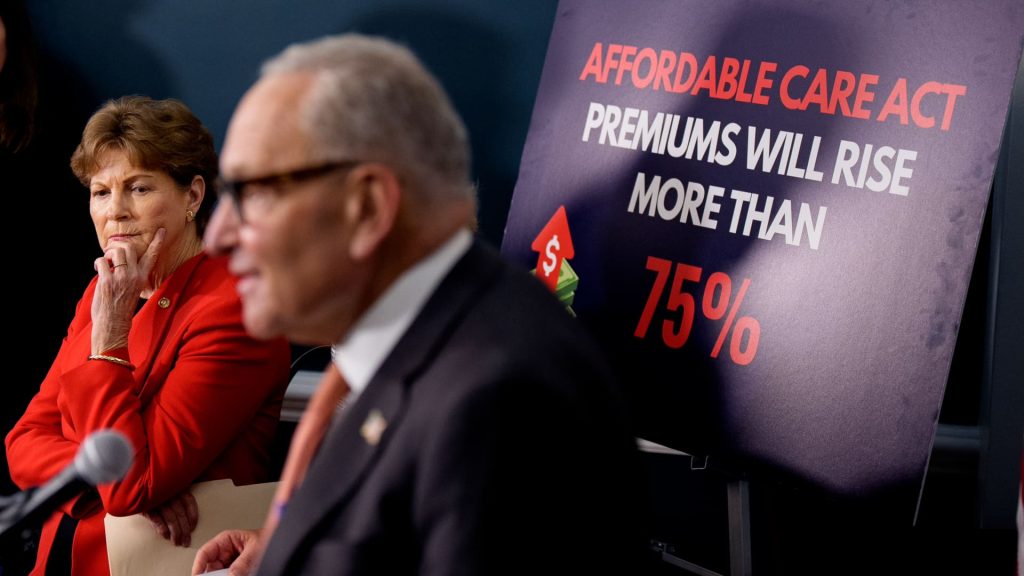

A poster reads “Affordable Care Act Premiums Will Rise More Than 75%” as Senate Minority Leader Chuck Schumer (D-NY) (2nd-L), accompanied by Sen. Jeanne Shaheen (D-NH) (L), speaks at a news conference to call on Republicans to pass Affordable Care Act tax breaks on Capitol Hill on Sept. 16, 2025 in Washington, DC.

Andrew Harnik | Getty Images

Open enrollment is underway for many employees, Medicare recipients, and those who purchase health insurance on their own through Affordable Care Act plans — and many of those Americans will see significant price hikes.

Health insurance premiums for plans bought over the ACA marketplace will increase 114% on average if enhanced subsidies expire at the end of 2025, according to KFF, a nonpartisan health policy research group. About 22 million of the 24 million ACA marketplace participants — including many self-employed and small-business workers — receive those premium tax credits, which are a key issue in the ongoing government shutdown.

Contributing to that price increase, ACA insurers are raising premiums for next year by an estimated 26% on average, according to KFF, in part because those companies expect healthier people to drop coverage if the enhanced subsidies expire.

“What’s not certain is whether the price you’re seeing today is what it will actually be,” said Louise Norris, a health policy analyst with healthinsurance.org. “If those subsidy enhancements get extended, or if they get modified and extended, you might end up paying a different premium than what you’re seeing now.”

Employer-sponsored plans are seeing smaller, but still notable, increases. The vast majority of Americans, about 165 million people, including employees and their dependents, obtain health insurance through their employer, according to KFF.

Employees could see their payroll deductions for health care coverage rise by 6.5% on average for 2026 —the steepest increase in 15 years, global consulting firm Mercer found.

“It’s invisible for a lot of people because it’s paycheck deduction,” said Zach Teutsch, founder of Values Added Financial in Washington, DC. Teutsch is a member of CNBC’s Financial Advisor Council.

