- Key insight: Agibank cut its IPO by over half hours before going public.

- Expert quote: “Issuers are having to price conservatively to get deals done.” — Rudy Yang, Pitchbook senior analyst

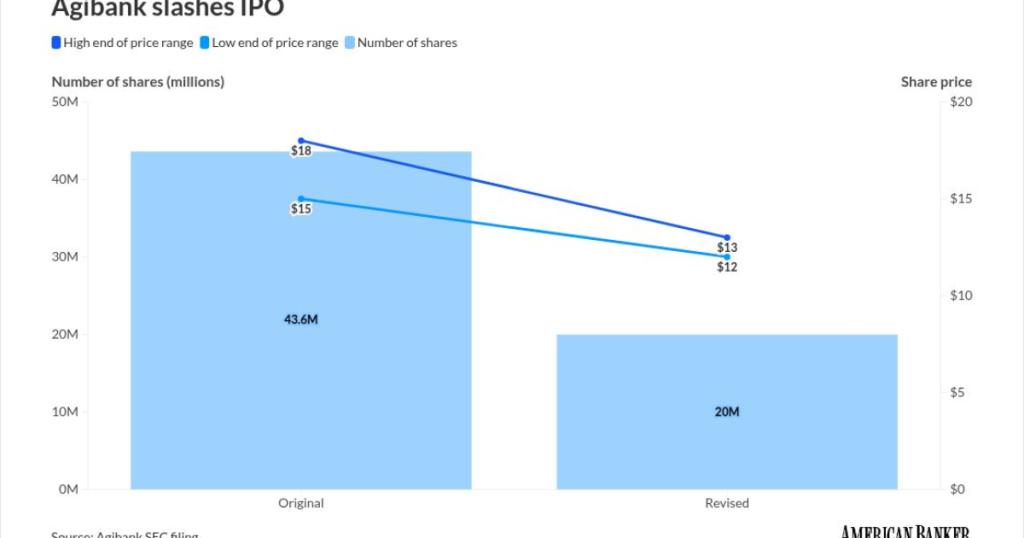

- Supporting data: Agibank could raise approximately 65% less than previously anticipated.

Agibank, a Brazilian digital bank providing banking services and low-cost loans to consumers, is debuting its IPO tomorrow, but not before reducing its offering by more than half.

Processing Content

The São Paulo-based fintech, scheduled to debut on the NYSE on February 11,

The company is now offering 20 million shares at a price range of $12 to $13 per share. The company had previously filed to offer 43.6 million shares at a range of $15 to $18. At the midpoint of the revised range, Agibank will raise approximately 65% less in proceeds than previously anticipated.

Bloomberg

Agibank did not respond to a request for comment from American Banker.

André Thiollier, partner at Foley & Lardner, told American Banker that the timing of the amendment is not unusual but the size of the cuts could be seen as more significant to investors.

“Banks normally price and finish the book building by the night before the [IPO debuts], because you want to have until the last second the ability to make sure you’re getting the right price,” he said.

With a reported 6.4 million active users, Agibank was reportedly valued at

Agibank’s IPO follows fellow Brazilian fintech

PicPay raised

Some market experts attribute PicPay’s performance and Agibank’s debut adjustments to a “choppy equity market” for fintech IPOs.

“Recent fintech listings have delivered mixed aftermarket performance, reinforcing investor sensitivity to valuation and near-term fundamentals rather than growth narratives alone,” Pitchbook emerging tech senior analyst Rudy Yang told American Banker. “PicPay’s post-IPO performance likely adds to that caution.”

This move doesn’t necessarily signal a shutdown of the U.S. fintech IPO market, he said, “but it does underscore that issuers are having to price conservatively to get deals done. Even after the cut, Agibank is coming at a relatively modest valuation compared to high-growth fintech peers, which suggests the company may be prioritizing deal certainty over maximizing price in a challenging environment.”

Other experts view the stock fluctuation for PicPay as largely expected and not a major factor in Agibank’s IPO adjustment.

“It’s not irregular for companies to have their stock price drop after an IPO because everybody who wants to get in on the action gets in, and then you have a lot of people selling it,” Thiollier said. “So I’m not as concerned.”

He noted that Agibank and Picpay entering the U.S. IPO market in the same window is a sign of larger market shifts across fintech, particularly between the U.S. and Brazil.

“Brazil is one of the countries with the most fintechs in the world,” Thiollier said. “There are large companies taking this window to IPO in the U.S. market, which is something that we haven’t seen since Nubank.”

Nubank made its public debut in the U.S. in

“Given the window that we’re having and fewer IPOs even in the U.S., it sounds like investors are a little bit more cautious,” Thiollier said, “especially because we’re talking about a company that is focused on a single market in Brazil versus a more global market.”