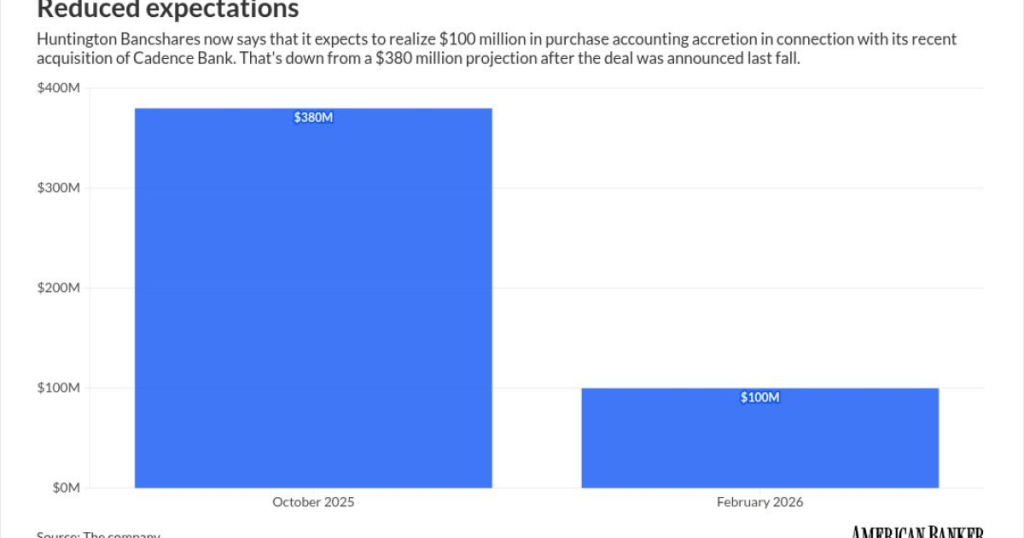

- Supporting data: Huntington Bancshares said it expects to realize about $100 million of purchase accounting accretion in 2027, about $280 million less than its initial projection.

- What it means: Though the bank scaled back its 2027 earnings-per-share estimate, it said it will have more capital to work with up front.

- Expert quote: “There’s a little bit of accounting … Put it aside. It doesn’t matter. It all nets to zero at the end of the day, anyway.” — Huntington CEO Steve Steinour

Processing Content

When

In comments at an investor conference on Tuesday,

“I think we’ve got a very exciting future,” Steinour said in remarks at the UBS Financial Services Conference in Key Biscayne, Florida. “There’s a little bit of accounting … Put it aside. It doesn’t matter. It all nets to zero at the end of the day, anyway.”

Ironically, the purchase accretion accounting revision — which prompted

He explained Tuesday that estimates made during the due-diligence process for a deal are “more top-down,” compared with the “more bottom-up” analysis that’s done later on.

In the case of the Cadence deal, the later analysis resulted in a lower rate mark on the portfolio, Wasserman said at the UBS conference.

That revised estimate left less room for accretion, but it also burned up less capital in the required mark-to-market calculations. Indeed, estimated tangible-book-value-per-share dilution resulting from the Cadence transaction dropped from 7% to 4.8%.

“Lower discount, more capital up front,” Wasserman said.

Analysts were divided over the impact of the new 2027 estimates, which came less than a month after Wasserman

Piper Sandler analyst Scott Siefers wrote Monday in a research note that it is “hard not to be disappointed that nearly half the originally expected 10% 2027 earnings-per-share accretion seems to have gone away within just a few months …”

Other analysts were more positive.

“We see potential for modest upside to guidance over time, supported by strong execution seen in 2025, which featured multiple beats and raises,” wrote Jefferies analyst David Chiaverini. “Overall, we believe 2026 and 2027 guidance is achievable and may prove conservative.”

“We see the long-term direction of travel on fundamentals as still very positive,” wrote TD Cowen analyst Steven Alexopoulos.

Shares in

Steinour argued that the furor over purchase accounting accretion does nothing to diminish the validity of

Those benefits include expanded scale in Texas and the Southeast, along with the ability to deliver

“This is a home run transaction for us,” Steinour said. He pointed to the deal’s 4.8% tangible-book-value-per-share dilution and argued, “we’ll earn it back in the same time frame, or shorter, as we get some of these revenue synergies into the equation.”

Steinour also said

“We have meaningful density today, substantial opportunity ahead and every intention to further invest and accelerate growth,” he said.

Prior to acquiring Cadence,