- Key insight: Banks are connecting consumers in need of financial assistance to fintech-curated community resources.

- Expert quote: Banks lack bandwidth to curate and vet nonprofits, says SpringFour CEO Rochelle Gorey.

- Supporting data: Lending fintech OppFi’s email campaign with SpringFour: 300,000 emails, 44% open rate, ~10,000 clicks, 5,000 searches.

Source: Bullets generated by AI with editorial review

As the distribution of November SNAP benefits remains uncertain pending federal litigation and the ongoing government shutdown hits a record of 41 days, financial institutions are partnering with outside resources to offer financial assistance to cash-strapped consumers.

One fintech that is bringing its technology and network to banks during the ongoing shutdown is

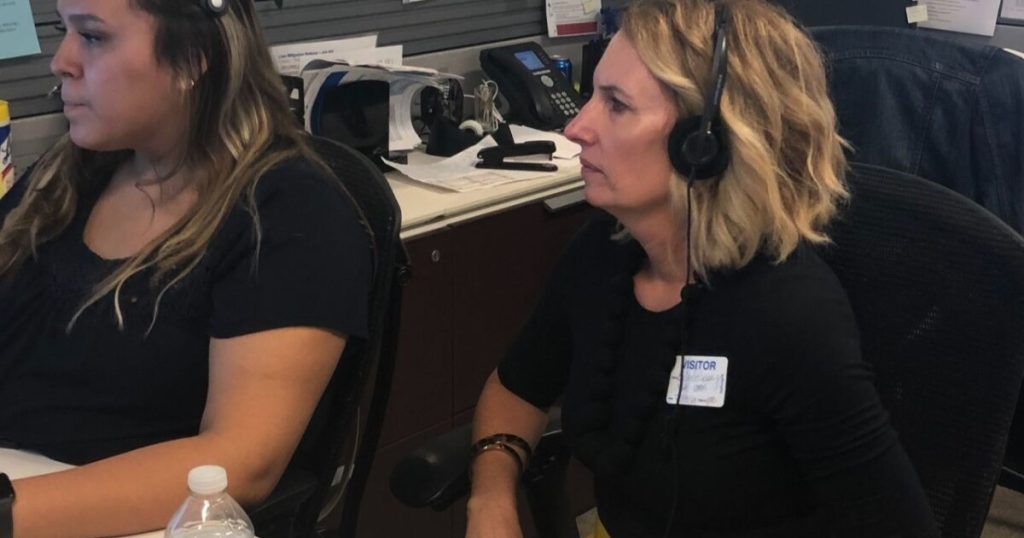

“Banks want to utilize SpringFour because we are the experts,” SpringFour CEO

The fintech’s business model is based on contracts with financial institutions, according to Gorey. Clients of SpringFour include

“We only make referrals to nonprofit and government resources that our SpringFour team independently vets and curates,” she said. “We receive no affiliate or marketing dollars for including organizations within our database, and that’s super important to the financial institutions who trust us to connect their customers to these local resources.”

SpringFour started in 2005 and has worked with banks to support consumers through multiple macroeconomic hardships such as the 2008 financial crisis, the last government shutdown in 2018-2019 and the COVID-19 pandemic.

Gorey claimed that

“We are dealing in a situation where people have had their paychecks cut off or their benefits cut off,” she said. “It is our belief that while lending products can be something that can assist people, it is still a product that is encouraging people to take out a loan and they don’t have the resources to pay back that loan. What we’re doing is encouraging people to access resources right in their community that are discounted or free.”

SpringFour’s platform lets users type in their ZIP code to search for community resources.

“Our technology makes it easy for financial institutions to connect consumers to our vast database of resources around the country in 25 different spending categories,” Gorey said. The fintech’s network of resources and partner organizations assists consumers in need with, among other categories, food savings, utility bills, employment resources and housing assistance.

The portal is designed as either a white-label offering directly within a bank’s platform or as a co-branded platform via a redirect, depending on the needs and existing tech stacks of the bank clients SpringFour partners with.

For example, California-based

“Golden 1 recognizes the impact a sudden loss of income can have on individuals and families,” Golden 1’s senior vice president of community impact Erica Taylor said in a statement at the time. “Our commitment to members includes providing practical support and resources to help get them through challenging financial times.”

Customers whose bank already works with SpringFour don’t have to wait to find resources, Gorey said. “The bank can proactively message their customers, ‘We want to help you.’ What we’ve seen is that it builds brand loyalty,” she said. “When people who have once been behind on their bills are able to catch up, guess who they’re going to pay back first?”

For banks and credit unions that contract with SpringFour, Gorey said that the fintech has tracked the benefits for banks from connecting their consumers to the resources SpringFour aggregates.

“Our bank clients see increased customer retention and engagement and an increase in brand loyalty and trust,” she said. “When deployed within a specific consumer loan portfolio as they track SpringFour referrals to loan repayment data, they see an increase in repayment rates, so we’re helping the bottom line as well. In addition, we deliver on ESG and social impact and CRA goals. It’s also an easy technology to deploy. If banks are serious about wanting to assist their customers, they call us, we get them deployed and they begin to reap all of the benefits of being there for their customers in good times and bad.”

“We actually sent out a proactive email campaign to all of our customers explaining that support and resources were available because of the financial uncertainty,” Schwartz told American Banker. “We sent almost 300,000 emails out and saw a 44% open rate. Just under 10,000 customers clicked through the SpringFour email and engaged with the platform, and over 5,000 of those customers did a search for local resources.”

Of the click-throughs that OppFi tracked, 28% were for employment services and 27% were for food savings.

“We are using all of our resources, including our partners, to keep customers in a good spot to the best of our ability,” Schwartz said.