This has been a wild earnings season. Every day, multiple stocks are up or down 15%, 20%, or more.

Eastman Chemical (NYSE: EMN) was one of those stocks, dropping nearly 20% on August 1.

That huge fall means the stock now yields 5.4%, which may attract the attention of income investors. But does the stock’s plummet signal problems with the dividend?

Let’s dig in and find out.

Eastman Chemical has been around for 105 years. Based in Kingsport, Tennessee, the company makes a wide variety of products, including lubricants, medical packaging, and ingredients used in beauty/personal care.

The steep drop two weeks ago came after the company missed earnings expectations, lowered guidance, and said it is cutting inventory due to trade policy.

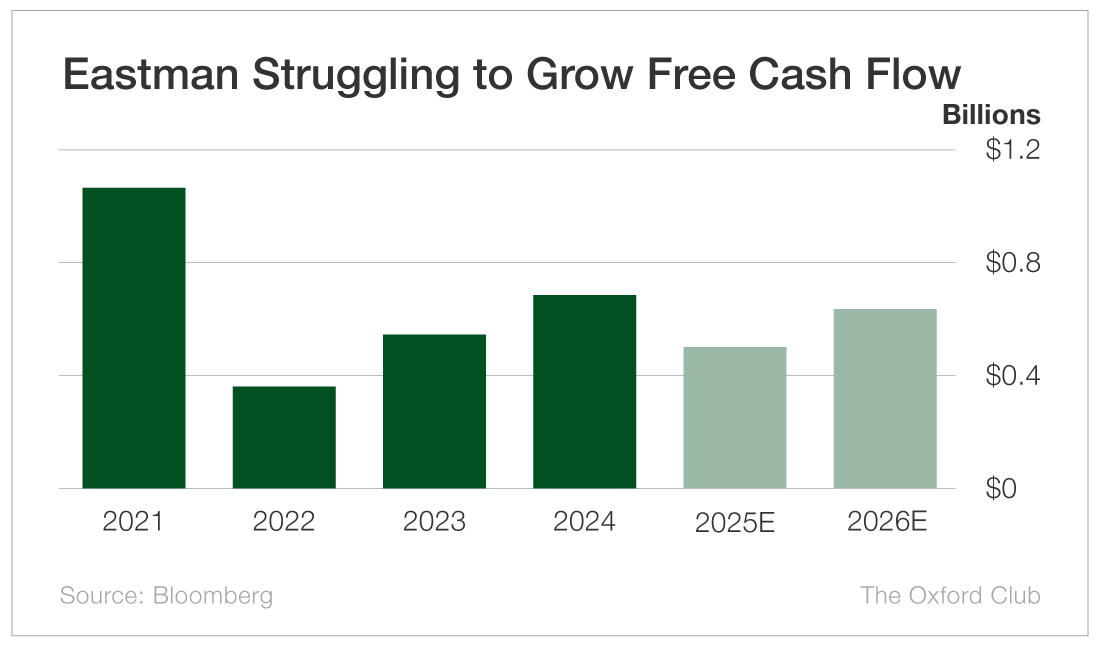

In 2025, Eastman’s free cash flow is forecast to drop to $501 million from $688 million last year. The Safety Net model never wants to see declining free cash flow, as that can make it more difficult for the company to afford the dividend if the deterioration continues. Even one year of falling cash flow is a warning sign.

Free cash flow is not expected to return to 2024’s level for at least the next two years.

Last year, while cash flow was up from 2023, it was still down sharply from 2021, when it totaled nearly $1.1 billion.

In 2024, Eastman Chemical paid shareholders $379 million, or 55% of its free cash flow. That’s a solid payout ratio. I’m comfortable with anything below 75%.

This year, if the company’s free cash flow comes in at $501 million as expected, the $380 million in projected dividends paid will be just above my 75% comfort zone at 76%.

One positive for Eastman is its dividend-raising history. It has raised its payout annually since 2010 – an impressive 15 straight years. The current quarterly dividend is $0.83 per share.

So the situation is this: We have a company whose free cash flow is declining and whose payout ratio is a little too high right now. If free cash flow rebounds and the company raises the dividend by a modest amount, it should be relatively safe. But those are big ifs, especially on free cash flow. If management is unable to boost free cash flow, it will put even more pressure on the affordability of the dividend.

Eastman Chemical’s dividend has some risk of being cut.

Dividend Safety Rating: C

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.