Editor’s Note: The Federal Reserve’s interest rate decisions – as well as new inflation and employment data – can cause big market swings.

A couple of weeks ago, I shared an article by Monument Traders Alliance’s Bryan Bottarelli about how September’s Fed meeting could be the biggest in decades.

Now that the meeting has passed, I’ve invited Bryan back to break down how he’s preparing for any potential volatility over the next few months.

– James Ogletree, Senior Managing Editor

CNBC polled 29 ‘professional economists’ about Fed Day.

I ignored them all and positioned for the one thing they didn’t consider: markets doing the opposite of expectations.

While Wall Street’s brightest minds were debating quarter vs half-point cuts…

I was laughing at a different number entirely.

94.7%.

That’s the probability that CME Fed Watch showed for a quarter-point cut.

When I see consensus that strong, my contrarian radar starts screaming.

Because here’s what those 29 experts missed…

Fed Day isn’t about being right on direction.

It’s about being positioned for chaos.

The Consensus Was Suffocating

CNBC’s survey revealed those professionals expected political pressure on Fed independence, inflation concerns, higher unemployment, and slower growth.

All very neat predictions about policy implications.

Meanwhile, I was watching something else entirely: the political warfare brewing between this administration and Jerome Powell.

Three months of name-calling. Court battles over Fed governors. Lisa Cook getting blocked from being fired right before the meeting.

You think that doesn’t create unusual market dynamics?

My Contrarian Setup

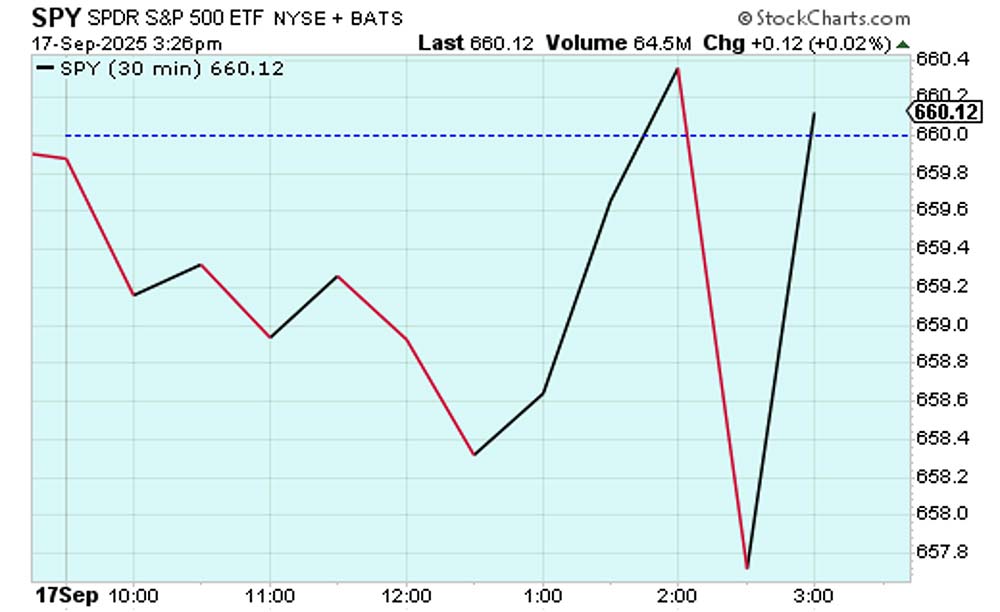

That’s why I positioned with a strangle – buying both calls and puts on SPY with strikes around 661 call and 660 put. Total cost: just under $6.

My target? A 1% move in either direction. The position would profit as long as the market moved more than my premium cost.

While the experts debated policy, I was focused on how the market would react to whatever Powell said.

The Real Fed Day Strategy

Position the day before. I sent out the trade at 2:30 Central, 30 minutes before close. Get positioned when you can think clearly, not when Powell’s talking.

Target 1% moves. Anything over 1% up or down on SPY, and the strangle position is profitable. It’s not about hitting home runs – it’s about consistent profitability on volatility.

Use zero-day options strategically. These become precision tools for capturing short-term volatility around known catalysts.

What The Experts Always Miss

Those 29 economists were trying to predict the future. I was positioned to profit from uncertainty.

The difference? When markets do weird things around Fed announcements – which happens more often than anyone wants to admit – I’m positioned to profit. They’re left scrambling to explain why their predictions didn’t match market reality.

![]()

YOUR ACTION PLAN

The Fed delivered exactly what 94.7% of the market expected.

But here’s what those 29 economists missed…

This rate cut just set up the next 90 days for PEAK volatility.

And volatility is where the real money gets made.

The zero-day strangle I showed you? That’s just the beginning.

Because when markets get chaotic (and they’re about to), having a systematic approach to profit from that chaos becomes everything.

The Fed Shockwave is Coming

The political warfare between Powell and this administration isn’t over.

The following 90 days could deliver the most volatile three months we’ve seen in years.

Most traders will panic when markets swing wild.

Smart traders will position themselves to profit from those swings.