In 2024, the overall rate of fraud targeting both consumers and financial institutions

Beneath these top-line fraud figures, however, are more specific and troubling trends. For example, even as fraud has decreased overall, financial exploitation of seniors (including both fraud and theft) has gained salience with regulators and states that are looking to tamp down on it.

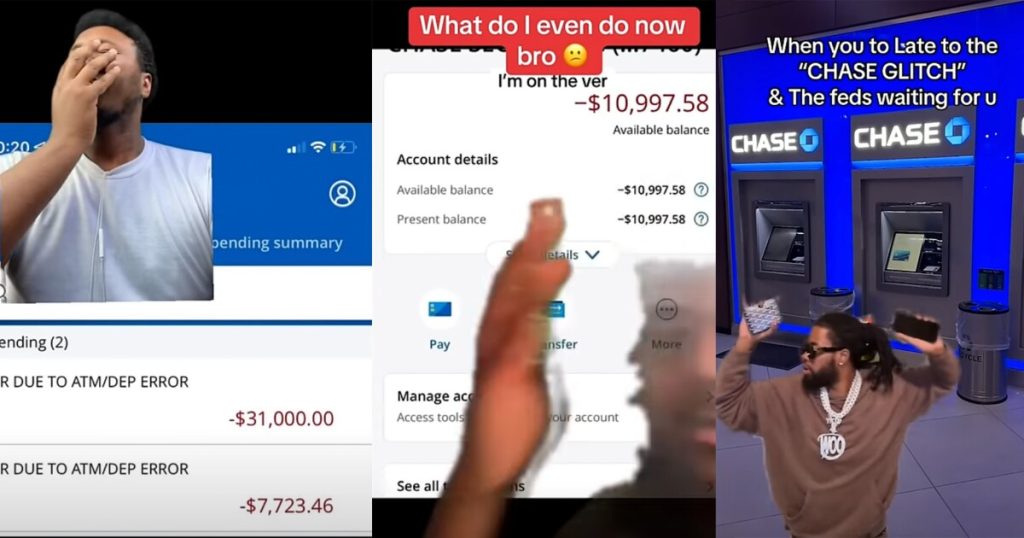

The past year also yielded some notable headlines featuring fraud and scams. In February, an inspector general report provided details about how a pig butchering scam hastened the failure of a regional bank. Then, in September, Chase found itself trending on TikTok as word of a supposed glitch allowed people to magically add money to their bank accounts — so long as they committed check fraud.

Here’s a look back at the year in scams and fraud.