5,150%.

That’s the approximate return I would’ve made if I’d trusted myself.

It was 2022, still deep in the pandemic’s long fade-out. Many industries were under pressure, and the auto market was one of the hardest hit. With little travel and even less commuting, demand slid and the entire sector slowed.

But in the middle of that slowdown, something caught my attention. It wasn’t loud. It wasn’t obvious. It was a small but steady shift taking place where almost no one was looking.

I was convinced enough to message my colleagues about it.

Carvana (NYSE: CVNA) had fallen 97%. “Deep value” barely captured it.

I’m a committed value investor, but even I hesitated. A collapse that sharp made me assume the market must’ve known something I didn’t.

So I held back as the stock closed at $8.76 that day.

But within a year, it was trading near $56 – a gain of well over 500%. And this week, it pushed past $460.

Again, that’s a more than 50-FOLD gain.

It’s a moment that stays with you – not because of the money, but because it reminds you how hard it can be to act when the crowd is running the other way.

That lesson is useful now as we ask a different question: After such a dramatic rise, where does the stock stand today?

Carvana has settled into its role as a full-scale online marketplace for used cars. Buyers can find a car, line up financing, handle the paperwork, and arrange delivery without stepping into a dealership. And recent results make it clear that the model is working at scale.

Retail units hit a record 155,941 in the third quarter, up 44% from last year. Revenue jumped 55% to $5.6 billion. Net income reached $263 million, while operating margins climbed to 9.8% – both company records.

Even more striking, Carvana crossed a $20 billion revenue run rate. Management says the firm now has reconditioning and production capacity for more than 1.5 million retail units a year, with long-term goals of selling 3 million.

These gains aren’t coming from hype alone. Carvana continues to bolt ADESA’s network into its system, adding more sites where cars can be processed and delivered faster and at lower cost. The earnings release shows this strategy is lifting both scale and efficiency.

But strong numbers don’t answer the central question: What is the stock worth right now?

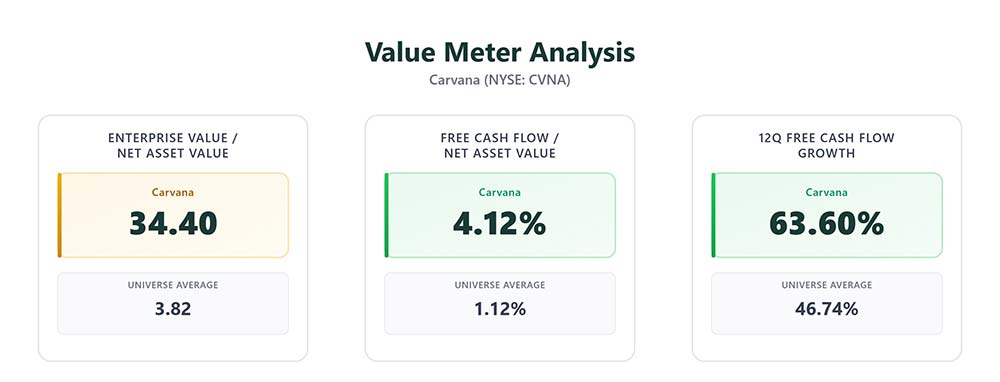

Carvana’s enterprise value-to-net asset value sits at 34.40, far above the universe average of 3.82. That means investors are paying a steep premium for each dollar of net assets. On that measure, the stock is expensive.

Its cash generation tells a different story. Free cash flow-to-NAV is 4.12%, versus a universe average of 1.12%. And over the past 12 quarters, Carvana has grown its free cash flow nearly 64% of the time – well above the 46.74% average.

That kind of consistency is uncommon, especially for a business that once looked fragile.

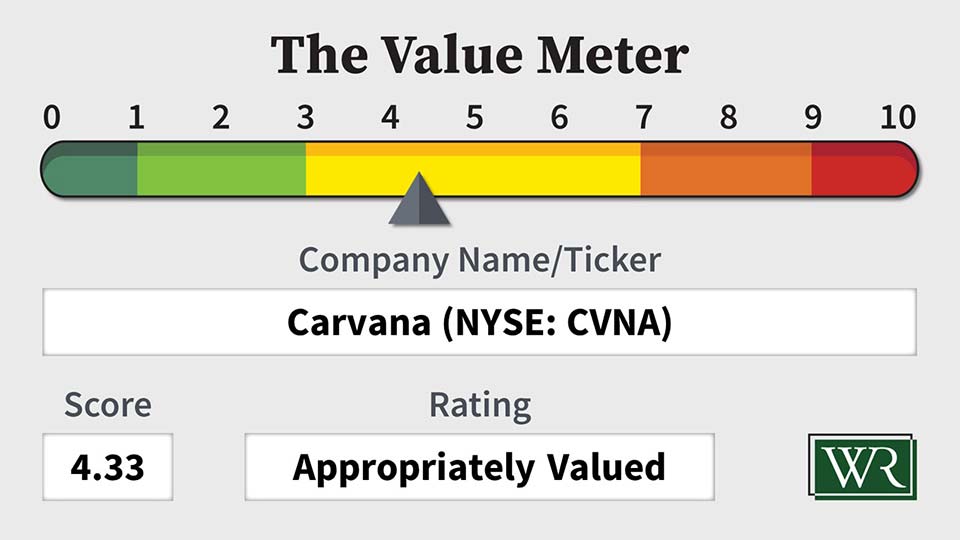

While the stock isn’t the deep-value setup it once was, it’s surprisingly not priced beyond reason either. Today’s valuation reflects a business that is finally delivering the scale and profitability investors doubted it could achieve.

If you already own shares, nothing in the numbers suggests urgency. If you’re considering entering now, patience may reward you with a better setup.

The Value Meter rates Carvana as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.