A friend recently mentioned that his college-aged son has been saving and investing in dividend stocks and planning for his future. I was particularly happy about that because I know that the kid read my book Get Rich with Dividends, so it must have made an impression on him.

Some brand-new research from Hartford Funds and Ned Davis Research shows that my friend’s son is doing the right thing. Dividend payers are critical for investing success.

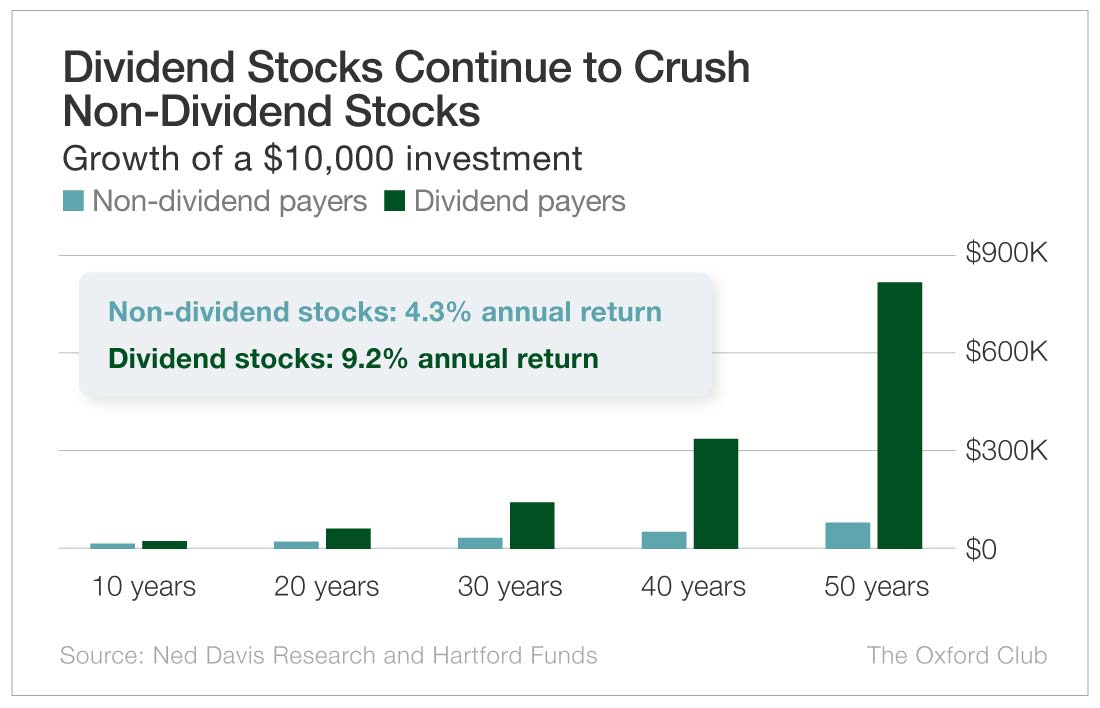

According to the new data, dividend payers more than doubled the return of nonpayers. Companies that paid dividends returned 9.2% per year on average, while companies with tight fists who refused to share the wealth only generated a 4.3% annual return.

Today, you can earn 4.3% on your cash virtually guaranteed. There’s no reason to take a risk on a stock for an expected 4.3% return.

You may think that 9.2% versus 4.3% doesn’t make that much of a difference. After all, it’s less than 5% per year – just $0.05 on every dollar invested.

But it adds up in a big way.

Starting with $10,000, a 4.3% annual return over 10 years results in $15,235. An investor earning 9.2% ends up with $24,111.

Expand that to 20 years, and we’re talking the difference between $23,210 and $58,137. The dividend investor earned 150% more than the non-dividend investor.

Three decades of investing results in $35,361 versus $140,177.

Forty years means $53,873 for the nonpayers (still less than the dividend payers grew to in just 20 years) and $337,991 for the dividend payers.

The gap widens each year. After 50 years, the dividend payers provide 10X the amount of money as the non-dividend payers.

Dividend payers were 24% less volatile as well, allowing you to sleep better at night and perhaps helping you not bail out of your stocks when things get rocky. That will help your performance over the long term.

All anyone can talk about right now is tech, tech, tech. But investing in a “boring” energy company like Chevron (NYSE: CVX), whose 4.6% dividend yield alone is already above the average annual return of the non-dividend payers, or a regional bank like Bank OZK (Nasdaq: OZK), with a 3.2% yield, gives you a much better chance of boosting your wealth than trying to pick the right tech stock.

My friend’s son is a finance major. He wants to work in private equity, financing exciting startups. But he’s investing his own money where it has historically performed best.

If you’re not investing in dividend stocks, you are leaving a lot of money on the table.