Community Healthcare Trust (NYSE: CHCT) has a remarkable dividend-raising track record. The company has boosted its dividend every quarter since it began paying one in 2015. The payout has been raised for 41 consecutive quarters.

The increases aren’t large – a quarter of a penny each time. While they have contributed to the current 13% annual yield, the big reason the stock has such a high yield is that the share price has fallen by two-thirds over the past three years.

Community Healthcare Trust owns 200 properties in 36 states that are leased to doctors, hospitals, and other healthcare organizations.

This is a small cap company that generates a little over $100 million in revenue per year. Despite the weak stock price, the company is profitable and cash flow positive.

Let’s see whether its cash flow is enough to sustain further quarterly raises.

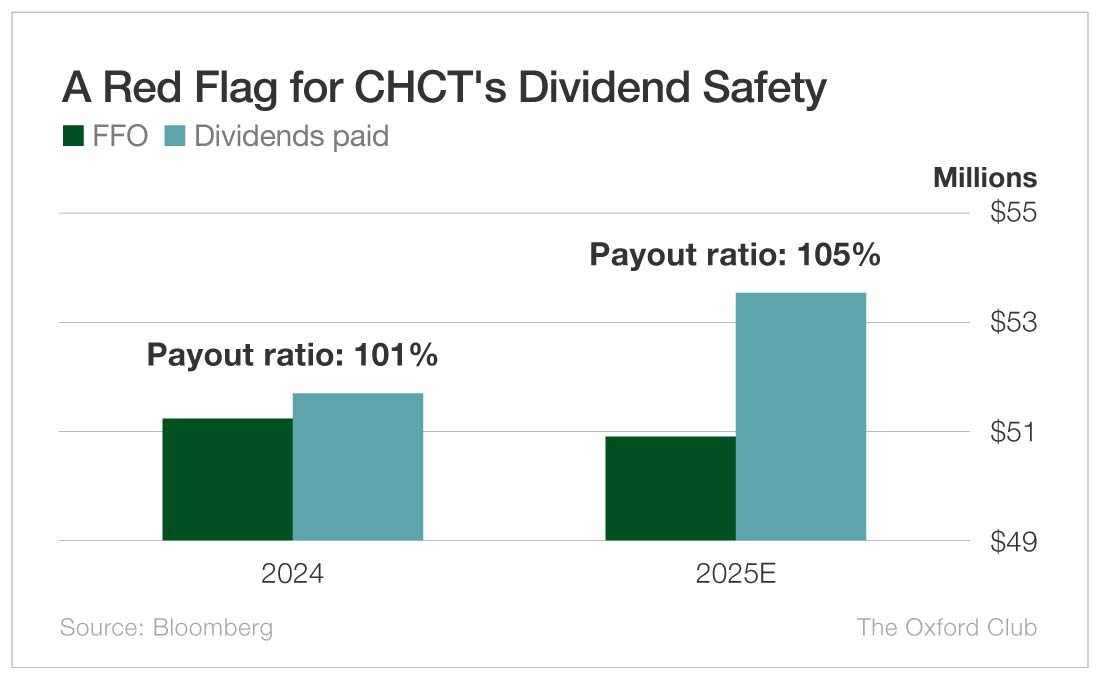

Because Community Healthcare Trust is a real estate investment trust, we use a measure of cash flow called funds from operations, or FFO.

Last year, FFO climbed 7% to $51.2 million. This year, it is forecast to slip slightly to $50.9 million. That projected slight reduction in FFO is enough to earn Community Healthcare a penalty on its Safety Net rating.

Negative cash flow growth is a big red flag.

Since the difference between last year’s total and the current estimate for this year is so small, it is possible the company reports positive FFO growth instead of slightly negative. If that occurs, Community Healthcare will earn an upgrade to its Safety Net rating.

Another area of concern is the payout ratio. Again, the difference between a penalty and no penalty is very small.

Last year, Community Healthcare paid shareholders $51.7 million in dividends against $51.2 million in FFO, so it paid more in dividends than it took in (but barely). This year, the gap is anticipated to widen a bit – to $53.5 million in dividends paid against $50.9 million in FFO.

That would push the payout ratio up from 101% to 105%, still just above my 100% threshold for REITs.

Over the first three quarters of 2025, FFO has totaled just $32.6 million, so the company would need a big fourth quarter to eclipse the current full-year estimate and cover the dividend.

As you can see, this is a dividend story with some problems. FFO has been declining, it’s projected to decline again this year, and the company pays out more in dividends than it takes in.

Though it only needs to beat FFO expectations by $300,000, that doesn’t seem likely given that FFO over the first nine months is pretty far away from that number and rental real estate is a somewhat predictable business due to rents being locked in.

On the plus side, the company has a stellar track record of quarterly dividend increases, and I expect management to do everything in their power to keep that 41-quarter streak alive.

I don’t expect an imminent dividend cut, and if FFO improves, the company’s dividend safety rating could even receive an upgrade or two. But if FFO doesn’t improve, management will have some tough decisions to make.

Dividend Rating Safety: D

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.

The post Community Healthcare Trust: How Safe Is This REIT’s 13% Yield? appeared first on Wealthy Retirement.