Lately, a lot of mortgage rate quotes have required points to be paid.

Known as discount points, they are a form of prepaid interest due at closing that lower your mortgage rate for the entire loan term.

For example, you might be able to get a rate of 5.99% if you pay one point instead of paying nothing and settling for a rate of say 6.25%.

The tradeoff is if you keep the loan long enough, you win via lower monthly payments (and less interest paid).

But if interest rates suddenly drop, you might be enticed to refinance to save even more, thereby giving up your old paid for rate.

What’s the Mortgage Rate Outlook?

While mortgage rates have been on a relative tear the past 15 months and change, they remain elevated.

After all, many big banks and lenders are still quoting rates for a 30-year fixed in the 6s.

That compares to rates in the 2s, 3s, and 4s back in 2022. Of course, those were different days and fueled by the Fed’s QE program where they bought trillions in MBS.

Some people think they’ll do it again, but many others think it’s a long shot.

It’s no secret the Trump administration wants to lower housing costs, and Trump campaigned on bringing mortgage rates back to 3%, or even lower!

But a lot of things are promised during campaigning that are ultimately never delivered.

So banking on that would be akin to a lottery ticket. It could happen, but probably won’t.

Instead, your best bet is to look at the underlying economic data to determine the near- and long-term mortgage rate outlook.

As stated, we’ve made a lot of progress on rates, which despite being at record lows in early 2022, rose to 8% in late 2023, and are now often quoted in the 5s.

That’s not too shabby, but you do wonder if they can get even better as the year goes on.

If you believe they can and you’re in need of a mortgage today, you might think to yourself, pay nothing at closing and keep your eyes on a refinance down the line.

For example, if you can get a 6% rate today with no points and limited or no fees, you could avoid a lot of out-of-pocket costs and leave nothing on the table if rates drop.

If mortgage rates drift lower later this year, all of a sudden you can apply for a rate and term refinance and snag something in the lower-5s.

Possibly without much in the way of closing costs to boot!

Long story short, you have to determine how long you expect to hold your mortgage (and the property while you’re at it).

It’s easier said than done obviously, and timing anything is typically a fool’s errand.

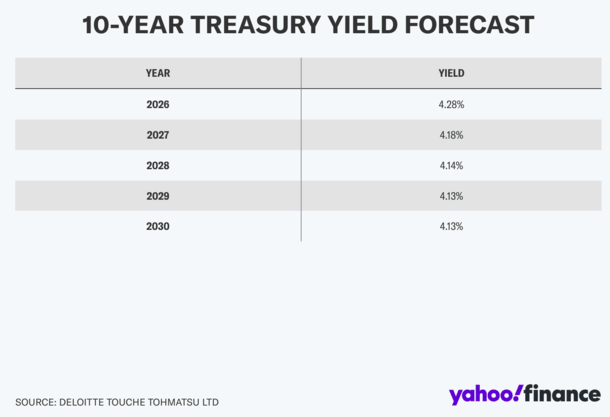

The 10-Year Bond Yield Could Be Flat Through the Year 2030

The reason I bring all this up is because there are forecasts out there that expect little to no movement in the 10-year bond yield, which is a good bellwether for 30-year fixed mortgage rates.

Deloitte is currently forecasting a 10-year bond yield that is essentially unchanged over the next five years.

If it barely moves from now until the year 2030, chances are mortgage rates will also be mostly stuck.

Yes, there is the spread component of rates, which is the difference between the 10-year bond yield and 30-year fixed rate.

But it’s normalized quite a bit already, and might not be able to come in much more either.

So if you believe all that, this could be close to as good as it gets for mortgage rates for some time.

Assuming that’s the case, you can then make the argument to pay discount points at closing to buy down your rate.

Why? Because mortgage rates won’t get any better so you’ll likely keep your mortgage longer and a lower bought down rate will be more beneficial as a result.

However, this is again just one theory. Mortgage rates could in fact fall more than predicted and start with a ‘4’ at some point, then your paid points would be a waste if you refinanced the rate away.

You Could Ride It Out with an ARM Instead

One alternative to consider, assuming you think mortgage rates won’t go up, but could come down, would be an adjustable-rate mortgage.

You could take out a 5/6 ARM or a 7/6 ARM, both of which offer a fixed rate for several years before the first adjustment.

They also come with an interest rate discount versus the 30-year fixed because they eventually become adjustable.

Then you could keep an eye on rates and if they do come down, you can refinance into a fixed loan if you want that certainty (or a new, cheaper ARM…).

That could give you the best of both worlds, the lower rate today and the optionality to refinance if rates vastly improve.

If they don’t, your ARM wouldn’t be too much of a risk, especially if short-term rates come down more than long-term rates.

The only caveat is you’d have to qualify for a mortgage if you needed to refinance in the future (if say rates spiked higher on your ARM). That means having a solid job, income, and credit to get approved.

With a 30-year fixed, you wouldn’t absolutely need to go out and get a new one, even if rates increased (or dropped and you wanted to take advantage).