Kinder Morgan (NYSE: KMI) is one of the nation’s leading natural gas pipeline and transport companies, with 79,000 miles of pipelines and 139 terminals. Roughly 40% of all natural gas produced in the United States moves through Kinder Morgan’s pipelines.

The great thing about the pipeline business is that once the pipelines are set up, the business is not very capital-intensive. That means these companies tend to generate lots of cash flow, which is often returned to shareholders in the form of dividends.

Kinder Morgan pays a $0.2925 per share quarterly dividend, which comes out to a solid 4.4% annual yield. Let’s take a look to see whether shareholders can continue to expect this strong of a payout.

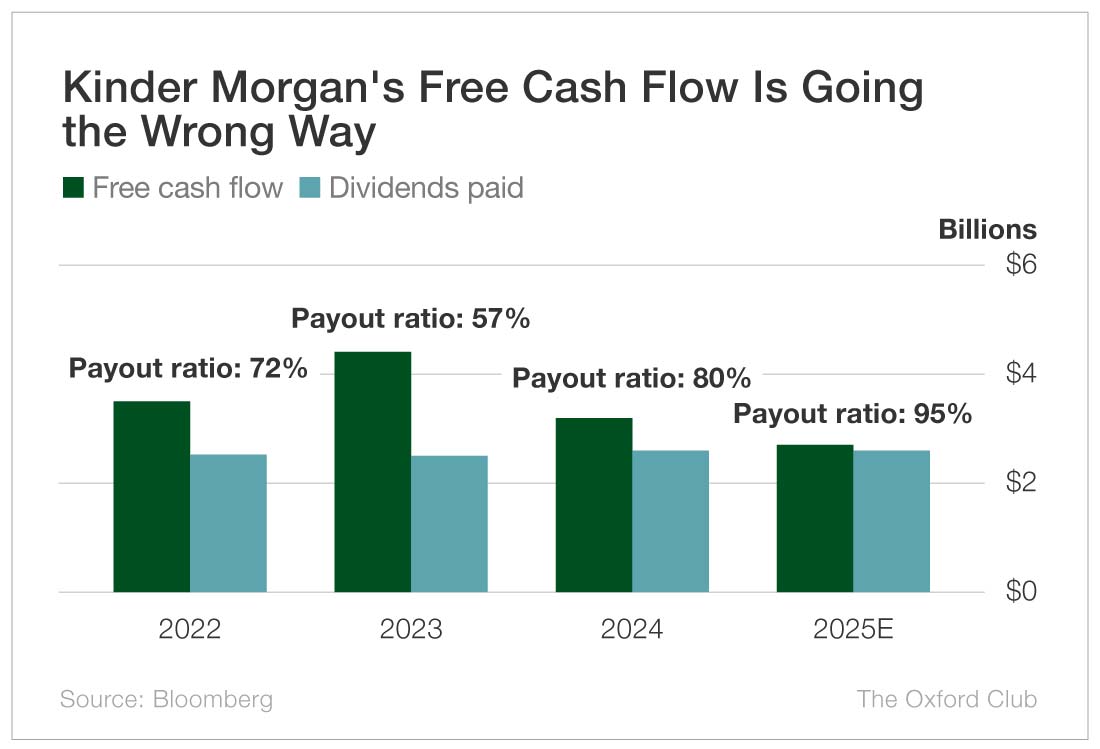

Several years ago, Kinder Morgan’s free cash flow was quite strong, reaching a high of $4.4 billion in 2023. That year, it paid out $2.5 billion in dividends for a payout ratio of 57%. That’s a healthy number. I want to see payout ratios below 75% to give me confidence a company can continue to pay its dividend even if it hits a rough year or two.

Last year, free cash flow slipped to $3.2 billion, and this year, it’s forecast to drop again to $2.7 billion. Anytime free cash flow slips, it’s concerning.

Furthermore, in 2024, Kinder Morgan paid $2.6 billion in dividends for an 80% payout ratio – above my 75% threshold. This year, it’s expected to pay about the same, which will result in a way-too-high 95% payout ratio.

Kinder Morgan has raised the dividend every year since 2017, though it slashed the payout to shareholders in 2016 from $0.51 to $0.125. The dividend safety rating is negatively affected by any cuts within 10 years.

Kinder Morgan needs to start generating more cash flow for the dividend to be considered safe. However, the cut from 2016 will age out next year. So by this time next year, it’s quite likely Kinder Morgan’s rating will be upgraded to “C.” And if cash flow does improve or is forecast to improve, it could be upgraded to “B.”

Dividend Safety Rating: D

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.