- Key insight: The Communications Workers of America is continuing its multi-year effort to organize workers in the financial services industry.

- Why it matters: The CWA’s lead organizer says there’s an uptick in union interest from employees at several large banks.

- Expert quote: “This is not your grandpa’s union. People think it’s cool to be in a union.” — labor-relations lawyer Trecia Moore

The first U.S. bank in several decades to agree to a union contract has re-upped its collective-bargaining agreement with the Communications Workers of America.

Processing Content

Beneficial State negotiated its initial pact with the CWA in 2021. It marked the first time since the mid-1960s that a U.S. bank agreed to a union contract, according to Nick Weiner, senior campaign lead for the CWA’s Committee for Better Banks,

The union contract announced Tuesday provides an average 9% average general wage increase in 2026, a $2.50 hourly wage differential for employees who can conduct business in Spanish and an increased employer match for 401(k) contributions. The agreement also gives most employees a one-time bonus averaging $4,805.

“We believe that empowering workers is what creates a strategic business advantage,” Beneficial State CEO Randell Leach said in a statement. “Leadership, management capabilities, organizational culture and even union representation can all play a factor positively or negatively in employee satisfaction and productivity.”

“The bottom line is banks don’t have to choose between profitability and worker empowerment, but they must choose to engage their employees if they want to harness the potential of their workforce,” Leach added.

The three-year deal took “several months” to conclude, but resulted in “what looks like a good agreement for both sides,” Weiner told American Banker.

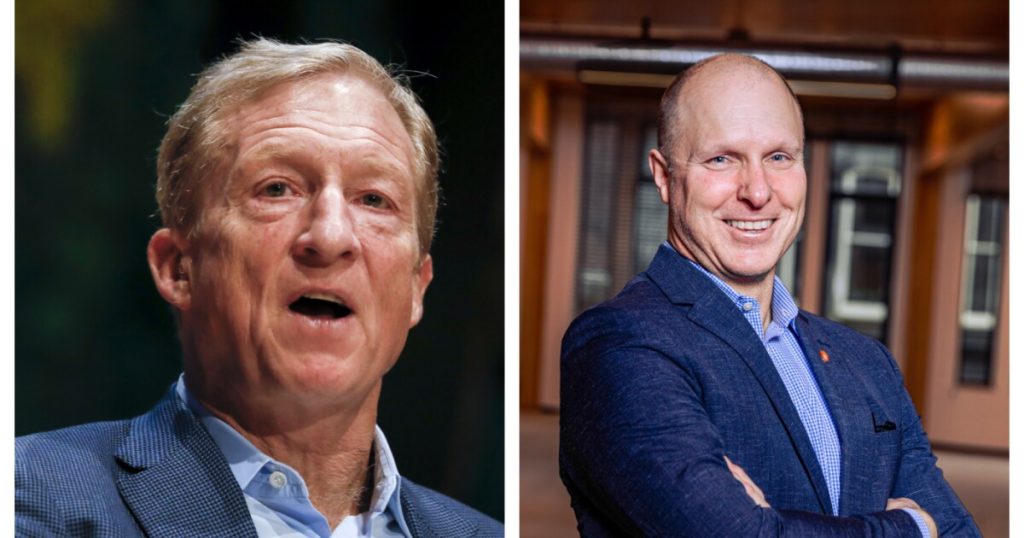

Beneficial State, which has $1.9 billion of assets, was founded in 2007 by the billionaire investor Tom Steyer and his wife, Kat Taylor. Steyer recently stepped down from his role as co-chair of the bank’s board after announcing that he’s running for California governor as a Democrat.

Beyond Beneficial State, the CWA has succeeded in securing a collective-bargaining agreement with the $47.4 million-asset Genesee Co-op Federal Credit Union in Rochester, New York. Both Beneficial State and Genesee Co-op agreed not to oppose unionization, smoothing the way for the CWA to mount organization-wide campaigns, Weiner said.

At other financial institutions — most notably Wells Fargo — union organizing efforts have met with opposition, prompting the CWA to employ more localized tactics.

“We’ve gone through a process to have elections at different branches site-by-site, because that’s where workers know each other and can more quickly organize and win their elections,” Weiner said. “It’s adapting a different strategy based on the circumstances.”

More than two-dozen Wells Fargo branches have voted to unionize since 2023, despite strenuous opposition from company management, Weiner said. Indeed, the union

The setback in Connecticut hasn’t slowed the CWA’s organizing drive, according to Weiner. Negotiations are underway at other Wells Fargo branches. Meanwhile, the union has received inquiries from employees at several other large institutions, Weiner said.

“Within the last couple months, there’s been a noticeable outreach from workers at some different, larger banks,” Weiner said.

While the CWA is working to educate financial-services workers about the basics of organizing and collective bargaining, it doesn’t have the resources to mount simultaneous campaigns at multiple banks, according to Weiner.

“Unfortunately, we’re a relatively small team,” Weiner said, referring to the CWA’s Committee for Better Banks. “We’ve had more interest from workers at different banks than we’re able to give them the time, energy and resources they deserve.”

Historically, people working in banking and finance “didn’t really see themselves as stereotypical union members,” but those traditional attitudes are giving way, Trecia Moore, a partner at the law firm Husch Blackwell in Kansas City, told American Banker.

“This is not your grandpa’s union,” said Moore, who represents employers in labor-relations and employment matters. “People think it’s cool to be in a union.”

Though Weiner raised concerns about banks mounting what he described as heavy-handed

“I don’t think the unions are having a difficult time,” Moore said. “It’s been very easy for employees to organize a union and for unions to win elections.”