When you lack a Social Security number, it can get in the way of your ability to build credit in the U.S., as it’s a requirement on most credit card applications. Plus, bringing your credit history from a different country isn’t usually an option, so you’ll have two potential roadblocks on the path to establishing credit.

But despite these obstacles, it’s still possible to start the clock on your credit history here. Some credit cards allow you to bypass one or both of these requirements.

It’s typically U.S. citizens and noncitizens with authorized work permits in this country who qualify for a Social Security number. However, you may qualify for an alternative form of identification, such as an Individual Taxpayer Identification Number (ITIN), regardless of your immigration status. Some credit card issuers allow you to apply with this number, or with other forms of ID, such as a passport.

Here are some credit cards that you can get without a Social Security number.

Without a Social Security number or ITIN

Firstcard® Secured Credit Builder Card

CARD DETAILS

-

Up to 15% cash back at 29,000 partner merchants.

-

Up to 10% cash back on qualifying purchases. This rate is stackable with other cash back earned. To access this bonus cash back, cardholders must spin the wheel in the Firstcard® Secured Credit Builder Card app, which will determine the bonus cash-back rate for each eligible transaction.

-

“Unlimited” cash back of 0.1% to 1% on all purchases, depending on the subscription plan you choose. This rate also stacks with the others.

Annual fee: $4.99-$12.99 monthly or $48-$120/year depending on subscription plan.

BENEFITS

The Firstcard® Secured Credit Builder Card is friendly to students and newcomers to the U.S. It skips the Social Security number and credit check requirement. Instead, you can use an ITIN or your passport information to qualify. The card can help you build credit by recording your payment history with all three major credit bureaus: TransUnion, Equifax and Experian. These companies record the information used to calculate your credit scores. Among secured credit cards in its class, the card stands out as one of the few starter cards that earns rewards.

DRAWBACKS

The card’s annual fee makes it harder to keep the account open over a long term to preserve the length of your credit history. It also lacks a path to upgrade to a regular unsecured credit card once you’re ready.

Neu Card

CARD DETAILS

Rewards: 1.25% back on all purchases.

Annual fee: $4 per month ($48 annually) or $7 per month ($84 annually), depending on eligibility.

BENEFITS

The Neu Card eliminates the credit history, security deposit and Social Security number requirements for eligible students. You might be able to qualify with a valid Visa stamp that has six months until it expires. The card doesn’t charge interest or fees (you’re literally unable to carry a balance from one month to the next). Unlike other credit cards in its class, it also offers the option to talk to live customer service representatives, which can be helpful if you have questions as you’re getting started with credit.

DRAWBACKS

As of this writing the card reports payments only to TransUnion, so your payment history won’t be recorded with Equifax and Experian. Ideally, you want your payment history recorded by all three credit bureaus. The monthly fee also makes it less advantageous to keep the card open and active once you climb your way up the credit ladder, especially since the issuer doesn’t provide an option to graduate to a better credit card.

Zolve Credit card

CARD DETAILS

Rewards: Up to 5% cash back, depending on which subscription plan you’re eligible for.

Sign-up bonus: Up to $50 in value, depending on which subscription plan you’re eligible for.

Annual fee: $0 to $299, depending on which subscription plan you’re eligible for.

APR: 19% to 35.25% as of January 2025.

BENEFITS

The Zolve credit card is friendly to international students and H1-B and L-1 visa holders. If you lack a Social Security number, you can qualify with alternative documentation like offer letters, pay slips or other eligible documents. The card has three subscription plans, and the credit limit you’re approved for determines which option you can choose. The Classic plan with a $0 annual fee is the best choice for beginners, given that it makes it easier to keep the card open and active over time and have that reflect positively on your credit. The card reports payments to all three major credit bureaus. It also earns rewards, which vary depending on the plan.

DRAWBACKS

This card is not as transparent as other starter cards. For instance, the website doesn’t mention the different subscription plans or how they work. When you’re starting out with credit, it’s valuable to have straightforward information upfront to avoid confusion.

With an ITIN

Chase Freedom Rise®

CARD DETAILS

Rewards: 1.5% cash back on all eligible purchases.

Sign-up bonus: Earn a $25 statement credit after signing up for automatic payments within the first three months of opening your account.

APR: The ongoing APR is 25.99% Variable APR.

The Chase Freedom Rise® doesn’t require a credit history, and you can apply with an ITIN number if you don’t have a Social Security number. You can be considered for a credit limit increase within six months if you use the card responsibly and make payments on time. If granted, a credit limit increase can have a positive impact on your credit scores, provided that you keep your credit utilization low. As you make purchases, you’ll also be rewarded with a solid flat rate. On your account anniversary, the account is automatically reviewed to see whether you’re eligible to upgrade to the Chase Freedom Unlimited®.

