A recent column (“How CSRS and FERS Retirement Annuities Are Taxed”) discusses how CSRS and FERS non-disability retirement annuities are federally taxed. In accordance with the IRS Simplified Rule, that column explains what portion of a monthly CSRS and FERS annuity is not taxable and at what point of time the annuity fully taxable.

This column discusses how Civil Service Retirement Service (CSRS) and Federal Employment Retirement System (FERS) survivor annuity benefits are federally taxed.

In discussing what portion of a CSRS or FERS survivor annuity (full or partial) is federally taxable, it is important to discuss how a survivor annuity is taxed under the following two scenarios, namely:

(1) A retired employee dies in at some point during retirement before receiving all of his or her contributions to the CSRS and/or FERS Retirement and Disability Funds; and

(2) A CSRS- or FERS-covered employee dies “in service” before starting to receive his or her CSRS and/or FERS annuity.

Also, children’s survivor benefits are paid to the eligible children of deceased employees and deceased retirees (annuitants). Eligible children include unmarried children younger than age 18 and children between age 18 and 22 and who are full-time college students. Those children who were disabled before age 18 are eligible for children survivor benefits that continue indefinitely unless the child marries. Note that unlike a survivor annuity benefit in which a retired employee has elected to give a survivor annuity to a spouse or to an insurable interest (thereby resulting in a permanent reduction to the annuity), there is no reduction to a retiree’s annuity in order to give a children survivor annuity benefit. But as will be discussed, a portion of a children survivor annuity is federally taxable.

Scenario 1. Retired Employee Dies in Retirement Before Receiving All of His or Her CSRS or FERS Contributions

As discussed in the previous column on how the tax-free portion of a CSRS or FERS annuity is determined using the IRS’ Simplified Method, the tax-free amount remains fixed, even when the annuity is increased by annual cost-of-living adjustments (COLAs).

If the survivor annuity benefit is provided for a surviving spouse only, then the same tax-free monthly dollar amount that applied to the annuitant’s CSRS or FERS annuity will be used by the surviving spouse annuitant until the deceased employee’s contributions are paid back in full. The following is an example of a CSRS employee who retired from federal service and died less than one year after retiring:

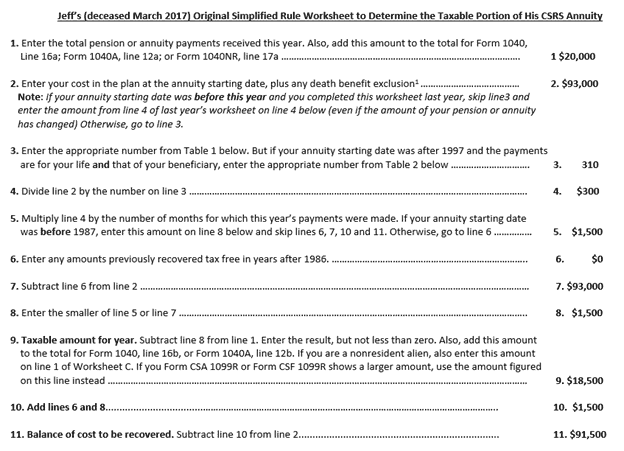

Example 1. Jeff retired from federal service under CSRS on June 29, 2016. He received a CSRS annuity that provided a CSRS survivor annuity benefit to his wife, Francine. His annuity starting date was July 1, 2016 and he received his first CSRS annuity check on August 1,2016. His gross monthly annuity benefit started at $4,000 per month and using the Simplified Method, the amount of his tax-free monthly amount is $300, as shown in the Simplified Rule worksheet below. Note that at the time of his retirement, Jeff was 65 and Francine was 57, for a combined age of 122 years.

Jeff’s Simplified Method Worksheet (for 2016) is presented here:

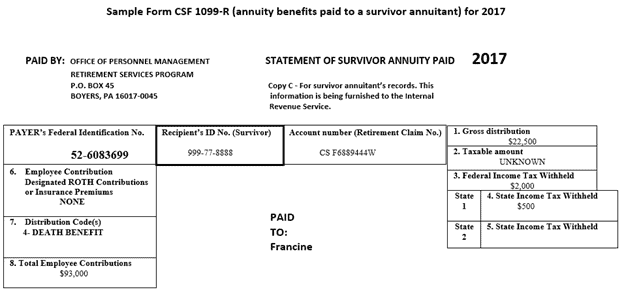

Jeff died in March 2017. Francine received her first CSRS survivor annuity payment in April 2017. She received a gross survivor annuity monthly payment of $2,500 each month between April 1 and December 31, 2017 for a total of $22,500 for 2017. Of the $2,500 monthly survivor amount, $300 is a return of Jeff’s contributions to the CSRS Retirement and Disability Fund ($93,000 – his “cost” in the CSRS Retirement plan – see “Total Employee Contributions” in Box 8 of the CSF 1099-R) and therefore not taxable. The $300 tax-free portion of the monthly CSRS survivor annuity will continue for 310 months (25 years and 10 months, starting with Jeff’s first monthly CSRS annuity check dated August 1, 2016).

Francine’s 2017 CSF 1099-R is shown here:

Annuitants and survivor annuitants should be aware that OPM’s Retirement’s Office (who issues CSA 1099-Rs and CSF 1099-Rs) does not inform survivor annuitants as to the tax-free portion of a survivor annuity. Please note the sample 2017 CSF 1099-R (issued to Francine for 2017) which informs Francine (a survivor annuitant) of CSRS survivor annuity benefits paid to her during 2017. In particular, note Box 2 (”Taxable amount”), which shows the taxable amount of the survivor annuity is marked as ”UNKNOWN”. However, OPM’s retirement office does in fact know what the taxable amount of the survivor annuity is because the same tax-free monthly amount that was applied to the CSRS or FERS monthly annuity applies to the CSRS or FERS monthly survivor annuity. It is therefore important that annuitants inform their survivor annuitants as to the tax-free monthly portion of the monthly annuity, in order that the same tax-free monthly portion amount be continued for the survivor annuitant.

