Last week, I talked about the major shift in the market’s perception of nuclear energy – and why it’s setting up a nice opportunity for investors who know how to spot value.

This week, we’re going to attempt to do just that. I’m breaking down a company that might be underappreciated by the market – despite its strong rally in recent months.

It’s easy to overlook established midcap companies when shiny new trends emerge. Most investors chase the startups or big household names.

But Centrus Energy (NYSE: LEU) isn’t riding mere hype. It’s riding momentum – and contracts.

Centrus is at the center of one of the most urgent national priorities in energy: bringing uranium enrichment back to American soil.

Let me give you the facts…

Centrus reported $154.5 million in revenue last quarter, down from $189 million the year prior. That might sound like a red flag – until you look deeper. Net income mostly held steady at $28.9 million, and margins actually improved.

More importantly, Centrus completed Phase 2 of a production contract with the Department of Energy, delivering 900 kilograms of enriched uranium on time. The DOE has already exercised part of Phase 3, adding another $110 million in contract value through mid-2026.

This isn’t just a contract win. It’s a strategic milestone.

It proves Centrus can deliver a highly technical product – something only a few firms on Earth can provide – and that the U.S. government is ready to keep funding domestic enrichment.

The company now sits on a $3.6 billion backlog stretching into 2040. Over $2.7 billion of that comes from its low-enriched uranium, or LEU, segment.

Centrus also has $833 million in cash – up from $671 million just six months ago. That’s a serious war chest for expansion.

Of course, investors have noticed. The stock has exploded from about $60 in early May to around $220 today. That’s nearly a fourfold gain in just three months.

But does that mean the stock is now overvalued?

Let’s run the numbers.

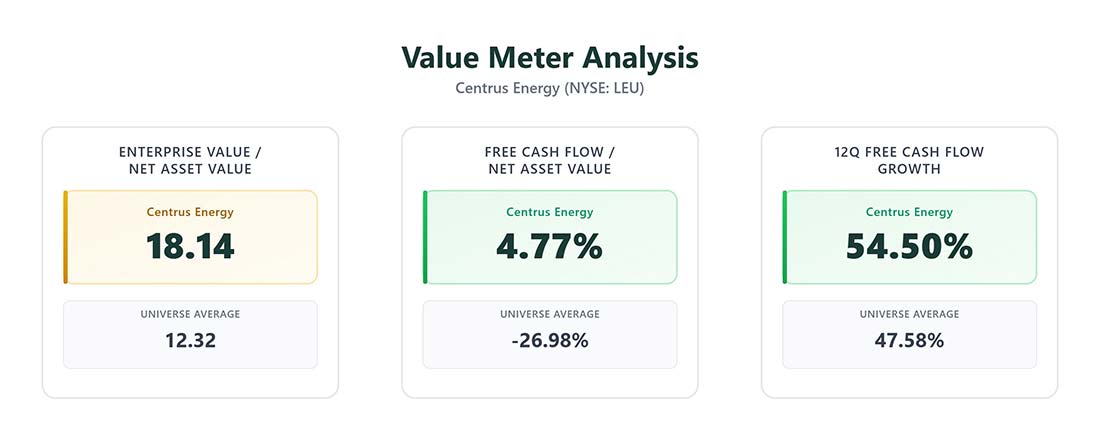

Centrus carries an enterprise value-to-net asset value (EV/NAV) ratio of 18.14. That’s well above the peer average of 12.32, which means you’re paying a premium for future growth.

However, the free cash flow numbers help justify that premium. The company’s average free cash flow-to-net asset value (FCF/NAV) percentage is 4.77% – far better than the universe average of -26.98%. Even more impressive, Centrus has grown its free cash flow quarter over quarter more consistently than the broader market.

That kind of consistency is rare in this industry.

Still, with the stock up nearly 300% in just a few months, the easy money has already been made. This is no longer a contrarian bet – it’s a momentum name backed by government funding and growing demand.

If you believe in the nuclear renaissance, Centrus remains a worthy contender. But at these levels, the valuation reflects much of the optimism already.

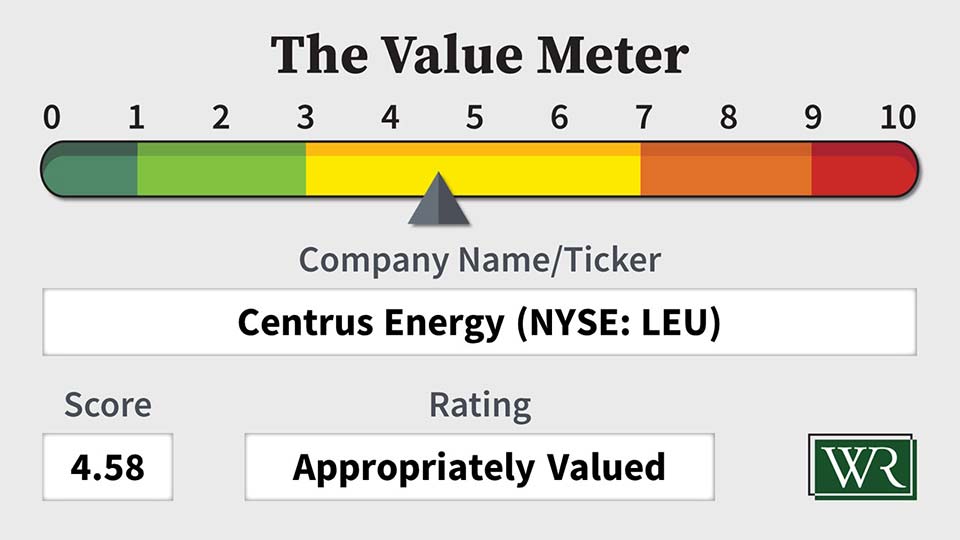

The Value Meter rates Centrus Energy as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.