The card allows you to increase your odds of approval with a Chase checking or savings account that holds a minimum balance of $250 — but since those kinds of accounts require a Social Security number top open, you may not be able to take advantage of this option.

Blue Cash Everyday® Card from American Express

CARD DETAILS

-

3% back* at U.S. supermarkets on up to $6,000 spent per year.

-

3% back at U.S. gas stations on up to $6,000 spent per year.

-

3% back on U.S. online retail purchases on up to $6,000 spent per year.

-

1% back on other purchases.

Sign-up bonus: Earn a $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months. Terms Apply.

APR: 0% intro APR for 15 months on purchases and balance transfers, and then the ongoing APR of 18.24%-29.24% Variable APR.

With an ITIN, you might be eligible to use your credit history from a different country to apply for the Blue Cash Everyday® Card from American Express. If you’re from Australia, Brazil, Canada, the Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Switzerland or the United Kingdom, AmEx (through a partnership with Nova Credit) may be able. to access your international credit history and weigh it in the application process.

If you can qualify for this option, you’ll build credit and get the perks typically reserved for those who’ve already built a good credit history in the U.S. The Blue Cash Everyday® Card from American Express offers top rewards in everyday categories and valuable introductory offers. There’s also a monthly $15 statement credit for Home Chef, a meal kit delivery service, and a $7 monthly statement credit for a subscription to The Disney Bundle. Terms apply.

Since the card belongs to the American Express network, you may face limited card acceptance when attempting to use it abroad.

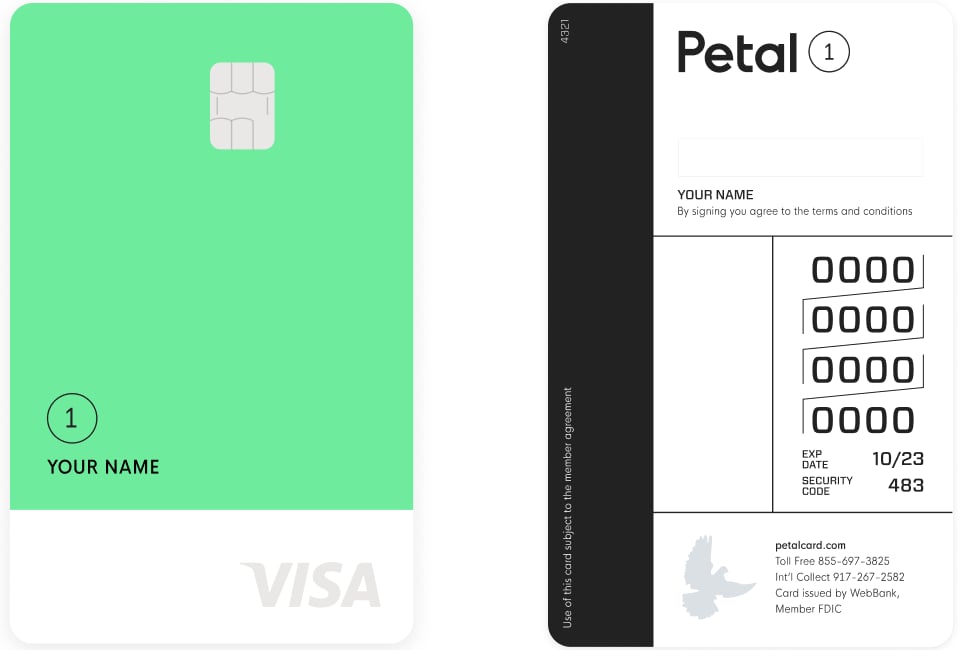

Petal credit cards

Sign-up bonus: Varies by card.

Annual fee: Varies by card.

If you have to pay an annual fee, it will be more difficult to keep a Petal card open and active to reap the benefits it can have on the length of your credit history.

Capital One Quicksilver Secured Cash Rewards Credit Card

CARD DETAILS

Rewards: 1.5% cash back on all eligible purchases.

Annual fee: $0, but a minimum security deposit of $200 is required.

APR: The ongoing APR is 29.74% Variable APR.

The Capital One Quicksilver Secured Cash Rewards Credit Card builds credit and earns rewards. It also lets you apply with an ITIN. The card requires a security deposit, but you can get it back eventually if you’ve maintained on-time payments once you close the card or get upgraded to the regular, unsecured Capital One Quicksilver Cash Rewards Credit Card. It’s one of the card’s two standout features, the other being the possibility of a credit limit increase. (You’re automatically considered for a higher credit limit in six months, which could help your credit.)

The card requires a security deposit which could present an obstacle if it doesn’t align with your budget.