The name Conagra Brands (NYSE: CAG) may not immediately be recognizable to you. But I would hazard a guess that you currently have one of its products in your refrigerator or pantry right now.

The company manufactures and sells grocery store staples such as Hunt’s tomatoes, Swiss Miss hot cocoa and pudding, Pam cooking spray, and many more.

Unfortunately for Conagra, the past couple of years have been a struggle, with its stock price retreating 54% since its peak in January 2023. Several factors, such as tightening margins, inflation, and negative M&A (mergers and acquisitions) results, have led to a slow but steady decrease in sales.

The stock’s current dividend yield sits at 7.4%. It has avoided any dividend cuts in the last 10 years – with the exception of when it spun off Lamb Weston Holdings (NYSE: LW) to separate its potato business from the rest of the company.

With all of the recent bad news, let’s see whether Conagra’s dividend is at risk of being cut or there is still hope for a rebound.

First, we need to highlight a huge move by the company: In June of this year, Conagra sold off the brand Chef Boyardee for $600 million. (While that’s very helpful in padding its free cash flow, I’m tempted to knock a point off Conagra’s dividend safety rating because it canned up my childhood nostalgia and sold it off.)

Only time will tell how much this will affect the company’s bottom line, as estimates in 2024 showed that Chef Boyardee brought in $450 million in sales.

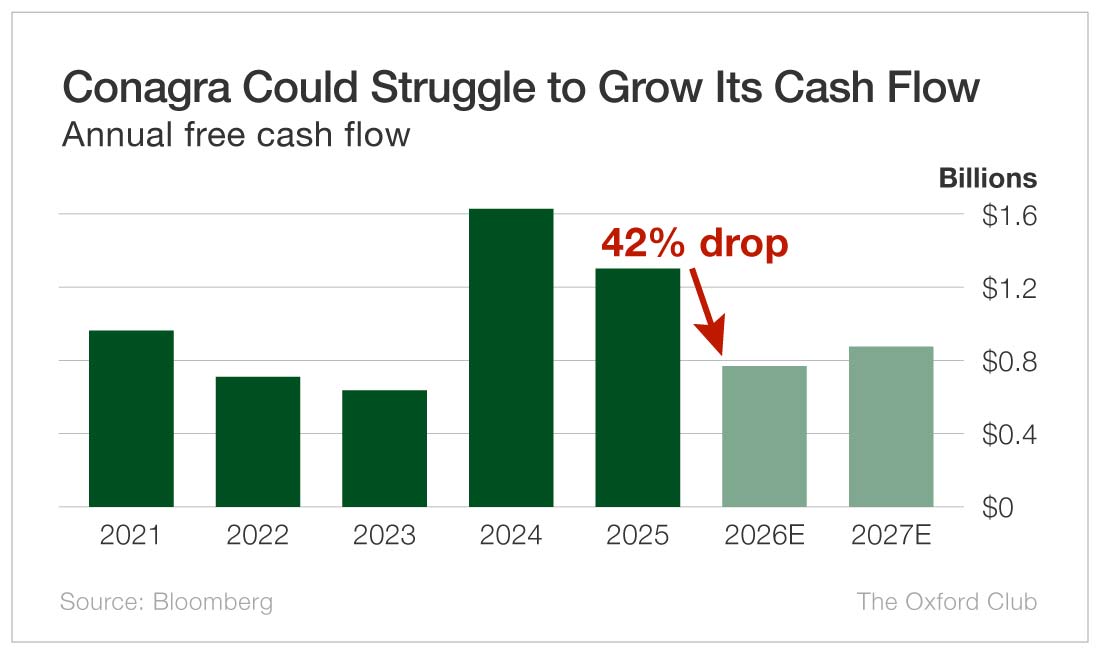

Now let’s isolate Conagra’s ability to pay its dividend by looking at its free cash flow. Despite the contraction of the stock price, 2024 was surprisingly a very good year for the company, as it more than doubled its free cash flow from $633 million to more than $1.6 billion.

The problem is that ever since then, there’s been a steady decline. Free cash flow sunk almost 20% to $1.3 billion in fiscal 2025, which ended in May. What’s even worse is that even with the company selling several of its brands this year, forward estimates indicate a 42% reduction in 2026 all the way down to $760.2 million.

Finally, Conagra has announced no plans to cut its dividend, which is going to throw its dividend payout ratio out of whack. Its payout ratio for 2025 sat at 51.4%, but due to the massive estimated decrease in free cash flow for 2026, that ratio is estimated to jump to 88.0% – above our threshold of 75%.

As with any stock, there’s hope that Conagra will right the ship and turn this around. But for now, it looks like the dividend is in danger of being cut in the near future.

Dividend Safety Rating: D

What stock’s dividend safety would you like us to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.