It’s not quite Halloween just yet, but home buyers may have already gotten a good scare.

The 30-year fixed mortgage, for which most buyers rely upon, jumped from around 6% to nearly 6.75% in the span of about three weeks.

And this took place right after the Fed finally pivoted and cut its own fed funds rate. Good timing I know.

Prior to this rate reversal, mortgage rates had steadily fallen all the way from 8%, their present cycle high that ironically took place just before last Halloween.

Talk about a good year for rates, moving down two full percentage points. But the trend is no longer our friend, at least in the interim.

Now I’d like to make a case for why this actually might be good for the housing market.

Higher Mortgage Rates Might Motivate More Than Lower Rates

I know what you’re thinking, higher mortgage rates can’t possibly be good for the struggling housing market.

Especially this housing market, which is presently one of the most unaffordable in recent history.

But bear with me here. I got to thinking recently how the low mortgage rates didn’t seem to get prospective home buyers off the fence.

As noted, rates came down quite a bit from their cycle highs, falling about two percentage points.

In Mid-September, you could get a 30-year fixed for around 6% for the average loan scenario. And in reality, much lower if you had a vanilla loan (high FICO, 20% down, etc.) and/or went with a discount lender.

The same was true if you paid discount points at closing. I was even stumbling upon rates in the high 4% range at that time.

Surely that would be good enough to get prospective buyers to bite. But the mortgage application data just didn’t respond.

You can blame seasonality, given it being a suboptimal time for rates to hit their lowest levels since early 2023.

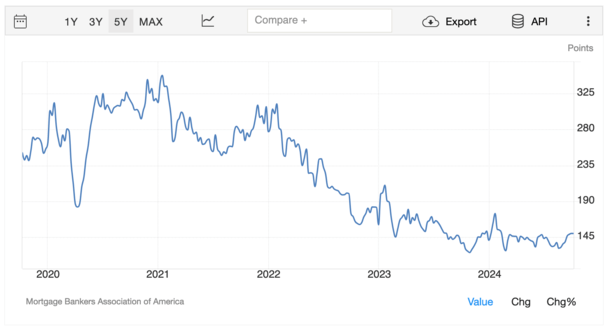

But if you look at the seasonally adjusted home purchase application index from the Mortgage Bankers Association (MBA), you’ll see it barely budged. See the chart above from Trading Economics.

Meanwhile, refinance applications surged, granted they are much more rate-sensitive. Still, given the best rates in years, home buyers just didn’t show up.

And this was surprising because there had been a narrative that they’d flock to the housing market the second rates dropped.

In fact, there were some who argued to buy a home early to beat the rush. That too seemed to be little more than a misguided dream. And it might all have to do with motivation.

Maybe Home Buyers Wanted Even Lower Mortgage Rates

With the power of hindsight, perhaps the culprit was the idea that falling mortgage rates simply make home buyers thirsty for better.

It’s a weird psychological thing. Once you get a little of something good, you want even more. And once you get more, it doesn’t seem as good as it once was. You need even more.

Simply put, falling mortgage rates seemed to prove less motivational than rising rates, as strange as that sounds.

When rates are going up, there’s an intense urgency to lock in a rate before they get even worse.

When rates are falling, you might bide your time and wait for even better. That appears to be exactly what prospective buyers did.

Despite previously being told to beat the rush, they were now being told to wait. So not only did lower rates not get buyers off the fence, they almost entrenched them further.

Of course, I’ve argued recently that it’s no longer about the mortgage rates, and could in fact be other things.

It might be uncertainty regarding the economy, it could be home buyer burnout, it could simply be that home prices are too high. Yes, that’s a possibility too!

However, and here’s the even stranger thing, now that buyers have been spooked with higher rates, that could actually get them to jump off the fence!

(photo: Marcin Wichary)