Cintas (Nasdaq: CTAS) is the kind of company investors instinctively trust. The business is steady. Margins are strong. Cash flow is reliable. In a market full of noise, that kind of consistency feels rare.

But is the consistency already reflected in the price?

While this is a high-quality operation, the stock may be trading at a valuation that leaves little room for error.

Cintas provides uniform rentals, facility services, first aid and safety products, and fire protection to more than a million businesses across North America. Most of its revenue comes from recurring contracts tied to daily operations. Customers don’t leave lightly. That makes the business durable.

Investors like Cintas because it takes a dull service and turns it into dependable cash. Few companies execute that model as cleanly.

The numbers back it up.

Revenue rose 9.3% year over year to $2.8 billion in the latest quarter, while operating income increased 10.9% to $655.7 million. Net income grew 10.4% to $495.3 million. Margins held up, with total gross margin improving from 49.8% to 50.4% and net margin inching up to 17.7%.

Free cash flow for the first six months of fiscal 2026 (from June through November) was $737.5 million, up from $710.8 million a year ago.

Cintas is also returning real money to shareholders. Over the last six months, it paid $340.1 million in dividends and spent $901.7 million repurchasing stock.

The board just approved another $1 billion buyback authorization as well, alongside the $700 million remaining on the current buyback program and the $0.45 quarterly dividend.

Operationally, this is a well-run business. Valuation is where things get less comfortable.

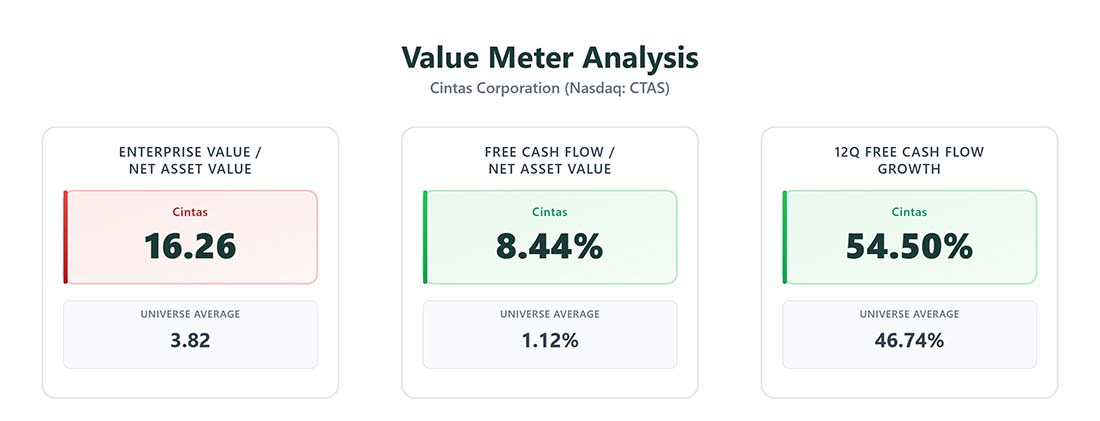

Cintas trades at an enterprise value-to-net asset value ratio of 16.26. Comparable companies average 3.82. That’s not a modest premium. It’s a wide one.

On an asset basis, this stock is expensive.

However, cash flow explains why investors tolerate it. Cintas generates quarterly free cash flow equal to 8.44% of its net asset value. The peer average is just 1.12%. That gap matters. Cintas turns assets into cash far more efficiently than most competitors.

The company’s consistency reinforces the case. Over the past three years, Cintas has grown its free cash flow quarter over quarter more than half the time, and it’s produced positive free cash flow in nearly every quarter. No drama. No dry spells. Cash arrives on schedule.

That reliability earns respect… but it doesn’t automatically create value.

The stock’s recent performance reflects that balance. Shares have held up well, without speculative excess. Investors aren’t chasing a story. They’re paying for execution.

So what’s the takeaway?

Cintas is expensive on assets and excellent at generating cash. The premium is earned – but it’s still a premium.

Though new buyers are paying full price for quality, existing shareholders don’t need to rush for the exits. Pure value investors will likely have to wait.

This is a stock for patient owners, not bargain hunters.

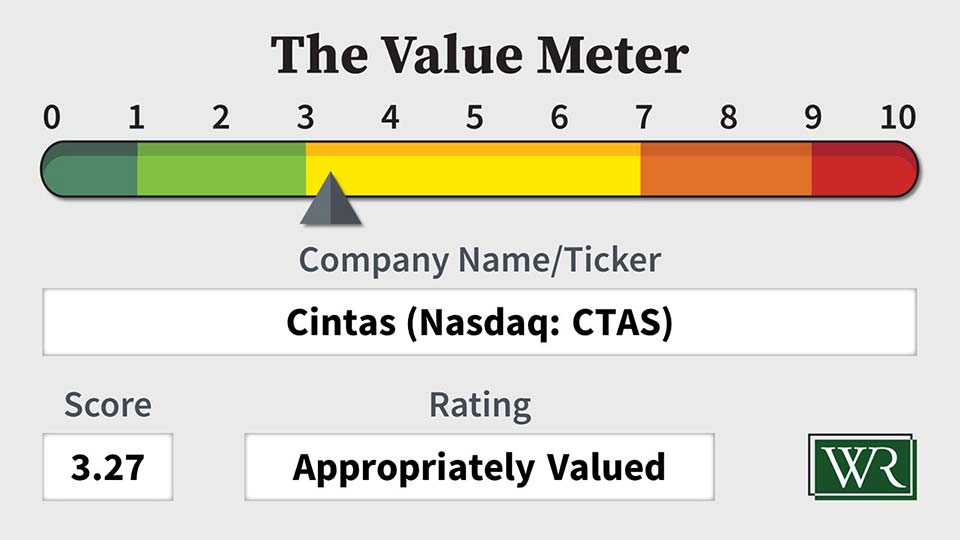

The Value Meter rates Cintas as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.