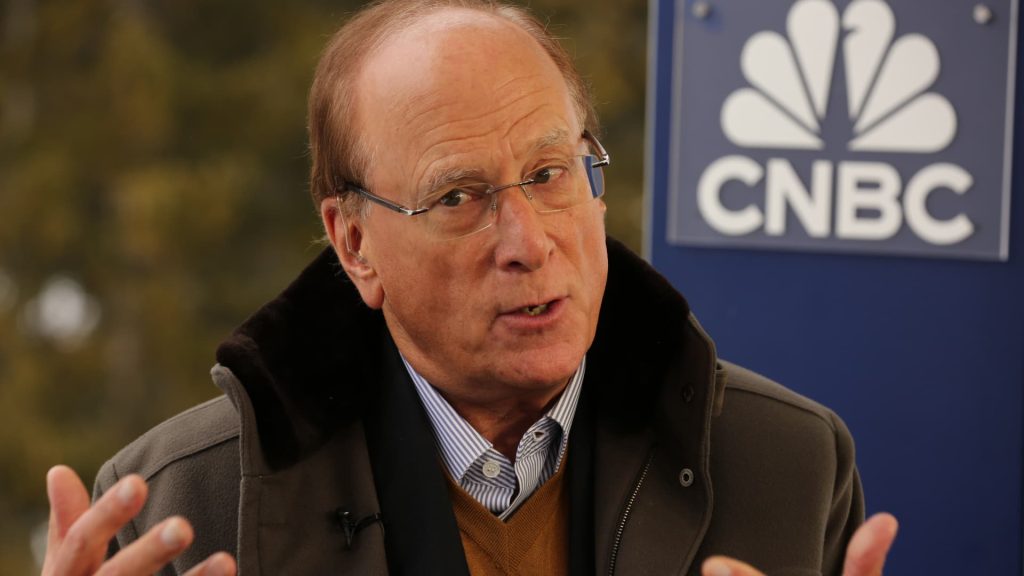

BlackRock CEO Larry Fink sounded the alarm on the spread of protectionist policies around the world, saying they will hinder global trade and weaken the economy. “Today, many countries have twin, inverted economies: one where wealth builds on wealth; another where hardship builds on hardship,” Fink said in his annual chairman’s letter to investors. “The divide has reshaped our politics, our policies, even our sense of what’s possible. Protectionism has returned with force.” Fink’s widely read letter came before President Donald Trump’s planned imposition Wednesday of reciprocal tariffs on “all countries.” The White House has already slapped punitive tariffs on aluminum, steel and autos, along with increased tariffs on all goods from China. Trump uses tariffs to shield the U.S. from what he calls unfair global competition, but concerns about a trade war are unsettling markets and fanning fears of at least a slowdown in growth, if not an outright recession. “I hear it from nearly every client, nearly every leader — nearly every person — I talk to: They’re more anxious about the economy than any time in recent memory. I understand why,” Fink said. “But we have lived through moments like this before. And somehow, in the long run, we figure things out.” Fink said the current backdrop is supporting what he believes to be the fastest-growing areas of private markets: infrastructure and private credit. Blackrock, the world’s largest money manager with more than $11 trillion in assets, made two big acquisitions last year in a push to expand in private credit and alternative investments. In December, it agreed to buy HPS Investment Partners for $12 billion in stock as part of an expansion into private credit. BlackRock also acquired Global Infrastructure Partners , an infrastructure investor, for $12.5 billion last year. “Governments can’t fund infrastructure through deficits. The deficits can’t get much higher. Instead, they’ll turn to private investors,” Fink said. “Meanwhile, companies won’t rely solely on banks for credit. Bank lending is constrained. Instead, businesses will go to the markets.”

BlackRock CEO Larry Fink says protectionism ‘has returned with force’

No Comments2 Mins Read

Previous ArticleIRS cuts more jobs as union sues over Trump executive order

Related Posts

Add A Comment