Everyone knows high mortgage rates have been a total drag lately, especially for prospective home buyers facing extremely high asking prices.

But what if I told you that nearly half of those who purchased a home recently still got an interest rate below 5%?

Sounds pretty unlikely, given the fact that the 30-year fixed is back over 7%, and never went lower than 6% for the duration of 2024.

However, that didn’t stop 45% of “mortgage buyers” (non-cash buyers) from obtaining a sub-5% mortgage rate, per a new survey from Zillow.

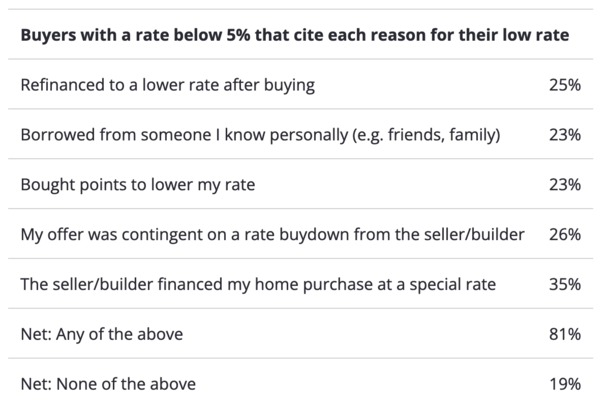

As for how, the most common reason cited was special financing offered by the seller or home builder.

Special Mortgage Rates from Home Builders

One of the most common ways to get a below-market mortgage rate has been via the home builders.

They often operate in-house mortgage companies to ensure their customers make it to the finish line.

And thanks to a financing tool call “forward commitments,” they’re able to offer super low mortgage rates to the customers who use their captive lender.

Those commitments involve buying low mortgage rates in bulk, ahead of time, and then deploying the low rates to customers who buy properties in select communities.

While some only offer temporary rate buydowns, lately many have offered permanent rate buydowns for the full 30-year loan term.

This probably sounds pretty sweet, but keep in mind you need to buy a newly-built home to get your hands on a special rate.

Some have argued that the discount is built into a higher sales price, so proceed with caution.

Also read my piece on using the home builder’s mortgage lender for more on that.

For the record, individual home sellers can offer sales concessions that can be used to buy down the mortgage rate too.

And together with builder buydowns, that was the most commonly cited reason for a low rate at 35%.

Another 26% said their offer was contingent on a rate buydown from the seller/builder. So more than half of the low rates came from these arrangements alone.

Buying Points to Lower Your Rate

The third most common reason a recent home buyer was able to get a low mortgage rate was due to paying discount points (at 23%).

If you have the available funds, it’s always an option to buy down your rate by paying some money upfront.

This is a form of prepaid interest where you pay today for savings tomorrow. The key though is keeping the loan long enough to experience the savings.

The problem with this is if mortgage rates happen to go even lower before the breakeven point (when the points become profitable), it disincentivizes a rate and term refinance.

Or if you happen to sell the property too soon, same thing. In contrast, temporary buydowns don’t result in lost funds.

If you sell/refinance soon after a temp buydown, the leftover funds are typically applied to the outstanding loan balance.

Long story short, there’s risk when buying points in that you’ll leave money on the table.

The same could be said of temporary buydowns in that mortgage rates might not be lower when the rate reverts to the higher note rate.

A lot of folks have bought the house and dated the rate, assuming the mortgage rates would come down. So far they haven’t.

Got a Mortgage from a Friend or Family Member

Another 23% of buyers said they got a low rate because they borrowed from a friend or family member.

This is pretty surprising to me seeing that it’s such a large share of the population. I can’t imagine that many home buyers getting special financing from mom and dad or someone else.

But per Zillow’s study, this is what the numbers indicate. For me, it’s pretty rare to use intrafamily financing, but it definitely is a thing, especially with rates so much higher today.

An example would be your parents offering to finance your home purchase with a special low rate from the Bank of Mom and Dad, perhaps at a cool 3.99%!

If you’re so lucky, great. But for most this sadly isn’t a reality.

Another common reason folks got a sub-5% mortgage rate was by refinancing after they bought the home.

They must have nailed the timing (and paid points) because rates never officially went below 6% this year.

Lastly, sub-5% mortgage rates were associated with adjustable-rate mortgages, homebuyer assistance, and shorter loans terms, such as the 15-year fixed.

Of course, if it’s not a 30-year fixed, sub-5% doesn’t have quite the same meaning or value.

Still, it’s impressive to see that nearly half of home buyers got creative and found a way to overcome the mortgage rate hurdle.

Problem is there’s still the high home price to contend with, and little way around that at the moment.

The Zillow Consumer Housing Trends Report 2024 study involved 18,500 successful home buyers and was fielded between March and September 2024.