The cost of everyday life keeps going up, from groceries to gas to rent. According to Bureau of Labor Statistics, grocery prices in 2025 are nearly 30% higher than they were in February 2020. While prices may eventually stabilize, many households are still struggling to keep up.

Understanding how rising prices affect your budget—and what you can do to adjust—can help you make more confident financial decisions. With a few realistic changes to your spending and income strategies, you can better manage the effects of inflation and stay in control of your money.

Understanding the Rising Cost of Living

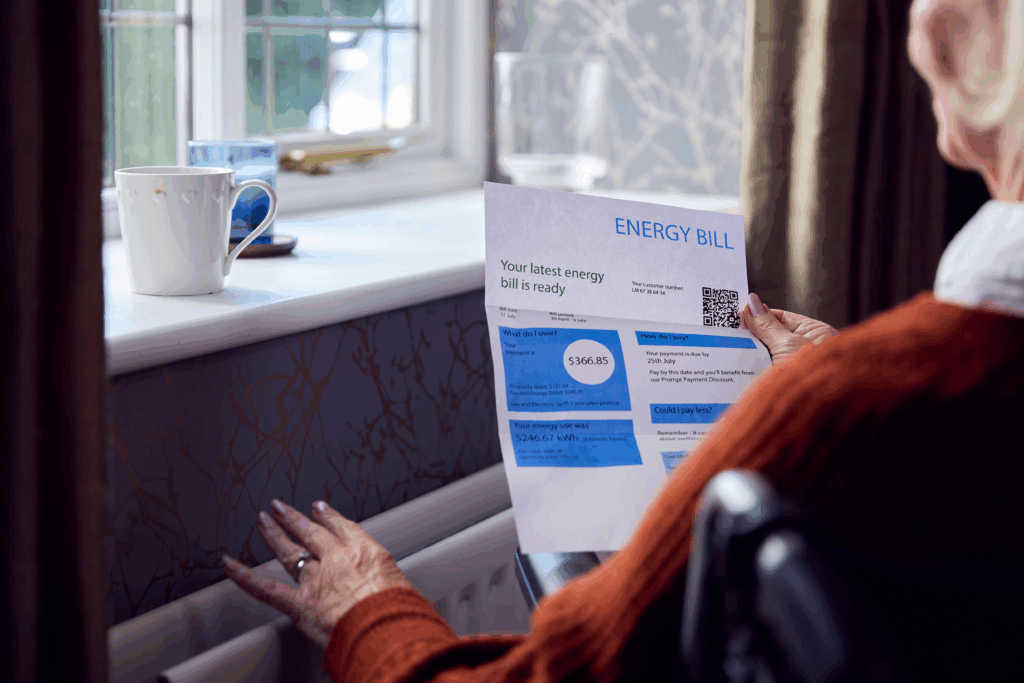

Many households have noticed that everyday essentials—like groceries, utilities, and housing—cost more than they used to. Even small price increases can make a noticeable difference when they happen across several areas at once.

While these changes may be out of your control, you can take steps to stay ahead. Tracking your spending, setting realistic goals, and adjusting your priorities can help you manage rising expenses with more confidence.

The good news is that small, steady changes often make the biggest difference over time.

Adjusting Your Spending Habits

When prices rise faster than paychecks, the first step is to get clear about where your money is going. A budget gives you that clarity. It helps you see what you spend, spot unnecessary costs, and make intentional choices about your priorities.

Start by tracking every expense for at least a month. You can use a spreadsheet, a budgeting app, or even a notebook—the method doesn’t matter as much as staying consistent. Divide your spending into two categories: needs (like rent, groceries, and utilities) and wants (like takeout or streaming subscriptions). Once you know where your money is going, it becomes easier to decide what can be reduced or eliminated.

Look for small ways to spend smarter on essentials, too:

- Review recurring bills: If your phone plan or internet package includes more than you use, consider a lower tier.

- Reduce utility waste: Turn off lights in unused rooms, adjust your thermostat when you’re away, and only run laundry or dishes with full loads.

- Shop with intention: Compare store prices, look for generic brands, and take advantage of sales or loyalty programs. Buying in bulk or splitting costs with friends or family can also stretch your dollars further.

Even modest adjustments can make a meaningful difference over time. The goal isn’t to live without comfort—it’s to make your money work more efficiently for what truly matters to you.

Finding Ways to Boost Your Income

When cutting back isn’t enough, finding ways to increase your income can help balance the effects of rising costs. Even a small boost in monthly earnings can relieve pressure and make it easier to stay on top of essential expenses.

If you’re currently employed, start by reviewing your pay and responsibilities. Research typical salaries in your field to understand whether your compensation aligns with industry averages. If it doesn’t, you may be able to start a conversation about a raise or additional hours. Employers often prefer to retain reliable team members rather than train new ones.

You can also explore opportunities outside your primary job. Side gigs, part-time work, or freelance projects can be flexible ways to earn extra income. Many people use their hobbies or skills—like photography, writing, or handyman work—to generate additional earnings.

If you’re thinking about switching jobs, focus on positions that align with your strengths and long-term goals. Sometimes, a better fit can offer both higher pay and more satisfaction. Just be sure to evaluate new opportunities carefully and consider stability, benefits, and work-life balance before making a move.

Staying Steady Through Inflation

Rising prices can feel discouraging, but staying organized and proactive can make a real difference. Building a budget, tracking spending, and setting aside savings when possible can help you feel more in control, even when expenses shift.

Try to review your financial plan regularly. Small adjustments—like canceling an unused subscription or finding a more affordable grocery store—can add up quickly. When changes happen in the economy, adaptability matters more than perfection.

It may also help to focus on long-term goals rather than short-term frustration. Whether you’re saving for emergencies, paying down debt, or just trying to get through a tight month, progress is progress.

Inflation can highlight financial challenges, but it can also be a reminder of your ability to adapt. By staying mindful of your spending, finding new income opportunities, and keeping your financial habits steady, you can move forward with more confidence, no matter what the economy looks like.

The Bottom Line

The rising cost of living affects everyone differently, but taking a thoughtful, steady approach can help you manage its impact. A clear budget, mindful spending habits, and a willingness to look for new income opportunities can all make day-to-day expenses easier to handle.

It’s not always possible to control how prices change—but you can control how you respond. Each small, consistent choice adds up, helping you protect your finances and build stability over time.

The content provided is intended for informational purposes only. Estimates or statements contained within may be based on prior results or from third parties. The views expressed in these materials are those of the author and may not reflect the view of SmartSpending. We make no guarantees that the information contained on this site will be accurate or applicable and results may vary depending on individual situations. Contact a financial and/or tax professional regarding your specific financial and tax situation. Please visit our terms of service for full terms governing the use this site.