Railcar producer Trinity Industries (NYSE: TRN) is on the radar of income investors, as the stock pays a 4.8% yield and has an impressive history of annual dividend raises.

But can the company continue to boost the dividend, or will the dividend jump the tracks?

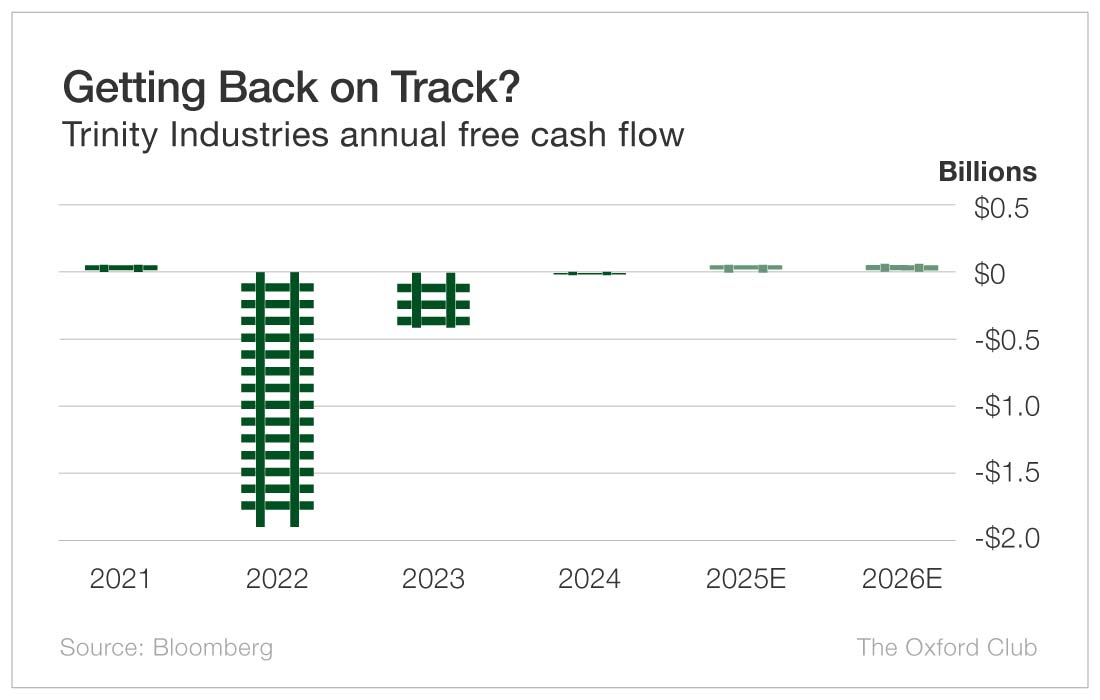

Trinity has not generated any cash flow for the past three years. The good news is that’s expected to change this year. Wall Street forecasts free cash flow to reach $34 million in 2025 and climb to $51 million next year.

I’ll give credit where credit is due. That’s a massive improvement.

However, it’s not enough to pay the company’s dividend.

This year, Trinity is expected to pay $94 million in dividends – nearly three times as much as it’s projected to generate in cash flow. Next year, dividends paid is anticipated to be $97 million versus $51 million in cash flow, so the company is still paying out more in dividends than it makes in cash flow.

The projected payout ratio (the percentage of cash flow paid out in dividends) of 190% is much better than this year’s 276%. But when the dividend payout is still nearly double the cash flow the company produces, it’s a very concerning sign.

That being said, cash flow problems haven’t stopped the company from raising the dividend in the past. Trinity Industries’ dividend has increased every year for 14 years – even when it was hemorrhaging cash.

So, on the plus side, Trinity is expected to return to being cash flow positive and to continue growing its cash flow this year and next year. Its dividend-raising track record is also impressive. But the payout ratio is too high. Unless it takes out a loan, the company simply can’t afford the dividend it’s been paying – and it hasn’t been able to for years.

While management seems committed to raising the dividend, the payout has to be considered moderately risky.

Dividend Safety Rating: C

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.