As costs spike, millions of Americans may be facing a tough decision about which health insurance option to choose — and how to afford it. Here are key steps financial advisors and health policy analysts recommend taking before enrolling in health coverage for 2026.

Review your 2025 health-care expenses

Before you look at 2026 options, tally your out-of-pocket costs for 2025 so far, including co-payments, medical bills, prescriptions and over-the-counter expenses. Tracking what you’ve spent on recent health-care needs will help you calculate potential 2026 expenses and give you a better idea of the type of medical coverage you’ll need.

Compare all available plans for 2026

Even if your insurer is offering the same health insurance plan options as this year in 2026, premiums and deductibles likely increased. Plus, your health needs may have changed. Check which of your current providers are still “in-network” and determine the coverage for out-of-network providers.

If you have to undergo surgery or now have a chronic illness, you may opt for a different plan, or you may need to make a plan change to better manage costs.

Many employers offer two choices, which boil down to: pay now or pay later. You can pay more upfront with higher premiums deducted from each paycheck and a lower deductible, which is the amount you pay before insurance kicks in. Or you can pay later with lower premiums and a higher deductible.

For ACA plans, you can compare options through the federal marketplace, or a state-specific website for residents in Washington, D.C., and 20 states.

If you’re enrolled in Medicare, use the Plan Finder Tool on Medicare.gov.

Pause on ACA enrollment

Longhua Liao | Moment | Getty Images

If you are getting coverage through the ACA marketplace, don’t sign up just yet. If the enhanced subsidies are extended or modified, “you might pay less than what it looks like it’s going to be,” said Norris.

Set yourself a reminder to check on the price in late November and make adjustments. Be sure to sign up before the December 15 deadline for a January 1 start date.

Consider your health needs

You don’t want to be uninsured, experts say: An emergency room visit or intensive care stay can reach six figures.

“The idea of a multi $100,000 hospital bill is not uncommon at all,” said Norris. “It’s one thing to set up a payment plan with the hospital to pay off, say a $7,000 deductible. It’s a totally different thing when you’re looking at trying to set up a payment plan for a $400,000 bill.”

People with no health issues and who rarely visit a doctor may save money with a high deductible plan, which, for ACA plans, is the bronze level. “That way, if you all of a sudden get hit by cancer or something bad, you’ll have health insurance coverage,” said Carolyn McClanahan, a physician and certified financial planner based in Jacksonville, Florida. Some doctors won’t even see you if you don’t have health insurance coverage, she said.

Another option, if you have chronic care needs or go to the doctor more often than a basic plan covers, is to add a direct primary care physician to a bronze health insurance plan, McClanahan said. A monthly subscription fee, typically $50 to $150, covers basic primary care visits and may include services such as lab work and x-rays. Those payments won’t count toward your deductible.

“It never goes under insurance,” said McClanahan, the founder of Life Planning Partners and a member of CNBC’s Financial Advisor Council. “It’s basically cash pay.”

Ask questions to understand what’s covered and that it’s a good fit, McClanahan said: “Just because they’ve opted to be a direct primary care doctor doesn’t mean that they’re necessarily the best doctor for you. So make sure that your personalities fit.”

Take advantage of FSAs and HSAs

If your employer offers a health flexible spending account, or FSA, you can use the pre-tax dollars you put into that account to pay for eligible out-of-pocket medical expenses, co-payments, deductibles, prescriptions and vision or dental care. Putting money into this account will not only lower your taxable income for next year, but also allow you to pay for health-care expenses with money that otherwise would have been taxed.

Health savings accounts, or HSAs, are another tax-advantaged option to help pay for medical, dental and vision expenses — as long as you are enrolled in a qualifying high-deductible health plan. Unlike FSAs, you can use the money over time and put it in long-term investments. Recent legislation has also expanded access to HSAs through more marketplace health plans.

SIGN UP: Money 101 is an 8-week learning course on financial freedom, delivered weekly to your inbox. Sign up here. It is also available in Spanish.