Scenario 2: Employee Dies in Service and Survivor Annuity Starts Immediately

If a federal employee dies in service and is providing a survivor annuity, then the survivor annuity will start the month after the employee dies. Note that in order to provide a survivor annuity, an employee must have had at least 10 years of federal service at the time of death.

How is the tax-free portion of a survivor annuity computed under these circumstances? The survivor annuitant will receive the employee’s “cost” tax-free. The deceased employee’s “cost” is the total of the CSRS or FERS retirement contribution that were deducted from the employee’s paychecks during the years of federal service through and including the deceased employee’s last paycheck.

The following discussion covers the Simplified Method applicable to the survivor annuitant.. A survivor annuitant must use the Simplified Method if their annuity starting date is after November 18, 1996. Under the Simplified Method, each of the monthly annuity payments is made up of two parts: (1) The tax-free part that is a return of the deceased employee’s “cost” in the CSRS or FERS retirement plan. Note that the deceased employee’s “cost” in the CSRS or FERS retirement plan is shown on the survivor annuitant’s CSF 1099-R in Box 8 (“Total Employee Contributions”); and (2) The taxable part that is the amount of each payment that is more than the part that represents the employee’s cost. The tax-free portion remains the same, even when the annuity or the survivor annuity is increased annually by COLAs.

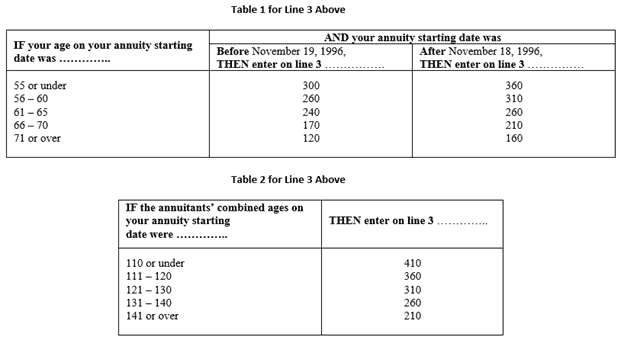

Scenario 3: Surviving Spouse with No Children Receiving Children Survivor Annuity Benefits

Under the Simplified Method, a survivor annuitant figures the tax-free portion of each full monthly annuity payment by dividing the amount shown in Box 8 of the CSF 1099-R (“Total Employee Contributions”) by the survivor annuitant’s single life expectancy in the year of the employee’s death. That single life expectancy can be found in Table 1 of the Simplified Method Worksheet under “AND your annuity starting date was after November 18, 1996) (see above). Here is an example:

Example 2. Donna, age 42, began receiving a $1,800 monthly FERS survivor annuity in June 2017 after her husband Carl died in May 2017. Carl contributed $7,800 to the FERS Retirement and Disability Fund during his 15 years of federal service. Using the Simplified Method worksheet, Donna divides $7,800 (line 2 of the Simplified Rule worksheet worksheet) by 360 (line 3, which was obtained from Table 1 based on Donna’s age of 42). $7,800 divided by 360 is $22 (rounded). Of the $1,800 FERS monthly survivor annuity, $22 is a return of Carl’s “cost” in the FERS retirement plan and is therefore not taxable.

Scenario 4: Surviving Spouse with Children Receiving Children Survivor Annuity Benefits

If the survivor benefits include both a life annuity for the surviving spouse and one or more temporary annuities for the deceased employee’s children, an additional step is needed under the Simplified Method to correctly allocate the monthly “cost” exclusion among the beneficiaries.

The total monthly exclusion for all survivor annuitants is determined by completing lines 2 through 4 of the Simplified Method Worksheet as if only the surviving spouse is receiving a survivor annuity. In order to calculate the monthly exclusion for each survivor annuitant, the survivor annuitant should multiply the calculated tax-free monthly amount on line 4 of the worksheet by a fraction. For each survivor annuitant (spouse/insurable interest and children) annuitant, the numerator of the fraction is the survivor annuitant’s monthly annuitant’s monthly annuity amount and the denominator of the fraction is the total of the monthly annuity of all the survivor annuitants. The following is an example:

Same facts as in Example 2, except that Donna has a seven-year-old child, Rachel. Under the provision that provides the children survivor annuity benefits, Rachel was entitled to receive $511 per month during 2017. Using the worksheet, Donna determines that $22 of the survivor annuity is tax-free. Donna must change the $22 monthly exclusion to include the allocation between her own annuity and that of her daughter Rachel.

To find out how much of the monthly exclusion to allocate to her annuity, Donna multiplies the $22 monthly exclusion by the fraction $1,800 (her monthly survivor amount)/$2,311 (the total of her $1,800 and Rachel’s monthly $511 child survivor annuity benefit).

$22 x ($1,800/$2,311), or $17.14

Rachel’s monthly tax-free annuity amount is

$22 x ($511/$2,311), or $4.86

A child’s survivor annuity normally ends at age 18 (or at age 22 if the child is a full-time college student). The conclusion of a child’s temporary annuity does not affect the total monthly exclusion computed under the Simplified Method. The total exclusion simply needs to be reallocated at that time among the remaining survivor annuitants. The surviving spouse is entitled to the entire monthly exclusion as was originally calculated in the Simplified Method Worksheet if the surviving spouse is the only individual left drawing a survivor annuity.

Additional information about taxation of CSRS and FERS annuities and survivor annuities may be found in IRS Publication 721 (Tax Guide to U.S. Civil Service Retirement Benefits) which can be downloaded here.