This is breaking news. Check back for more updates.

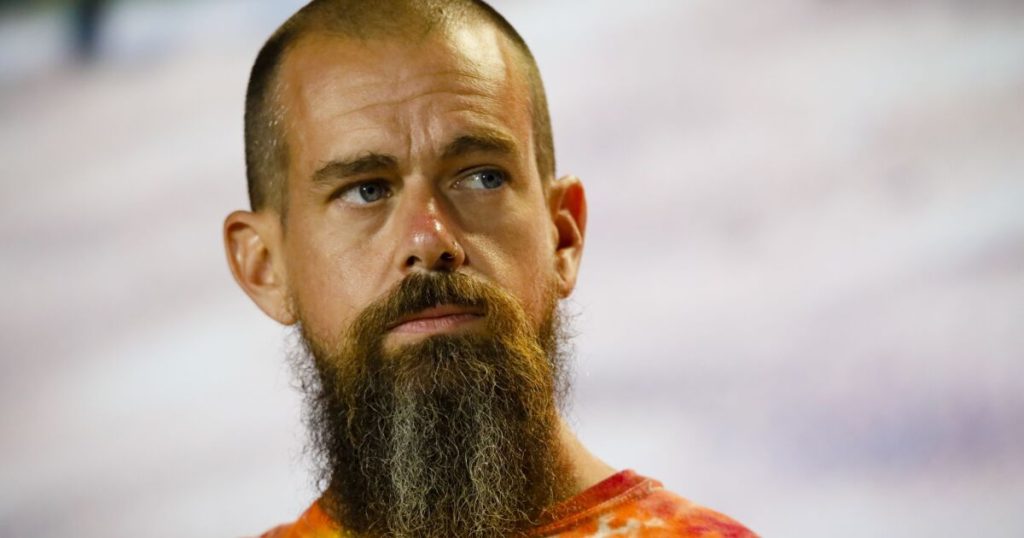

Block’s shares were reeling Thursday, falling nearly 10% in after hours trading after reporting third quarter revenue of $5.98 billion, lower than analysts’ projections of $6.24 billion.

The payment company also reported $2.25 billion in gross profit for the quarter ending September 30, up 19% from the prior year. Net income was $283 billion, up from a loss of $88.7 billion the prior year, and earnings per share of $0.88, compared to analysts’ projections of $0.87.

Block’s Cash App transfer app, which supports payments for Block’s consumer and merchant customers, reported $1.31 billion in gross profit, up 21% over the prior year. The company said active monthly users of Cash App’s card users passed 24 million, up 11% from 2023.

Block’s stock was trading at about $68 per share Thursday evening. Last year, Block’s stock increased from about $55 per share to its current level. That followed a decline from about $247 per share in 2021 to as low as $43 per share in October 2023.

The company earlier this year dumped an organizational structure that focused on business lines such as the Cash App transfer service, the business-focused Square, the Tidal music streaming company, the digital asset unit (which is called TBD) and others.

In its place is a structure that organizes functions such as engineering, product development, sales, customer service, marketing and additional tasks. The change determines reporting structure and project management strategy.

Dorsey earlier this year named BNPL lender Afterpay co-founder Nick Molnar as sales head. Block has owned Afterpay since 2021, and the business has been a solid performer for Block. The BNPL lender’s gross merchandise revenue, or the value of the business, grew more than 20% over the past year.

“Since

Block faces stiff competition from legacy payment companies such as FIS and Fiserv, which sell payment processing and bank technology; and other payment fintechs such as Stripe and PayPal. PayPal is in the midst of its own restructuring, as new