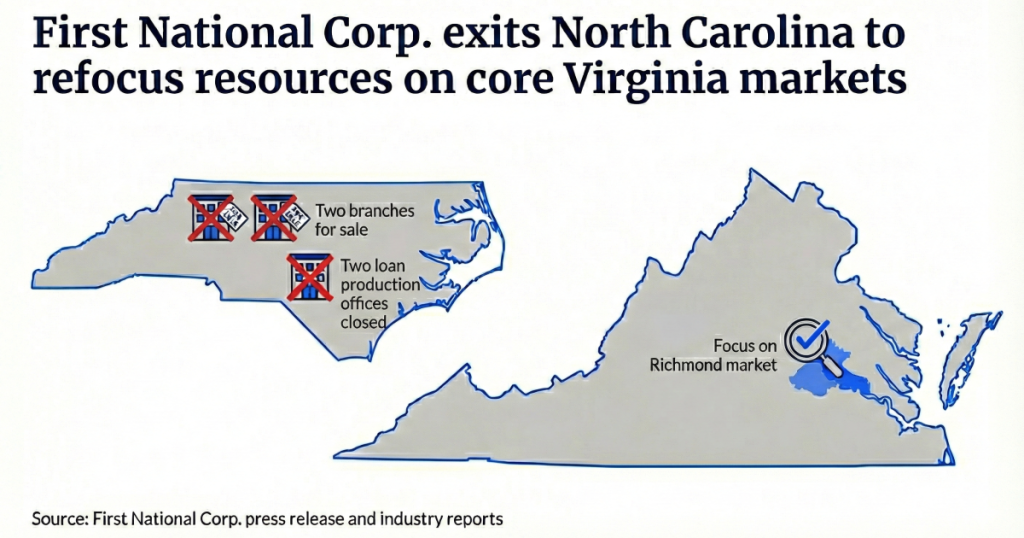

- Key insight: A small Virginia bank plans to exit North Carolina. It’s already shuttered two loan production offices, and it expects to sell two branches in the second half of 2026.

- What’s at stake: Many of the industry’s most prominent players are taking the opposite tack, establishing aggressive expansion plans in high-growth North Carolina and South Carolina.

- Supporting data: North Carolina is the nation’s third-fasting-growing state, according to Census data.

At a time when banks around the country

Processing Content

First National Corp. in Strasburg, Virginia,

First National entered North Carolina in October 2024, after

Former Touchstone CEO James Black, who joined First National as a regional president, left the company around the start of the year, according to his LinkedIn profile.

First National CEO Scott Harvard said Thursday that the optimization effort will allow the $2 billion-asset bank to focus its resources on its core markets. “By optimizing our delivery footprint, we can invest more effectively in technology, staff training, and community initiatives that directly benefit our customers and neighbors,” Harvard said in a press release.

Harvard did not respond by deadline to a reporter’s request for more details about the decision.

First National’s plan to exit North Carolina comes at a time when the Carolinas are attracting interest from institutions around the country. The list of banks bolstering their presence in the region includes both megabanks and regional institutions based in different parts of the country, such as Cincinnati-based Fifth Third Bancorp, F.N.B. Corp. in Pittsburgh and Los Angeles-based City National Bank.

Zach Wasserman, chief financial officer at Huntington Bancshares in Columbus, Ohio, said Tuesday at the UBS Financial Services Conference in Boca Raton, Florida, that his $279 billion-asset company expects to open a branch in the Carolinas “virtually every two weeks” in 2026 and 2027.

Even some of First National’s peers among the ranks of Virginia community banks are demonstrating a healthy interest in the Carolinas.

The $4.9 billion-asset Carter Bankshares in Martinsville established a commercial presence in Greenville, South Carolina, in November. Meanwhile, Atlantic Union Bankshares CEO John Asbury said last month that the $37.6 billion-asset, Richmond-based bank anticipates pursuing “new organic opportunities in North Carolina,” including opening 10 new branches in Raleigh and Wilmington.

North Carolina is the nation’s third-fastest-growing state, according to the

For its part, First National appears more focused on growing its presence inside Virginia, especially in Richmond, where it’s added branches, lenders and senior executives in recent months. Company leaders “remain optimistic about the Richmond market’s potential to drive material expansion,” Hovde analyst David Bishop wrote in a research note earlier this month.

Like the Carolinas, Virginia’s capital city and the surrounding communities are experiencing solid growth, with the region’s population expected to surpass 1.4 million by 2030. That’s about 21% more than the 2020 population estimate, according to the Greater Richmond Partnership.

First National did not disclose a sales price for its North Carolina branches or the identity of the buyer, and it did not identify the particular branches in Virginia that it plans to consolidate. It did say that staffers at the branches it is selling will be offered jobs, so no layoffs are expected. First National also said it will book a one-time gain after the transaction closes in the second half of 2026.

“These strategic decisions reflect our ongoing commitment to operating as an efficient, forward-thinking community bank while maintaining the personal touch and local focus that define us,” Harvard said in the press release.