Disruptive technologies such as generative AI, the rapid-fire changes to regulation and tariffs under President Donald Trump’s second term, and shifting consumer habits are having a dramatic impact on the payments industry, according to new research from American Banker.

The payments leaders at banks and credit unions are planning their investments for the year ahead with these trends in mind. The goal is to capitalize on these changes while also staying one step ahead of competitors and fraudsters.

American Banker and its parent company, Arizent, surveyed 100 bank, credit union and payments-company employees in January and February for the 2025 Payments Predictions report. Eighty-three percent of respondents are in a director role or higher at their organization. These roles span executive leadership, marketing/sales, product management, finance, fraud, IT/operations and more. All respondents expressed a deep knowledge of the payments industry, with 72% saying their role is directly involved in payments.

Key findings include:

- Most respondents expect the payments industry to grow in the coming year, both domestically and worldwide, as measured by transaction volume and U.S. dollars moved.

- Artificial intelligence will be a significant area of investment, with 89% of respondents planning to increase spending within their payments business on AI technology.

- While fraud and security risk were major drivers of the adoption of generative AI, only 30% of respondents use gen AI for this purpose today. Other factors, such as customer service, were stronger motivators of adoption.

- The payments industry is cautious about the impact of Trump’s tariffs, but it is more enthusiastic about his attitude toward regulation, with half of respondents expecting higher domestic and international transaction volumes to result.

The research also examines the future of real-time payments, the industry’s influence within the Trump administration, the appetite for embedded payments and more.

All charts below are interactive. Mouse over each section for more detail, and click on the chart labels to show or hide sections.

Investing in growth

The payments industry is, at its heart, a technology industry. Every investment that is made is to remove friction, whether it’s a faster checkout process or a less intrusive security check. But not all tech investments are equal.

AI’s impact is being felt throughout banks, credit unions and payment companies. Curiously, more respondents expected their organization to increase spending on AI than on technology overall — demonstrating how AI is also disrupting tasks such as customer service, which are not typically categorized as technology roles.

Consumers are driving the change

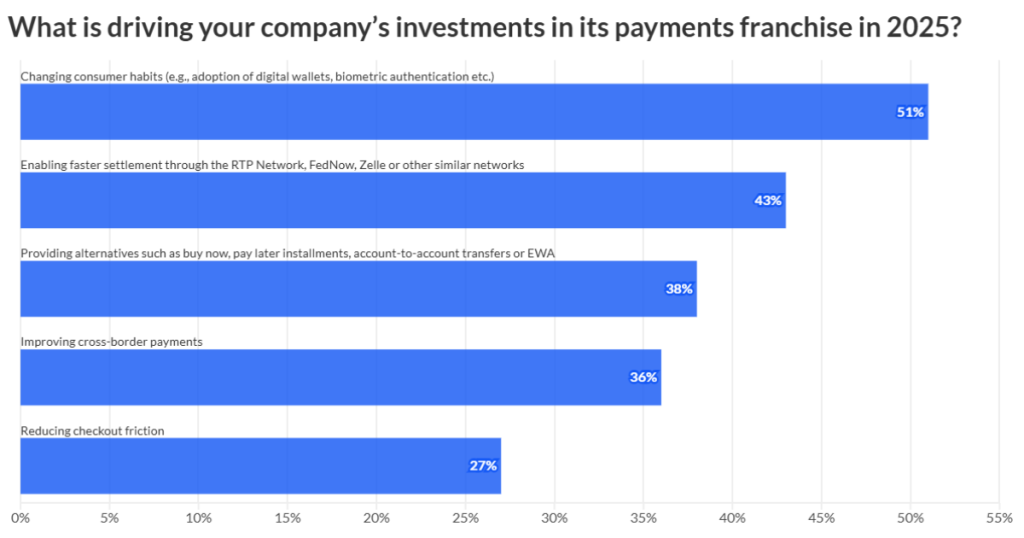

More than any other trend, consumers’ changing habits — including their adoption of digital wallets and their increased comfort with biometric authentication — represent the top driver of investments in the payments industry, with 51% of respondents listing it as a reason for their investments.

Security risk is a close second, at 50%; after all,

The global shift to

AI and faster payments

Many banks, credit unions and payment companies have already implemented generative AI. These deployments often focus

Now that the U.S. has two real-time settlement networks in The Clearing House’s RTP network and the Federal Reserve’s

One in five respondents expect the U.S. to be the dominant country in real-time payments within three years; expand that to 10 years, and 59% of respondents are on board with this prediction. But nothing is guaranteed, and 12% of respondents say the U.S. will never hold the top spot.

Companies of all sizes are investing in digital payments, but their focus shifts based on their asset size. Banks and credit unions with assets of $100 billion and over are the most attentive to embedded payments, with 71% of respondents in this category expressing interest, compared to midsize banks and credit unions (assets of $10 billion to $100 billion) at 59% and smaller ones at 48%.

For the internet of things and wearable payments, midsize banks and credit unions are in the lead, with 47% expressing interest, compared to 41% for larger companies and 25% for those with assets below $10 billion.

The smallest companies have the biggest interest in Web3/digital asset/”virtual world”/NFT payments, with 38% expressing interest compared to 35% of large companies and 25% of midsize ones.

Tariffs and regulation

Banks, credit unions and payment companies have high expectations for the president’s second term — and for having his ear as he shapes policies that affect the payments industry.

Thirty percent of respondents predict that the payments industry will have “a seat at the table” as Trump determines his stance on financial innovation. An additional 43% expect to have moderate influence; they won’t have a seat at the table, but they expect government agencies to seek their industry’s expertise.

The biggest expectations from Trump’s use of tariffs are higher inflation and higher domestic transaction volumes. Fully 92% of respondents predicted that higher inflation was somewhat likely, very likely or certain to occur. Seventy-five percent expect domestic transaction volumes to rise.

Conclusions

Banks, credit unions and other companies see 2025 as a year of opportunity for their payment operations, but only to the extent that they make the right investments.

Generative AI is a dominant theme among respondents, though the companies are divided over where it will make the greatest impact. Customer support, marketing and security are the top areas of investment, and many are already using gen AI for these purposes.

Broader industry trends, such as fraud risk and faster payments, are also driving technology investments.

Many respondents expect Trump’s second term to be favorable to them, with a regulatory policy that fosters innovation under the input of the industry itself. They’re wary of the impact tariffs will have on inflation, but they expect those policies to increase domestic payment volume.

Nevertheless, fraud and cybersecurity remain significant impediments to the industry’s growth, as does the reliance on legacy technology. This makes the investments in AI and other new technologies all the more crucial to the payments industry’s growth.