woods downgraded Berkshire Hathaway to underperform, warning that Warren Buffett’s succession risk and a slew of business-specific headwinds could weigh on the conglomerate’s earnings and share performance over the next year. The brokerage slashed its rating to the equivalent of sell from neutral, and cut its price target for Berkshire’s Class A shares to $700,000 from $740,000, implying a 5% downside from Friday’s close of $738,500. “Beyond our ongoing concerns surrounding macro uncertainty and Berkshire’s historically unique succession risk … we think the shares will underperform as earnings challenges emerge and/or persist,” analysts led by Meyer Shields wrote in a note to clients. KBW said the company’s core businesses — from auto insurer Geico to railroad Burlington Northern Santa Fe — are likely to face simultaneous pressures in the year ahead, reflecting a mix of cyclical and structural challenges across the conglomerate’s portfolio. The analysts pointed to softer insurance investment income, weaker railroad growth and shrinking energy tax credits as mounting headwinds for Berkshire’s sprawling operations. The Omaha-based conglomerate has underperformed the S & P 500 this year as the stock tumbled double digits from all-time highs after the 95-year-old Buffett in May announced he’s stepping down as CEO at the year-end after six legendary decades. The sell-off partially reflects the so-called Buffett premium, or the extra price investors are willing to pay because of the billionaire’s unmatched record and exceptional capital allocation skills. BRK.A YTD mountain Berkshire Hathaway year to date Berkshire’s succession uncertainty reflects “Warren Buffett’s likely unrivaled reputation and what we see as unfortunately inadequate disclosure that will probably deter investors once they can no longer rely on Mr. Buffett’s presence at Berkshire Hathaway,” KBW said in the note titled “Many Things Moving in the Wrong Direction.” Berkshire’s B shares are up 8.6%. in 2024 as of Friday, compared to the 15.5% year-to-date gain for the S & P 500. The stock is lagging the equity benchmark by 6.9 percentage points, marking the largest gap it’s been all year. Moving in the Wrong Direction? For the second quarter, Berkshire’s operating profit dipped 4% year over year to $11.16 billion, impacted by a decline in insurance underwriting. KBW expects insurance profitability to weaken further as Geico lowers personal auto rates and ramps up marketing spending in an effort to regain market share. Berkshire Hathaway Reinsurance Group is also facing a less favorable backdrop, the firm said. A mild hurricane season has weighed on property-catastrophe reinsurance pricing, a trend that could reduce both premium volumes and profitability in the coming quarters, KBW said. Investment income, a key earnings driver in recent years, is expected to soften as well. With short-term interest rates declining, returns on Berkshire’s massive cash and Treasury portfolio are likely to come under pressure, limiting a source of steady income that has bolstered recent results. Buffett’s cash hoard of $344.1 billion remained near a record high at the end of June. At the railroad division, Burlington Northern Santa Fe’s inflation-adjusted revenue has historically moved in tandem with U.S.–China trade activity. KBW cautioned that persistent tariff pressures and weaker trade flows could continue to constrain growth. Berkshire Hathaway Energy also may see its profitability erode as the “One Big Beautiful Bill Act” accelerates the phase-out of clean-energy tax credits, KBW said. The policy shift could diminish the returns of future renewable projects and weigh on the conglomerate’s long-term energy earnings, it said. The conglomerate is set to report third-quarter earnings Saturday morning.

Berkshire Hathaway downgraded to sell by KBW, citing Buffett succession, ‘many’ other issues

No Comments3 Mins Read

Previous ArticleHuntington’s $7.4B deal for Cadence continues Texas push

Next Article APM Elevate: October 2025

Related Posts

Add A Comment