When the COVID-19 Pandemie forced the UK in Lockdown in 2020, people turned up and down the country to bake sourdough bread and yoga. For Redinel and Oerta Korfuzi, the restrictions for another chase: trade with prior knowledge.

As a result, the Albanian brothers and sisters are now confronted with a new form of Lockdown. On Friday, a London judge sentenced former Janus Henderson research analyst Redinel Korfuzi, 38, up to six years in prison and his sister Oerta Korfuzi, 36, up to five years.

“This case has elements related to a Greek tragedy in which a person of a status is brought by a fatal error[ . . .]You both found that you are too smart to be caught, “his real estate judge Milne told the couple in handing out their prison conditions for prior knowledge and money laundering.

“This is not a fraud without victims,” he added. “Insider trade reduces the trust of the public in the integrity of the market.”

The brothers and sisters of Korfuzi looked straight ahead and showed little emotion when the sentences were read. Immediately afterwards they were accompanied by guards from the dock.

Their conviction caps a trial period of four months in which the Korfuzis-Evenes Redinel’s Personal Trainer Rogerio de Aquino and the Girlfriend Dema Almeziad of the Aquino-Werden accused of the British financial behavioral authority of one count of the prior knowledge trade between 2019 and 2021.

A jury found the brothers and sisters guilty last month after 19 hours of deliberations. The Aquino and the Almeziad were acquitted of all charges.

Korfuzi had worked at Janus Henderson for less than a year when he decided to use information he obtained from his work to start an insider turn scheme, the court heard.

The brothers and sisters lived together in a small flat with two bedrooms in Brunswick House, a converted mansion in the Marylebone area in London. Working from home during the Pandemie meant that he could easily share tips with her and coordinate the insider trading operation.

Oerta, who was the director of a company that gave recommendations about trade effects, carried out the first transactions on her accounts.

A year later, Redinel Korfuzi persuaded the Aquino and Almeziad to open trade accounts, using the fact that the personal training activities of the Aquino struggled in the pandemic and the desire of the couple to save for a house as an incentive.

The Aquino would later tell the FCA in an interview that he and Almeziad were just “two idiots” for the trust of the korfuzis and that they were recorded by the “unique” intelligence of Redinel. “This is the darkest [time] of my life, “he told the researchers.

The korfuzis fed a short-handed strategy that tried to take advantage of the decrease in a share-pricing transactions often within 24 hours after obtaining the indoor information about companies that achieved from Jet2 to Daimler.

Yet even with the winning lead, trade decisions were often loaded when the brothers and sisters tried to optimize their profit.

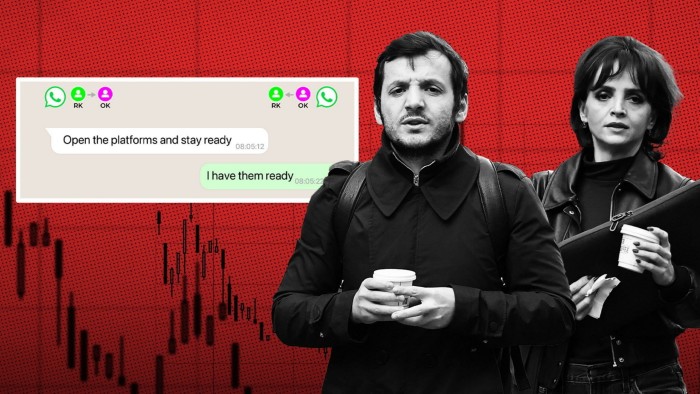

In a WhatsApp interview about a course in the Swiss test company SGS in the early hours of 4 February 2020, Redinel told Oerta in Albanian to “stay ready because we have to close it if necessary”.

‘Open that nonsense of [sic] A phone ‘he added, when she had not responded 11 seconds later.

Between September 2020 and March 2021 alone, the Korfuzis made £ 962,723 trade on 11 shares. During the indictment period, the brothers and sisters used inside information to place transactions in at least 13 companies prior to market announcements, according to the FCA.

“The truth is for the inhabitants of Brunswick House, there would never be enough money,” said the judiciary Tom Forster KC in a copy of his final speech for the jury. “Arrogance, pride, rights and greed have encouraged them – and it has ruined them.”

The trial represented a rapid fall of grace for Korfuzi, which, in addition to his prior knowledge trade, was beautifully paid by his employer Janus Henderson – almost £ 540,000, plus a share price of $ 80,000, alone in 2020.

The beginning of the end came in the early hours of March 24, 2021, when the police appeared in Brunswick House and the brothers and sisters arrested. The Aquino and Almeziad were also arrested in London. The group was charged in 2023.

While the Korfuzi brothers and sisters refused to comment on the FCA in interviews, they both testified in court. The pair claimed that bundles of cash in safety boxes and bank accounts – often at several branches on the same day – were given to Redinel by British customers of the Albanian construction activities of his father.

Between January 2019 and March 2021, the group of 176 cash deposits of almost £ 200,000 did.

“The explanation that you are invited to accept with regard to the origin of these funds is that it was collected from four Albanian construction workers – of whom two Benni and Ei were mentioned and purchasing money represented or are being built (it was never clear),” said Forster of their defense in a copy of his final remarks.

The Aquino and Almeziad have not testified.

Janus Henderson said in a statement after conviction: “We are delighted that the procedure with regard to this inheritance has now been completed. Neither Janus Henderson, nor other past or current employee of the company, was the subject of the procedure or accused of a misconduct.”

For the FCA, Operation Naples, as the research was called, represents a much -needed victory such as the regulator tries to clean up the trade in the city of London.

Almost four in 10 British takeovers were reported in the media before their announcement in the 14 months to May this year, according to a request for Financial Times Freedom of Information to the FCA. The watchdog has given bankers warnings about leaks, which have come alongside an increase in unusual trading activities.

The FCA said on Tuesday that 38 percent of British business takeovers in 2024 caused a positive abnormal price movement in the two days before the deal was announced – which points to potential trade with prior knowledge. That has risen from an average of five years of 32 percent.

“The brothers and sisters have tensioned to use internal information to draw the system,” Steve, jointly executive director of enforcement and market overview at the FCA, told the FT.

He added: “When people act on the basis of confidential information, they abuse them and get an unfair advantage – we will use all our powers to detect and disturb their happiness.”