- Key Insight: Federal Reserve Bank of Kansas City President Jeff Schmid said he supported a 25 basis point cut to interest rates in September as a precautionary measure, but thinks that going forward the central bank should continue to focus on cracking down on inflation.

- Expert Quote: “I view the current stance of policy as only slightly restrictive, which I think is the right place to be,” Fed’s Schmid said.

- What’s at stake: Nine members of the Fed’s rate setting committee said in their quarterly economic projections last week that two more 25-basis-point rate cuts remain possible for this year, showing that concerns over the job market are rising among some members.

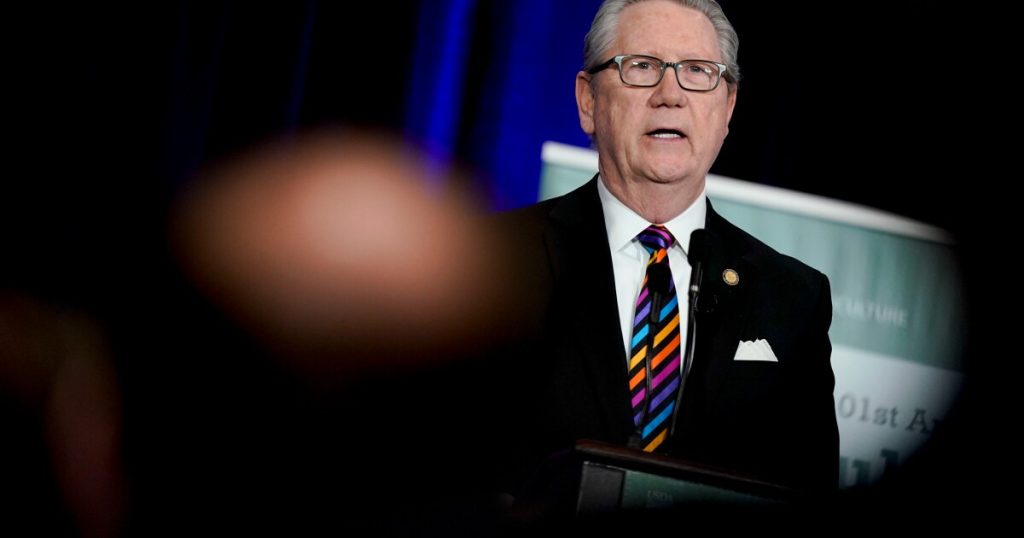

Federal Reserve Bank of Kansas City President Jeff Schmid signaled a more hawkish view on the central bank’s monetary policy Thursday, suggesting that despite signs of weakness in the job market, bringing down inflation should remain the top priority.

Speaking at a Mid-Sized Bank Coalition of America event, Schmid said he supported the Federal Open Market Committee’s recent 25-basis-point cut to short-term interest rates due to signs the labor market is slowing. However, he noted that the job market remains relatively stable.

Inflation is currently running around 2.5%, near the Fed’s 2% target for price stability, but not yet at that level. Schmid, a voting member on the rate-setting committee, said setting policy “appropriately” means not only responding to where the economy is now, but also considering where it “might be going,” due to the delayed effects of monetary policy.

“My view is that inflation remains too high while the labor market, though cooling, still remains largely in balance,” Schmid said. “I view the current stance of policy as only slightly restrictive, which I think is the right place to be.”

Schmid’s take on the central bank’s monetary policy clashes with recent concerns expressed by other committee members regarding the labor market and what the path forward might be for Fed monetary policy.

Fed Governors

“The recent data, including the estimated payroll employment benchmark revisions show that we are at serious risk of already being behind the curve in addressing deteriorating labor market conditions,” Bowman said. “Should these conditions continue, I am concerned that we will need to adjust policy at a faster pace and to a larger degree going forward.”

Fed Chair Jerome Powell, on the other hand, called the

During his speech Thursday, Schmid also commented on the importance of the Fed’s role in banking supervision, arguing that without it the central bank cannot effectively serve the public.

Schmid said there has been “politically charged” discussion in the past about pushing the central bank away from its supervision function, which he called “misguided and could lead to unintended consequences that are often not sufficiently considered.”

“Congress has tasked the Fed with protecting the health of the financial system, and in turn the economic health of the nation,” Schmid said. “There is an important interconnectedness here: Each of our mission areas—supervision, monetary policy, liquidity provisioning, and the robustness of the payments system—depends on the others to function effectively and cohesively.”