The Los Angeles-based company behind a well-known cash-advance app went on a wild 18-hour ride late Tuesday and early Wednesday.

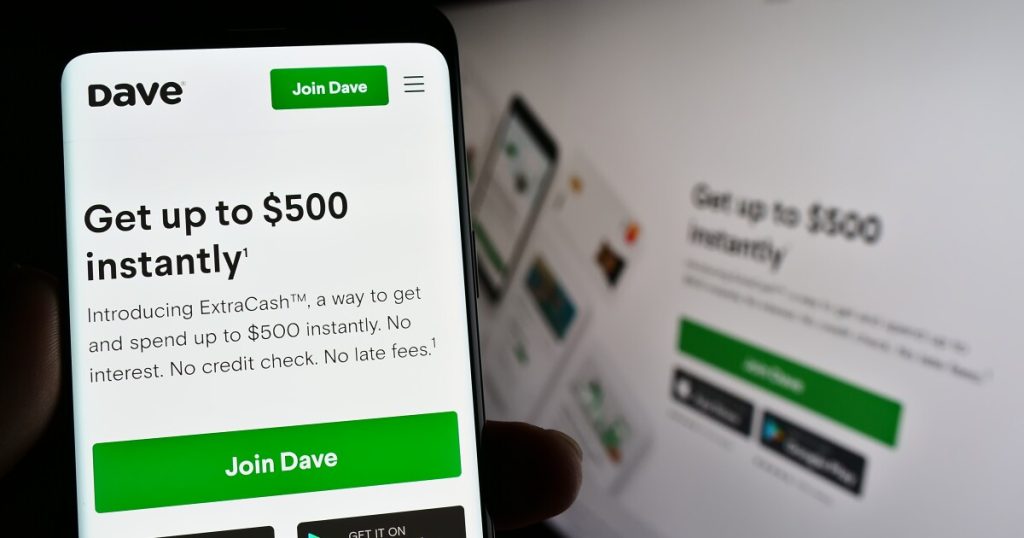

After the stock market closed on Election Day, the Federal Trade Commission filed a lawsuit against Dave Inc., which markets its ExtraCash product as a way to help consumers bridge the gap when they need to pay bills or buy groceries.

Dave’s stock price briefly plunged by nearly 14% in after-hours trading before recovering much of that ground. And then overnight, the presidential election was called in favor of Republican Donald Trump, an outcome that will likely result in new leadership at the FTC.

Shares in Dave surged on Wednesday, closing at $45.87, or about 22% above the previous day’s close.

“I think the market is reacting to the fact that there is going to be less red tape for businesses,” said Shawn Collins, head of the consumer regulatory practice at the law firm Stradling Yocca Carlson & Rauth.

Dave was not the only consumer finance company

Shares in both Synchrony Financial and Bread Financial, two companies that would benefit from the eventual demise of the Consumer Financial Protection Bureau’s effort to slash credit card late fees, rose by more than 18% on Wednesday.

And the stock price of Credit Acceptance Corp., a nonbank auto lender that is facing a CFPB lawsuit, climbed by 5.8%.

In

“Dave lured in consumers living paycheck-to-paycheck with false claims of big-dollar advances,” then reached into their pockets to give itself a so-called ‘tip,'” Samuel Levine, director of the FTC’s Bureau of Consumer Protection, said in a press release.

Dave, which disclosed the FTC’s inquiry over the summer, vowed to fight the lawsuit.

“Following months of good faith negotiations, we are disappointed the FTC has chosen to file suit against Dave, a company on a mission to level the financial playing field for the millions of Americans poorly served by the legacy financial system,” the company said in a written statement.

“We believe this case is another example of regulatory overreach by the FTC, and we intend to vigorously defend ourselves. We take compliance and customer transparency very seriously and believe that we have always acted within the law.”

The FTC, which filed the suit Tuesday in federal court in California, alleges that Dave was deceptive when it advertised “instant” cash advances of “up to $500.”

The complaint states that “only a miniscule amount of customers” got cash advances “in amounts anywhere close to the amounts advertised,” and that Dave charged a $3 to $25 fee to avoid a 2 to 3 business day delay in receiving the funds promised instantly.

The FTC also faults Dave for charging certain fees that it allegedly “does not clearly and conspicuously disclose before it obtains access” to customers’ bank accounts. Those charges include a $1 monthly maintenance fee, which the FTC alleges was frequently imposed without the customer’s knowledge or consent.

The so-called “tips” that Dave charged were often set by default at 15% of the cash advance, according to the FTC.

“Many consumers are either unaware that Dave is charging them or unaware that there is any way to avoid being charged,” the lawsuit alleges. “Dave also falsely claims that, based on the consumer’s payment of this charge, Dave will pay for or donate a specified number of meals to feed hungry children.”

“In truth, however, Dave does not provide the meals as claimed, and instead makes only a token charitable donation — usually $1.50 or less — while keeping the bulk of the charge for itself.”

Dave said in its statement that the FTC’s lawsuit makes “many incorrect claims” regarding the company’s disclosures and how it acquires consent for the fees it charges.

“For the avoidance of doubt, Dave’s ability to charge subscription fees and optional tips and express fees is not in question,” the company said.

The FTC also pointed in its lawsuit to consumer complaints about Dave’s business practices.

“But all the law requires of you is that you have to make clear and conspicuous disclosures at the point of sale,” said Collins, the Stradling lawyer, who specializes in defending companies that are sued by government agencies.