You don’t bring me flowers

You don’t sing me love songs

You hardly talk to me anymore

When you come through the door

At the end of the day

– Neil Diamond and Barbra Streisand

Despite my being a head-banging teen who routinely blasted AC/DC and Van Halen at full volume, when my dad played Neil Diamond and Barbra Streisand’s duet, You Don’t Bring Me Flowers, it stopped me in my tracks.

The lyrics, which describe the sadness and loneliness of being in a relationship that has withered on the vine, are profound.

Shareholders of Flowers Foods (NYSE: FLO) may be able to relate. Though the company boasts a 6.3% yield, the stock has steadily fallen for the past 2 1/2 years, losing half of its value.

Unlike Neil and Babs, Flowers Foods is trying to keep the relationship with shareholders alive by offering a robust dividend yield and annual increases. Let’s see whether that dividend is sustainable.

Flowers Foods makes baked goods, primarily bread, under the brands Nature’s Own, Dave’s Killer Bread, and Wonder, among others. It also owns the Tastykake snack brand.

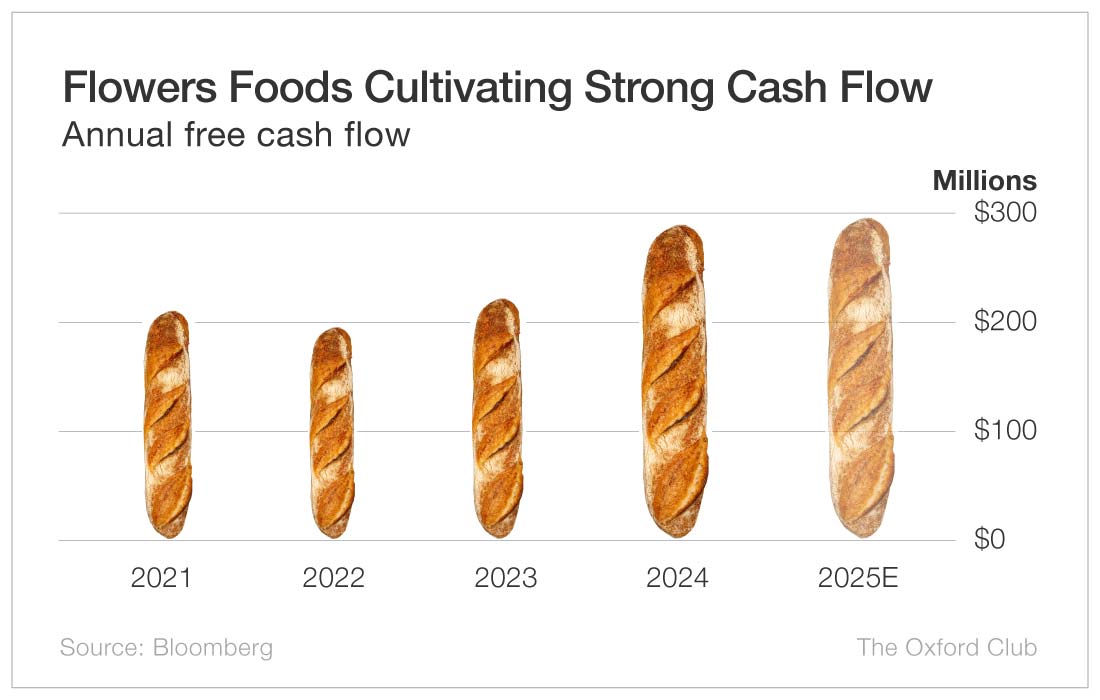

After a dip in 2022, free cash flow has been climbing, primarily through acquisitions. It is forecast to rise another 4% in 2025.

Last year, Flowers paid shareholders $203 million in dividends for a 72% payout ratio, which is fine. My threshold is 75% for most companies. As long as the payout ratio is below 75%, I trust that the company can handle any short-term downturns in free cash flow without having to cut the dividend.

This year, the company is projected to pay $208 million in dividends, with the payout ratio shrinking slightly to 71%, so it’s still in good shape.

Flowers Foods has a very impressive dividend-raising track record. It has boosted the dividend every year since it began paying one in 2002, including hikes of a penny per share in each of the pandemic years. This proves that while bread may not be a huge growth business, it is a stable one.

By the looks of the share price, Wall Street doesn’t seem to be buying into the “growth by acquisition” story. But with Flowers Foods’ rising cash flow, reasonable payout ratio, and excellent track record of increasing its payout, investors should feel confident that the company’s dividend will have a happier ending than the couple in the song that made this metalhead get all emo.

The dividend is safe.

Dividend Safety Rating: A

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.