A police mug shot of Italian-born American swindler Charles Ponzi (1882 – 1949) after his arrest for … [+]

Natalie Cochran was recently convicted of first-degree murder for killing her husband in 2019 and sentenced to life in prison without the possibility of parole. Natalie was already serving a 135 month sentence for money laundering and wire fraud connected with a Ponzi scheme she perpetrated between 2017 and 2019.

In 2017, Natalie Cochran, with no experience in weapons or government contracts quit her job as a pharmacist and, along with her husband Michael Cochran, formed Tactical Solutions Group (TSG) a company they said would bid on contracts to sell weapons and other goods to the federal government. Natalie Cochran had told friends that she was inspired to start the company after seeing the 2016 movie “War Dogs” which was a fictional story based on the lives of David Packouz and Efraim Diveroli, two men inexperienced in either weapons or government contracts who bid on small military contracts ignored by bigger, more established companies. Ultimately, they landed a $300 million contract to supply ammunition to the Afghan National Army, but in so doing violated laws resulting in their conviction on fraud charges. Toni McCall an investor in TSG and a friend of Natalie Cochran’s remarked “When she told me that we’re going to make all of our employees watch ‘War Dogs” as like an onboarding video, I said, ‘Well you do realize that the guys went to jail, right?”

Natalie Cochran went to at least eleven friends and family and convinced them to invest approximately $2.5 million with promises of big profits based on government contracts she said they would obtain. Unfortunately, there were never any contracts, and no money was ever earned by the company which managed to appear successful for a time by, as typical with a Ponzi scheme, paying early investors with money obtained from later investors while she used the funds invested to pay for a lavish lifestyle including three homes, expensive vacations, jewelry and a 1965 Shelby Cobra automobile.

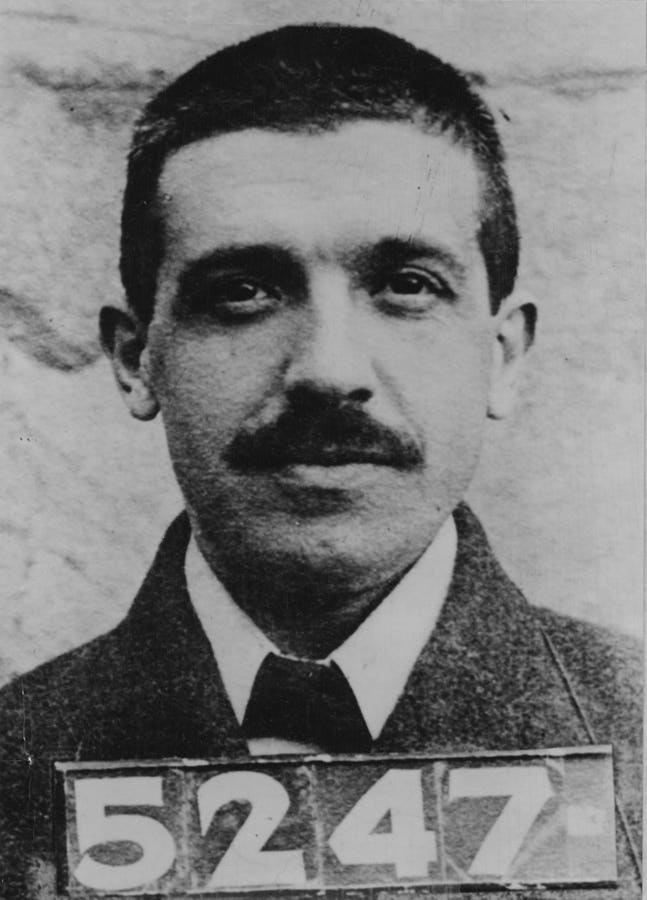

The Ponzi scheme takes its name from the infamous Charles Ponzi, who in Boston in 1920 promoted a scheme by which he guaranteed his investors a 50% profit in 45 days and a 100% profit within 90 days from his buying and selling of postal reply coupons. There never were any postal reply coupons. Ponzi merely paid early investors with the funds invested by later investors to make his scam appear legitimate. Eventually, after a year Ponzi was exposed and convicted of fraud, but by that time his victims had lost $20 million. Ponzi schemes are most often associated with men, such as Bernie Madoff or Allen Stanford but the originator of this simple, but effective scam was a woman, Sarah Howe, who also in Boston in 1879 established the Ladies’ Deposit Company, a bank that took deposits only from unmarried women. Howe offered interest rates of 8% per month to the women depositing money in her bank. Again, it was merely a scam in which she paid earlier depositors with the money she received from later depositors. Like Ponzi, she was convicted of fraud and served three years in prison.

On February 6, 2019 Natalie Cochran and her husband Michael, who was a minority owner of TSG were going to fly to Virginia for a business meeting with Bank of America related to TSG, however, they never went as Natalie told friends that Michael was sick. When a friend came to visit, she urged Natalie to take Michael, who appeared particularly ill to a hospital, however Natalie told them that Michael had indicated that he did not want to go to a hospital. Hours later, she did take him to a hospital where he was found to have a swelling of the brain. Five days later, without ever regaining consciousness, he died. At the time his death was considered to be by natural causes. Five months later, a concerned investor who suspected wrongdoing at TSG contacted local police who conducted a search of the Cochran home which resulted in evidence being obtained that led to her indictment. Initially Natalie Cochran pled not guilty to fraud charges but eventually changed her plea to guilty of wire fraud and money laundering.

With the Ponzi scheme charges resolved, law enforcement turned their attention to the death of Michael Cochran and exhumed the body. An autopsy concluded that Michael Cochran’s death was a homicide caused by injected insulin. In November of 2023, Natalie, who was then six months into her prison sentence was charged with first-degree murder. The prosecutors’ theory of the case was that Natalie had injected Michael with insulin sufficient to kill him out of a concern that her Ponzi scheme would have been exposed at the scheduled meeting with Bank of America in February of 2019. Prosecutors believed that Michael was not a part of the Ponzi scheme.

On January 29, 2025, Natalie Cochran was found guilty of first degree murder and sentenced to life in prison without the possibility of parole.