Processing Content

- Key insights: Pushback on fees, BNPL and new technology are shifting how consumers shop and make payments.

- What’s at stake: Swipe fees for credit cards and debit cards totaled $187.2 billion in 2024, up from $172 billion in 2023.

- Forward look: Agentic commerce and crypto will also draw consumers to new payment options in the new year.

Consumer payment trends such as pushback on interchange fees, the rise of buy now/pay later, crypto payments and agentic commerce are set to shape payments in 2026.

The elephant in the room is the

If the settlement is approved, banks will need to consider other ways to replace lost interchange revenue. That could mean charging higher interest rates, increasing fees on accounts or diminishing the richness of rewards for customers, Sara Elinson, managing director and partner in L.E.K. Consulting’s financial services practice, told American Banker. “Customers are very much driven by the richness of rewards,” she said.

Here’s what banks need to know about changes in consumer payment trends, looking ahead to 2026:

Pushback on interchange fees

Even if the settlement doesn’t go through, there’s been consumer pushback on interchange fees, which could diminish credit card use in the future.

The

Continued rise of BNPL

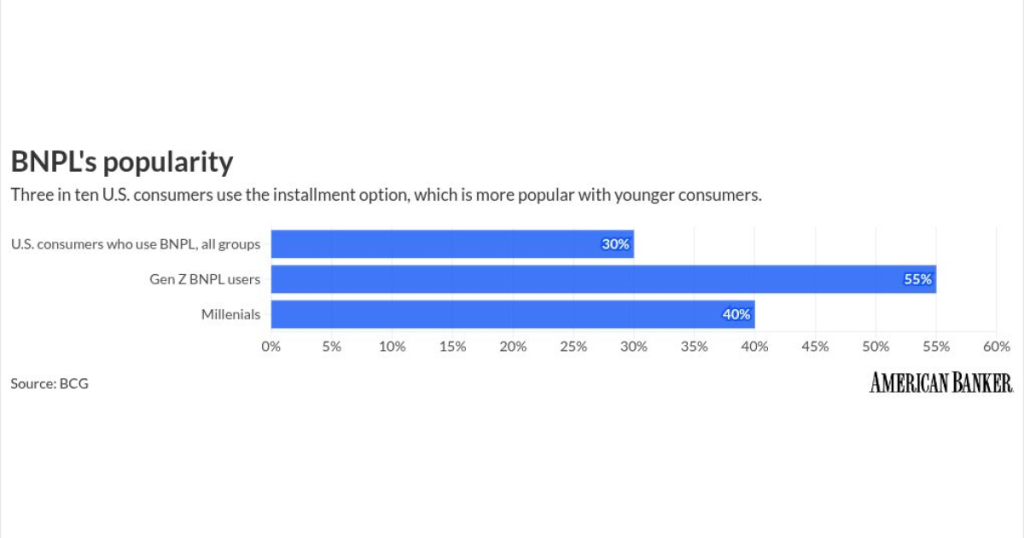

Budget concerns among consumers are expected to continue to lift buy now/pay later as a payment method. BCG research shows that 30% of U.S. consumers are using some kind of BNPL solution. Usage is higher among younger consumers, with 55% of Gen Z and 40% of millennials using BNPL, BCG’s research shows. The trend could have a potential effect on credit card use, especially among younger buyers.

“I think there will be more categories in which consumers will want to have it available,” Elinson of L.E.K. Consulting told American Banker. “I think we’ll see more of it creeping into everyday items — groceries, pharmacies and potentially more into the physical point of sale.”

Some banks, including Barclays, JPMorganChase, Deutsche Bank and

Crypto payments

There’s a growing interest in using stablecoins for payment among consumers, Jeroen Hölscher, global head of payment services at Capgemini, told American Banker. It’s still new, and the legal framework is being set, but growth potential exists. While they’ll primarily be used for cross-border payments initially, consumers will be able to use them for payment in the not-too-distant future, he predicted.

The ability to use digital assets such as bitcoin for payments continues to gain traction. In November, Square enabled roughly 4 million U.S. merchants to accept bitcoin with zero fees through 2026. Merchants need to offer these options so that “whatever the customer wants, they’re able to accept it. They don’t want to send the customer away because they can’t support a certain payment scheme,” Hölscher said.

Gen AI and agentic commerce

In the U.S., 45% of consumers report using g

This year Visa and Mastercard launched AI-powered platforms that enable shopping assistants to search, select and pay on behalf of consumers. In May,

Hölscher expects to see more experiments by merchants, payments players and technology companies in this area next year. There will be cases where it doesn’t work well, and it will be interesting to see trends in consumer adoption, he told American Banker.

Consumers might be willing to let AI shop for them. But are they willing to let AI pay for them? How much can you trust it’s doing the payment right? Questions persist around authentication, authorization and convenience. “Convenience is everything,” Hölscher said.

Younger consumers turn to fintechs for financial needs

Many young consumers use fintechs for financial services. As examples, Jonathan Vaughan Burleigh, associate analyst of banking and payments at GlobalData, cites the popularity of Monzo and Revolut in the U.K. and SoFi and Chime in the U.S.

GlobalData research shows that younger consumers prefer convenience and speed, so banks need to continue rolling out new products and services on digital channels to satisfy younger consumers’ desire for instant and flexible banking. These fintechs have a lot of payment options, including debit and credit cards, and there’s the potential to steal banks’ lunch even more than they are now, Vaughan Burleigh added. With digital banks, “it’s less hassle to manage your money.”