Editor’s Note: Just like the price of gold itself, interest in gold has been surging over the past year.

That’s why I decided to pass along this article from Golden Portfolio’s Garrett Goggin. He’s one of the most knowledgeable experts in this space, and – as you’ll see below – his recent track record speaks for itself.

You’ll be hearing more about Garrett in the coming weeks… he and Chief Income Strategist Marc Lichtenfeld have been working on a major project together. We’ll share more details as soon as we can.

– James Ogletree, Senior Managing Editor

President Trump has already told us the game plan: “With the kind of growth we have now, the debt is very low… You grow yourself out of that debt.”

This is the same economic policy the U.S. has been running since 1970, when Nixon took us off the gold standard. But now, with $37 trillion in debt, Trump is driving the debt-fueled growth playbook into hyperdrive. Buckle up. This is the end run of the U.S. dollar. It’s nirvana for gold. The world’s never seen anything like this before.

Inflation will be allowed to run hot, so asset prices will continue higher, the Dow could rise to 100,000, real estate prices could double, everyone with assets will be a millionaire, and U.S. debt will be easier to pay back… but a bottle of Coca-Cola will cost $20 in due time.

The U.S. Dollar Is Going Down

Treasury Secretary Scott Bessent and Trump are both calling for 1% rates. Trump even said he wants to pump GDP growth to 25%. We have Trump appointee Stephen Miran, the author of the Mar-a-Lago Accord, on the Fed’s Board of Governors. Miran has made the case for boosting U.S. manufacturing competitiveness by a managed U.S. dollar devaluation.

The Fed has recently restarted quantitative easing, buying $40 billion of short-term debt per month. The U.S. has about $8 trillion of debt coming due over the next year that nobody wants. Rates can’t be allowed to rise, because the interest on $37 trillion in debt is already a $1 trillion annual expense.

Crypto Is a Gateway to Gold

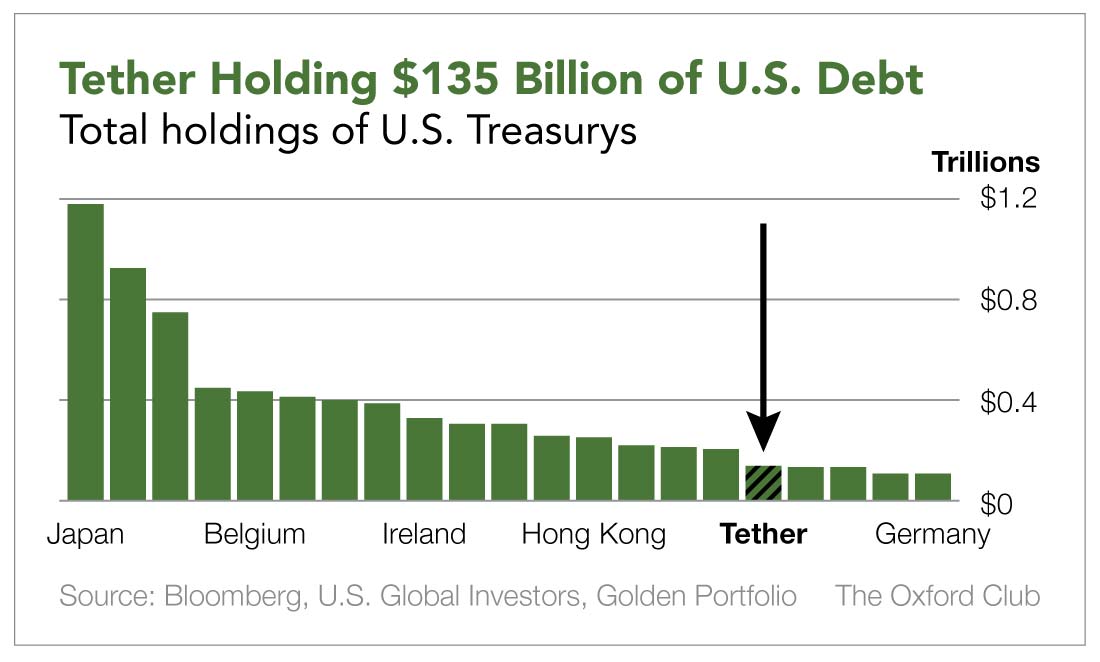

The U.S. embraced stablecoins when it passed the GENIUS Act. Now that many of our trade partners have walked away from U.S. debt, preferring gold, the U.S. believes stablecoins will provide demand for our debt. One stablecoin, Tether, already holds more U.S. debt than all but 16 countries.

Tether has also already amassed 3.3 million ounces of gold in its own vault in Switzerland, worth $13 billion.

Crypto was invented to protect against U.S. dollar devaluation. Crypto holders don’t want U.S. dollars at any price, especially when the GENIUS Act prohibits interest payments on stablecoins.

These interestless stablecoin dollars will find their way into gold-backed tokens, like Tether Gold. The world’s best store of value for 1,000 years, combined with crypto’s instant transfer and frictionless exchange, creates the World’s Ultimate Currency. It’s Gold 2.0. Tether executives have whispered to me that Tether Gold will prove to be more popular than the original Tether, which tracks the U.S. dollar.

The U.S. Wants Gold Higher

The U.S. holds 8,133.5 metric tons, or 261.5 million ounces, of gold. The Gold Reserve Act of 1934 required the Fed to transfer all its gold to the Treasury. The Treasury then issued gold certificates to the Fed at $42.22 per ounce, and the Fed created $10 billion in monetary reserves.

The U.S. now wants gold higher. A Bitcoin bill written by Sen. Cynthia Loomis proposes revaluing gold higher and using the accounting surplus to establish a Bitcoin reserve. The higher gold rises, the better it is for the U.S., which can use the surplus to also pay down debt in an accounting sleight of hand.

At $4,000 an ounce, 261.5 million ounces of gold is worth $1.046 trillion. At $10,000 an ounce, U.S. gold reserves would be worth $2.615 trillion – enough to cover 7% of the total public debt of $37 trillion. At $25,000 an ounce, U.S. gold reserves would be worth $6.537 trillion, 18% of total public debt.

How to Play the Melt-Up

I’ve been a precious metals equity analyst for 20 years. I went independent in 2023 and started the Golden Portfolio to bring investors a select group of precious metals equities whose costs never increase even as gold goes exponential. I often refer to them as my Inflation Protection Machines, or IPMs.

Since its inception in 2024, the Golden Portfolio (which is focused on IPMs) is up 236%. That’s better than several major gold ETFs – and five times the return of the S&P 500.

In short, you need to own assets: real estate, stocks, and especially gold. Trump’s devaluation plan is likely to get out of control. In the end, the U.S. will be the only buyer for its debt. This is straight-up debt monetization, and it’s great for gold.

You have the opportunity to leverage the upcoming financial madness to create a legacy for your family. Don’t miss it.