Last week, we did a poll to see which stock Wealthy Retirement readers wanted me to review for dividend safety. The overwhelming winner was Icahn Enterprises (NYSE: IEP).

That’s probably not too surprising given its 21% yield and the fact that it’s controlled by legendary chairman Carl Icahn.

Icahn Enterprises is a holding company that owns a variety of businesses in the energy, real estate, and pharmaceuticals industries, among several others.

The company currently pays a $0.50 per share quarterly dividend. With the stock a little above $9, that comes out to a gigantic 21% yield.

How likely is the company to maintain such a high yield?

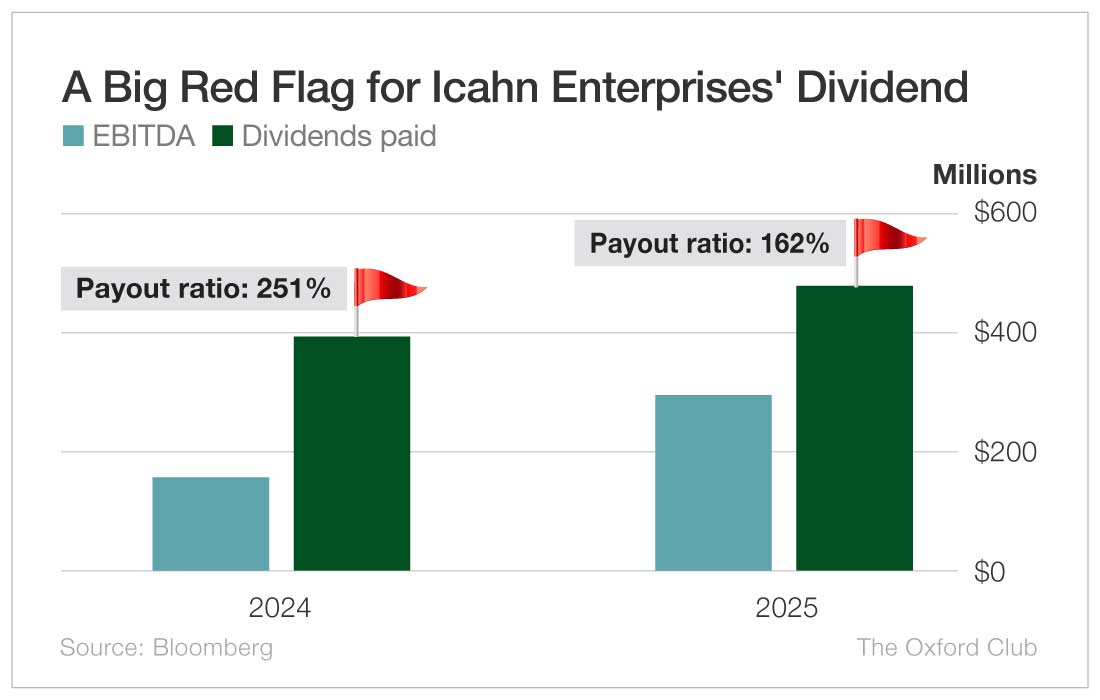

Icahn Enterprises generated $156 million in EBITDA (earnings before interest, taxes, depreciation, and amortization) in 2024. EBITDA is a surrogate for cash flow. I typically look at other metrics, such as free cash flow, funds from operations, distributable cash flow, etc., depending on the company – but Icahn Enterprises reports its results using EBITDA, so that’s what we’ll go off of.

This year, EBITDA is expected to nearly double to $293 million. However, both 2024’s and 2025’s forecasts are down from three years prior. The Safety Net model penalizes companies for negative three-year cash flow growth.

Another problem is how much the company is paying out in dividends compared with EBITDA. In 2024, while bringing in $156 million in EBITDA, it paid $391 million in dividends. This year, dividends paid are forecast to rise to $475 million.

Icahn’s total dividend payout last year was 251% of its EBITDA. In 2025, that figure is projected to be 162%.

In other words, the company doesn’t make enough money to pay its dividend.

Lastly, the company has cut the dividend twice in the past two years. From 2019 to the second quarter of 2023, Icahn paid shareholders $2 per share. That dividend has since been cut 75% to the current $0.50.

So we have a decline in EBITDA over the past three years, a couple of recent dividend cuts, and a dividend that is higher than the amount of money the company takes in. Those are all signs that another dividend cut is coming soon.

Dividend Safety Rating: F

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.