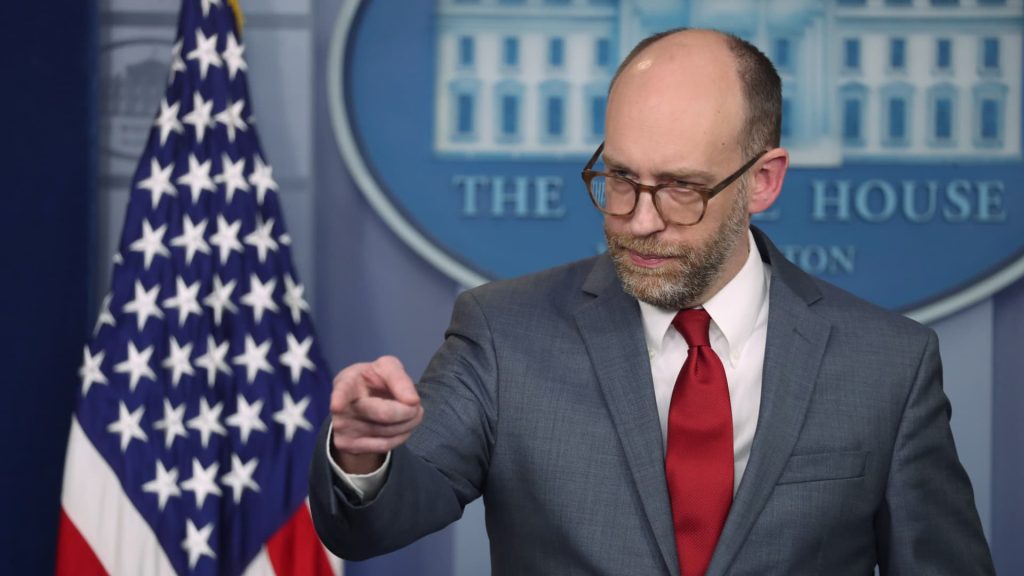

Office of Management and Budget (OMB) Acting Director Russell Vought speaks with reporters during a press briefing at the White House in Washington, U.S., March 11, 2019.

Jonathan Ernst | Reuters

Consumer Financial Protection Bureau employees were told Sunday to work remotely because their Washington, D.C., headquarters would be closed through Feb. 14, according to a memo obtained by CNBC.

The memo, from CFPB Chief Operating Officer Adam Martinez, follows an email sent Saturday from newly-installed acting CFPB director Russell Vought which instructed staff to suspend nearly all activities of the regulator, including supervising financial firms.

The developments come amid concern about the fate of the CFPB and its staff after operatives from Elon Musk’s DOGE arrived at the regulator late last week. The DOGE employees have been given access to CFPB data sources, including staff performance reviews, said people with knowledge of the situation who have asked for anonymity out of fear of reprisal.

Musk, who last year called for the deletion of the CFPB, on Friday posted “CFPB RIP” on his X social media platform.

Besides putting a freeze on nearly all CFPB activity with his inaugural memo, Vought on Saturday posted on X that he was halting the flow of fresh funding to the agency. “This spigot, long contributing to CFPB’s unaccountability, is now being turned off,” Vought wrote.

Vought, who was confirmed as President Donald Trump’s head of the Office of Management and Budget on Thursday, is one of the authors of Project 2025, the master plan to reshape the federal government.

Layoff fears

CFPB employees are bracing for the possibility of being put on administrative leave or laid off, similar to what Trump officials have attempted with the U.S. Agency for International Development, according to people at the bureau.

While there are roughly 1,700 CFPB employees, only a few hundred workers have positions which are mandated by law to exist, according to a person with knowledge of the agency.

Mass layoffs would jeopardize the mission of the CFPB, created in the aftermath of the 2008 financial crisis to prevent banks and other financial firms from exploiting Americans. Bank trade groups have long accused the CFPB of being unfair and have fought the agency’s rules in court, even unsuccessfully attempting to declare the agency unconstitutional.

At risk are several CFPB efforts that would’ve saved consumers tens of billions of dollars, including restrictions on credit card and overdraft fees, and a rule that would’ve removed $49 billion in medical bills from the credit reports of 15 million Americans.