- What’s at stake: A quantum attack on a top bank’s payment access could trigger a cascading failure costing the U.S. economy up to $3.3 trillion.

- Supporting data: Experts estimate a probability of up to 34% that a quantum computer capable of breaking current encryption will arrive by 2034.

- Forward look: Regulators and the G7 are urging financial entities to establish milestones for a post-quantum transition immediately.

Overview bullets generated by AI with editorial review

Processing Content

A single-day quantum computing attack on a major U.S. bank could cost the American economy trillions of dollars, according to a report from Citi that contributes to a growing chorus of voices from the banking sector urging the industry to adopt new cryptographic standards immediately.

The report, published by Citi Global Perspectives & Solutions, warns that the window to protect the financial system is closing.

While a quantum computer capable of breaking current encryption may still be years away, the enormous scale of the necessary migration, plus the threat of adversaries stealing encrypted data today to decrypt it later, makes inaction an issue bank CEOs and boards must face now, according to the report.

For U.S. bankers, the message reinforces a reality that regulators and industry groups have emphasized with increasing frequency: Companies must transition to using post-quantum cryptography, or PQC, to maintain the integrity of the global financial system.

According to Citi, if an adversary launched a quantum-enabled cyberattack on any of the top five U.S. financial institutions by targeting its access to the Fedwire Funds Service payment system, it could trigger a cascading failure costing the U.S. economy between $2.0 trillion and $3.3 trillion in indirect impacts.

This figure represents a decline in real GDP of 10% to 17%.

“Quantum computing is rapidly moving from being a science research topic to becoming a boardroom issue,” the Citi report said.

The threat of harvesting now, decrypting later

The urgency in migrating to PQC does not stem from the immediate existence of a powerful quantum computer. None powerful enough exists today. Rather, it is a way of defending against a strategy known as “harvest now, decrypt later.”

In this scenario, adversaries intercept and store encrypted data today — such as the cryptographic keys banks use to secure interbank messaging and payment access, or state secrets — with the intent of decrypting it once a sufficiently powerful quantum computer comes online.

“For data that requires long-term confidentiality, retroactive cracking of encryption makes action now urgent,” the Citi report notes.

This assessment mirrors warnings from other industry bodies. The Financial Services Information Sharing and Analysis Center, or FS-ISAC, urged the sector in a 2023 report to prepare “immediately” for the threat quantum computers pose.

Consensus on the timeline

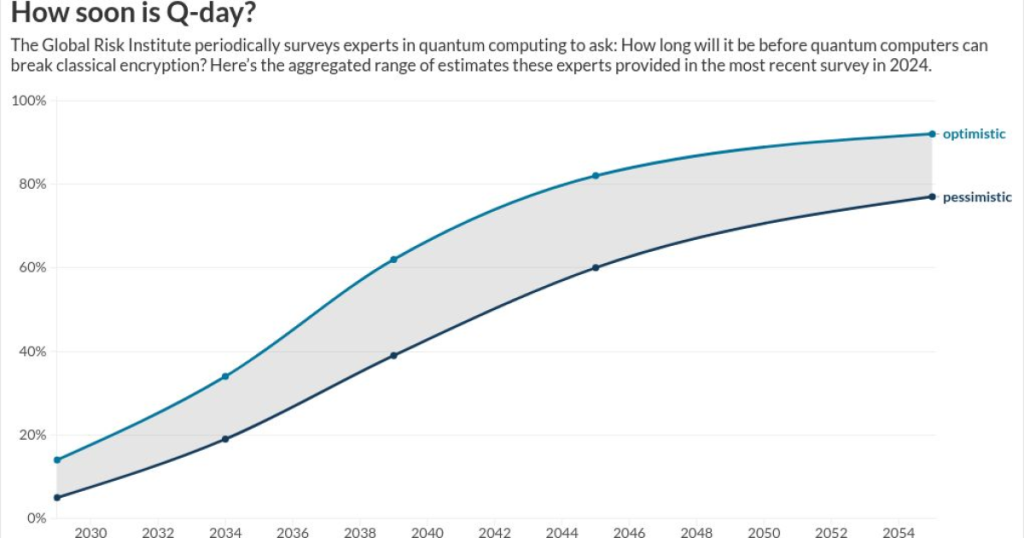

The industry refers to the moment a quantum computer can break existing encryption as “Q-Day”.

Citi cites data from the Global Risk Institute, or GRI, which surveys quantum experts annually. The 2024 GRI report indicates a probability of 19% to 34% that Q-Day will arrive by 2034. That probability jumps to more than 60% when asked whether Q-day will arrive by 2044.

While 2034 and 2044 may seem distant, the migration timeline is lengthy.

“Quantum readiness starts with a clear sequence of actions that identify exposure, prioritize critical systems, enable agility, guide migration and sustain long-term resilience,” Citi said in the report.

Vulnerable technology

The specific technologies at risk by quantum computers are public-key encryption methods, particularly the Rivest–Shamir–Adleman, or RSA, algorithm and Elliptic Curve Cryptography, or ECC. These algorithms underpin the security of online banking, digital signatures and virtually all secure web traffic.

The threat also extends to the cryptocurrency sector. Citi estimates that approximately 25% of all bitcoin — roughly 4.5 to 6.7 million coins — are held in public addresses that are exposed to the quantum threat.

“Quantum risk does not merely threaten crypto primitives,” said Daniel Doll-Steinberg, co-founder of quantum- and AI-focused venture capital firm Edenbase, in the Citi report. “It challenges the ideological foundations of crypto itself.”

A harder fix than Y2K

The banking industry’s preparation for quantum computing often draws comparisons to the Y2K problem. The Citi report argues that Y2K offers a lesson in successful preparedness rather than a case of overreaction.

“Looking back, the Y2K remediation effort in the late 1990s was the last comparable global software overhaul,” the report reads. However, the report notes that Y2K was a “relatively contained problem with a clear deadline.”

In contrast, the quantum shift requires a “complete overhaul of digital infrastructure to replace every piece of classical encryption,” making the upgrade much larger and more complex.

“Quantum computing will trigger the largest upgrade of cryptography in human history, far bigger than the Y2K transition,” said Steve Suarez, CEO of consulting firm HorizonX.

Implementation is the bottleneck

The technical solution to the quantum threat is already available. The National Institute of Standards and Technology, or NIST, finalized its first set of post-quantum encryption standards in August 2024.

“The challenge is not the lack of a solution, but the difficulty of implementing the right solution at scale,” the Citi report said.

Challenges include identifying where public-key cryptography exists within a bank’s sprawling infrastructure, a lack of skilled personnel and dependencies on third-party vendors.

To manage this, the report advises institutions to adopt “crypto-agility,” or the ability to swap out cryptographic algorithms without disrupting the entire system. FS-ISAC promoted the same agility in its 2023 report.

Regulatory pressure mounts

Citi joins a crowded field of organizations calling for action. The G7 Cyber Expert Group issued a statement in September 2024 encouraging jurisdictions to “begin planning for the potential risks posed by quantum computing.”

Similarly, FS-ISAC released a white paper last year promoting a global transition timeline for the financial sector.

The G7 group advises financial entities to start by developing a plan to mitigate risks.

“Financial entities should consider establishing governance processes … and establishing milestones for key actions based on the anticipated deployment of a cryptographically relevant quantum computer,” the G7 statement reads.