Bloomberg News

As states affected by Hurricanes Milton and Helene in the past few weeks tally the damage, the Small Business Administration’s disaster relief program is in dire need of replenishment as those areas begin to dig out and rebuild.

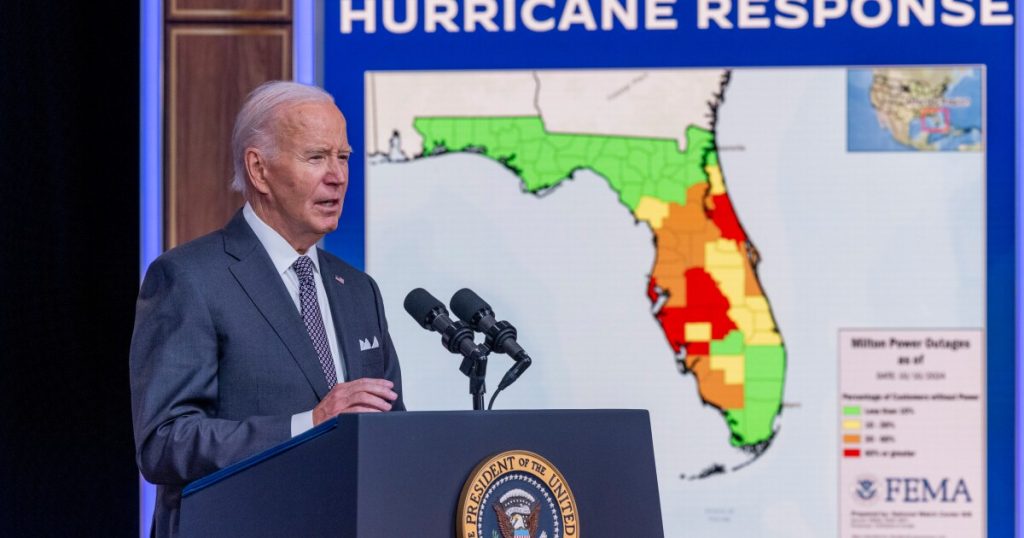

Millions are still without power after Hurricane Milton hit land last night near Tampa, Florida, and officials are beginning to assess the damage and loss of life in the area. This comes on the heels of another devastating storm, Hurricane Helene, that made landfall near Perry, Florida, on Sept. 27.

A key part of the recovery from these storms is the SBA’s disaster relief fund, a program that is close to running out of money. The program offers low-cost loans of up to $2 million to home and business owners affected by natural disasters. It’s the

President Joe Biden addressed the issue at a press conference on Thursday afternoon.

“That’s in discussion now,” Biden said, when asked how close the SBA fund and the Federal Emergency Management Agency are to running short of funds. “I don’t want to mislead you.”

Biden said that, when it comes to the SBA specifically, “It’s pretty right on the edge right now.”

“I think that Congress should be coming back and moving on emergency needs immediately,” he said. “They’re going to have to come back after the election as well.”

“We will do everything in our power to help you put back the pieces together,” he added.

The easiest way for Congress to approve the additional funds is for the legislature to seek unanimous consent during a pro forma session while it’s on recess during the election campaign season.

While Republicans typically would object to expanding spending — a move that would delay the vote on replenishing the fund until December — they are unlikely to do so out of fear of denying financial help to voters in swing states right before an election, said Jaret Seiberg, an analyst at TD Cowen, in a note.

“It is why we expect these funds to flow out sooner rather than later,” he said.

Biden

“I requested more funding for SBA multiple times over the past several months, and most recently, my Administration underscored that request

While banks do not disburse the SBA disaster loans, the influx of funds into the program could still impact them, Seiberg said. It’s also likely that regulators will insist that banks offer forbearance on mortgages and other loans impacted by the storm, Seiberg said.

“[SBA disbursements] could lead to a surge in deposits at banks and branches in the impacted areas, which could present liquidity challenges as consumers are likely to use the funds in the coming months to rebuild,” he said.