Bloomberg News

The Federal Reserve is still in wait-and-see mode for how the U.S. economy will respond to stiff new tariffs, but at least one central bank official is confident the outcome will not be positive.

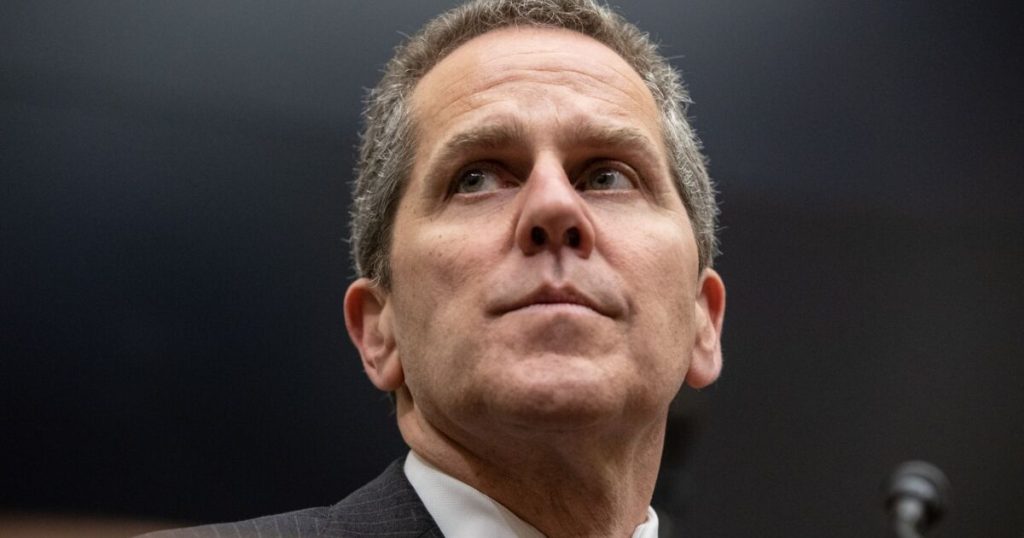

In a Friday morning speech, Fed Gov. Michael Barr said the tariffs have already “clouded” the overall

“I expect tariffs to lead to higher inflation in the United States and lower growth both in the United States and abroad starting later this year,” Barr said in a speech delivered at the Reykjavik Economic Conference in Iceland.

In particular, he said he worries that high tariffs will disrupt global supply chains in ways that result in “persistent upward pressure on inflation” rather than a one-time step up in price level, as other Fed officials

If this happens, Barr said, businesses will have to undergo the lengthy and expensive process of rerouting their distribution networks, an outcome that could have serious consequences for suppliers, many of which would struggle to survive.

“This concern is particularly acute for small businesses, which are less diversified, less able to access credit and hence more vulnerable to adverse shocks,” he said. “Small businesses play a vital role in production networks, often providing specialized inputs that can’t easily be sourced elsewhere, and business failures could further disrupt supply chains.”

He pointed to the COVID-19 pandemic as a recent example of how such disruptions can have “large and lasting effects on prices, as well as output.”

Tariffs could also lead to higher unemployment, particularly if they result in a broader economic slowdown, Barr said, an outcome that would

“Thus, the FOMC may be in a difficult position if we were to see both rising inflation and rising unemployment,” he said.

Echoing comments from Fed Chair Jerome Powell during his post-Federal Open Market Committee

Barr added that the Fed’s current monetary stance, with a federal funds rate targeting rates between 4.25% and 4.5%, is “in a good position to adjust as conditions unfold.”

Barr discussed his economic outlook during a speech on the

In his speech, Barr outlined the potential ramifications of AI advancements on the economy and society more broadly. He noted that AI will likely create a host of opportunities for growth and development, but will also come with growing pains and challenges that need to be addressed through policy.

“AI is poised to transform our economy, likely in profound ways. But the speed and extent of that transformation are not yet clear,” he said. “AI is likely to boost productivity, increase scientific discovery and transform the nature of work. How these developments unfold will have important implications for society and for central bankers.”